DecentGirl786

06/15 08:23

Futures traders fuel MKR rally The price jump was

Futures traders fuel MKR rally

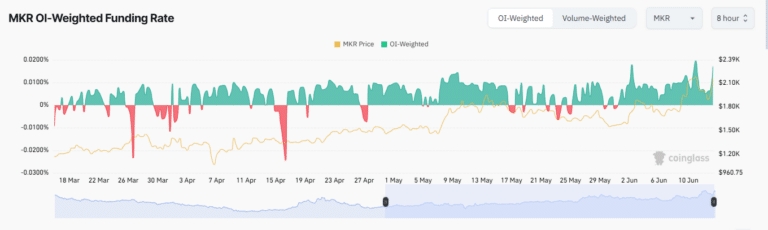

The price jump was primarily fueled by aggressive long positions in the derivatives market.

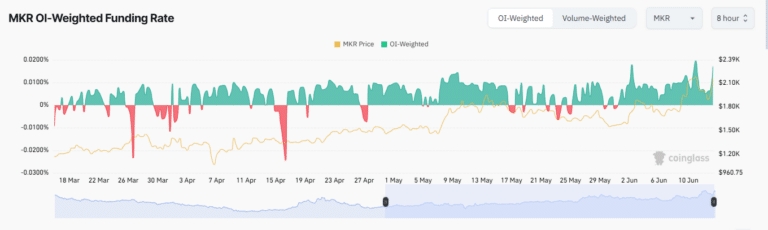

At press time, analysis of the Open Interest (OI) Weighted Funding Rate showed a positive reading of 0.0170%, the third-highest level this year.

This suggests that most open contracts on MKR come from long traders, who are paying a premium to maintain their positions.

While Futures traders led the bullish push, spot traders sold over $1 million worth of MKR during the same period.

Such a significant sell-off implies that these traders are either taking profits or cutting losses to avoid potential downside.

In this case, profit-taking appears to be the likely motive, given the asset’s recent strong price movement.

#Claim1,200 USDT in the Monthly Creation Challenge#Share Your Thoughts on Popular Assets in June#Picking Children's Day Token Gifts

1Share

All Comments0LatestHot

No records