Crypto Express

07/14 01:54

ETH : A new phase of price discovery

The impact of this structural shift is clearly reflected in Ethereum’s price action. Since the 22nd of June, ETH has rallied by an impressive 40%, doubling Bitcoin’s 20% gain over the same period.

In doing so, Ethereum decisively broke through the $2,800 resistance, reclaiming levels last seen in early February, all while the 30-day whale address count declined by 15%.

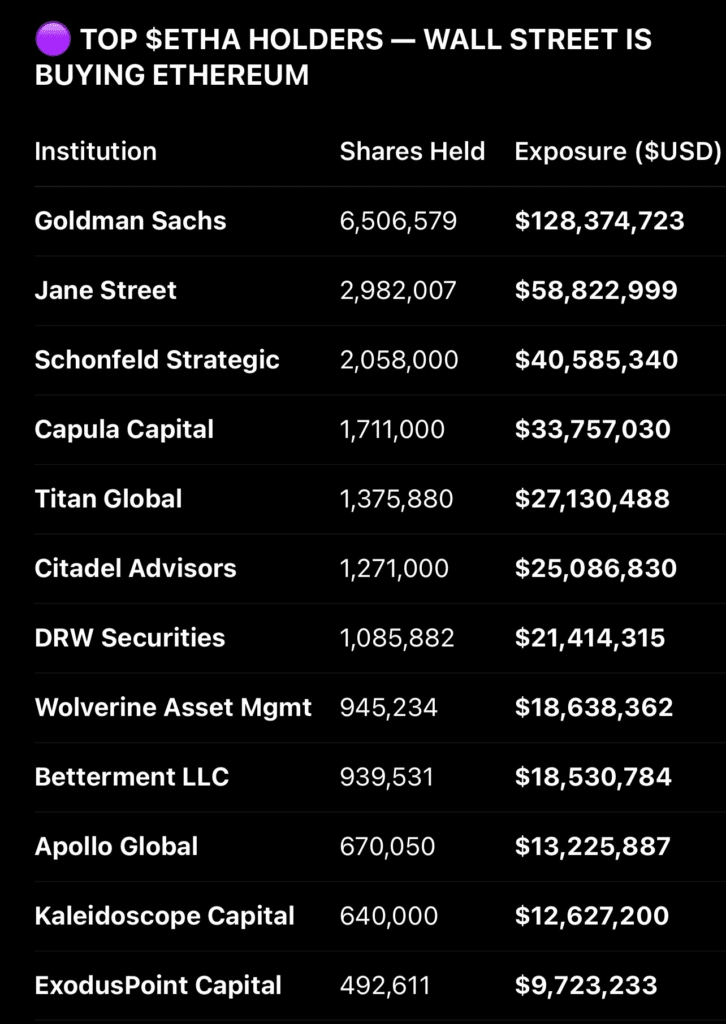

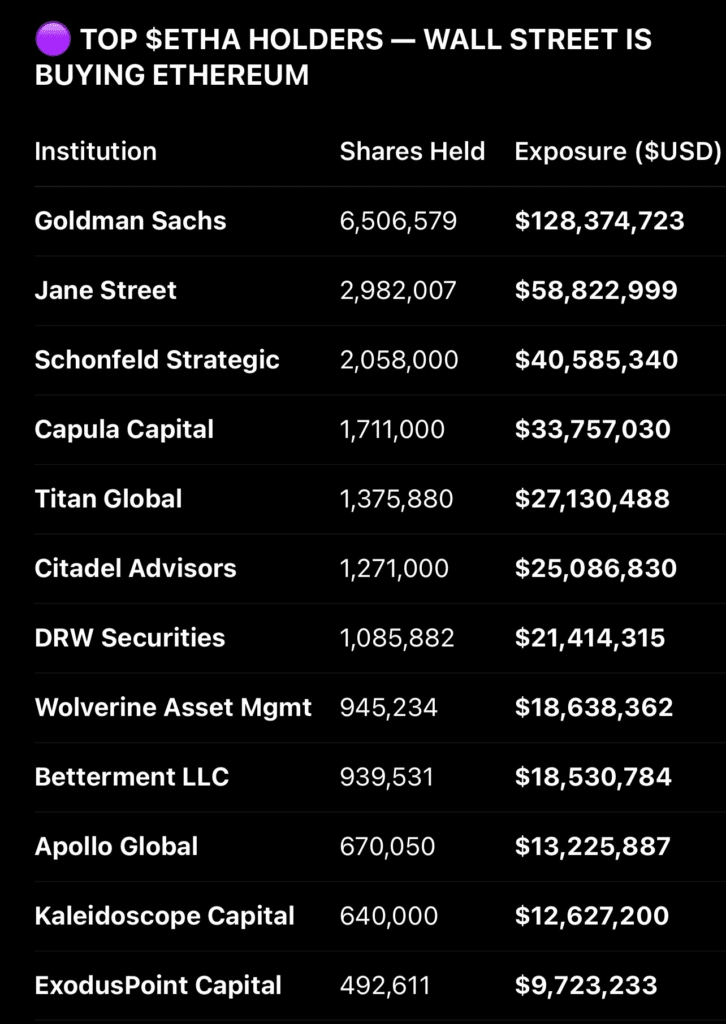

What’s absorbing this volatility? Institutional capital. ETHA exposure among Wall Street giants is accelerating, with Goldman Sachs leading at 6.5 million shares valued at $128 million.

In fact, the top five holders now command over $288 million in ETH-linked exposure. It is a clear indication that institutional conviction in ETH is deepening, turning its volatility from a threat into a supply-side squeeze.

Consequently, that dynamic is pushing Ethereum further along its path toward price discovery. With this kind of structural setup, ETH’s 40% gap to its all-time high may close quicker than the market expects.

#Check In Daily, Win Prizes Daily — Join the Fun!#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge#Do you think SPK is promising?#Do you think BULLA is promising?

62Share

All Comments0LatestHot

No records