Noorr

07/24 04:09

Could Ether gain ground as a Store of Value? Onch

Could Ether gain ground as a Store of Value?

Onchain analysis platform iCrypto said that Ether could gradually become a Store of Value similar to Bitcoin

BTC

$119,065

, due to the recent influx of institutional capital, staking yield and the upcoming staking exchange-traded funds (ETFs). The platform highlighted how institutions have doubled down on ETH as a strategic treasury asset.

Bit Digital sold all its Bitcoin holdings and allocated $172 million to purchase over 100,000 ETH, making it one of the largest institutional ETH holders. BTCS Inc. boosted its ETH position to 29,122 ETH after a 221% increase since late 2024. BitMine Immersion Technologies doubled its holdings to 163,000 ETH, while SharpLink now holds over 360,807 ETH, second only to the Ethereum Foundation01983866-9a03-7bda-b519-c4de052c4a8e (1).webp

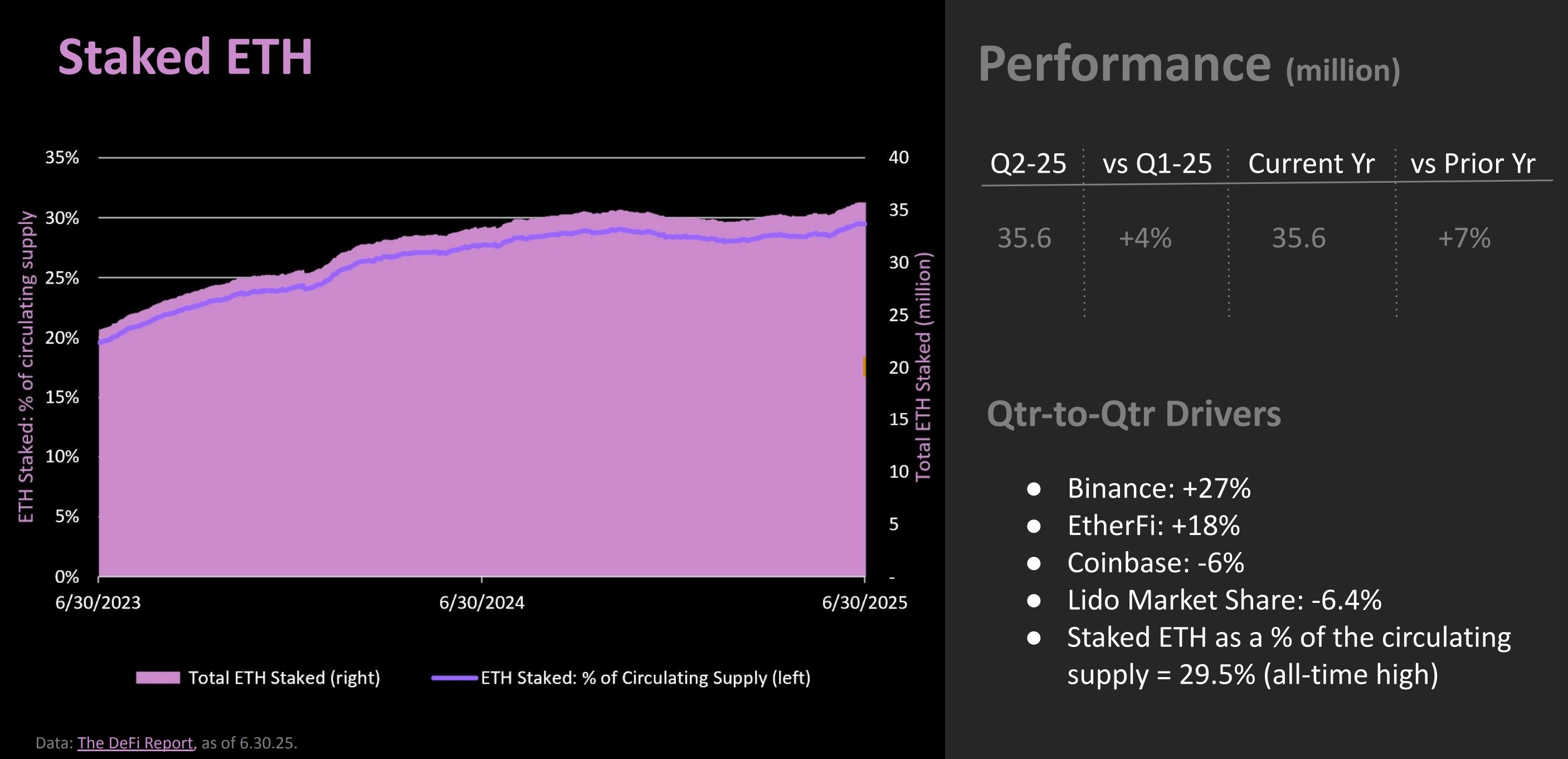

This growing demand is also reflected in ETH staking interest. As of July, 51 organizations have disclosed staked ETH holdings totaling 1.26% of Ether’s total supply.

The launch of Ether staking ETFs is expected by the end of Q3 2025. While spot ETH ETFs have pulled $70 million in daily inflows over the past year, adding a 3–4% staking yield could attract an extra $20–30 billion yearly.019837f7-d6f6-7952-a600-4cdef33d2ab3.jpeg

#ETH price breaks through $4,600, buy or sell?#Check In Daily, Win Prizes Daily — Join the Fun!#XTZ 2.0 – can it stand out in the Layer 2?#Do you think MemeCore is promising?

5Share

All Comments0LatestHot

No records