Jami

07/14 17:48

MANTRA Leads Innovation in Real-World A

MANTRA Leads Innovation in Real-World Asset Tokenization with MultiVM Blockchain

The platform’s infrastructure facilitates the tokenization of physical assets, including real estate and environmental credits.

Recent strategic developments demonstrate this capability, particularly the partnership with Dimitra to tokenize agricultural projects and carbon credits, beginning with cacao farming initiatives in Brazil and forest conservation programs in Mexico. These efforts are expected to generate one million traceable carbon credits within the coming decade.

Network security and institutional credibility received a major boost with Google Cloud becoming MANTRA’s largest validator. Concurrently, the project has advanced its decentralization efforts by reducing internal validators by 50% and incorporating 50 external validation partners during Q2 2025.

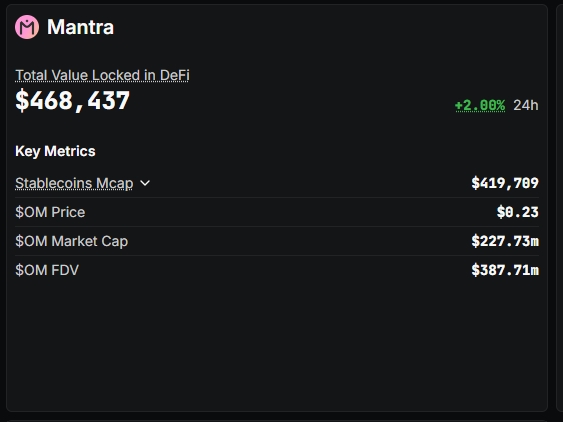

In response to market conditions following a 90% price decline in April, MANTRA’s leadership implemented a 150 million OM token burn, a decisive move to address supply concerns. This reduction in circulating tokens, coupled with observed whale accumulation patterns showing minimal large-scale sell-offs, creates favorable conditions for price appreciation.

Market analysts identify several positive indicators for $OM (MANTRA) despite its moderate (0.0059%) market share.

Technical assessments suggest a potential 5x price increase to $1, supported by growing interest in RWA solutions and MultiVM adoption. Market sentiment metrics and liquidity patterns reflect increasing speculative interest, while the rising TVL demonstrates substantive ecosystem engagement.

All Comments0LatestHot

No records