Crypto Express

06/17 01:30

Cardano’s $1.2 billion pivot towards Bitcoin

Beyond institutions, corporates, and sovereign entities, Bitcoin is now being recognized as a store of value by an unexpected source, another Layer-1 blockchain. The catalyst? Its ability to generate reliable yield.

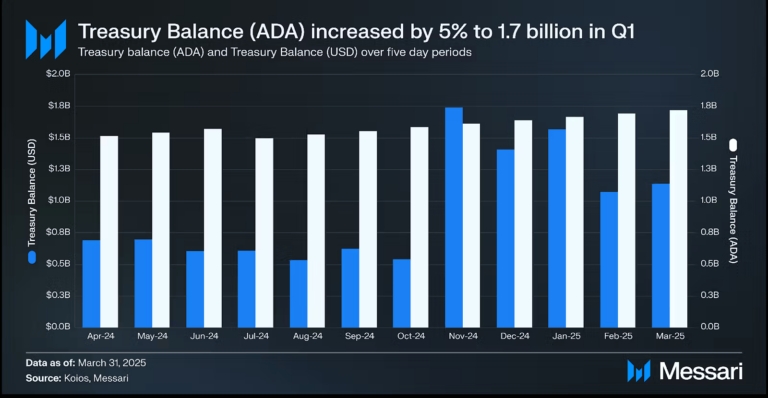

In fact, Charles Hoskinson has now laid out a plan that could reshape how Cardano runs its treasury. The idea is to use part of the $1.2 billion in ADA reserves to buy Bitcoin, then use the yield from that BTC to buy back ADA.

In short, it’s a simple feedback loop, designed to gradually reduce supply and support price appreciation along the way. Consider this – With its treasury, Cardano could acquire approximately 11,320 BTC at the press time spot price of $106,000.

Should Bitcoin reclaim the $110,000-level, that position would generate unrealized gains of around $40 million. If redirected into ADA buybacks, Cardano could buy approximately 66.67 million ADA at a spot price of $0.60.

Consequently, this will reduce supply while reinforcing price support. Though yet to be implemented, it sure is a high-conviction strategy that could shape ADA’s long-term value trajectory

#Share Your Thoughts on Popular Assets in June#Post To Earn Bonus#Claim1,200 USDT in the Monthly Creation Challenge

46Share

All Comments0LatestHot

No records