Crypto Express

06/09 07:55

AVAX Traders’ eyes on short positions

So far, it’s not only crypto giants who have been losing interest in the token, but traders as well.

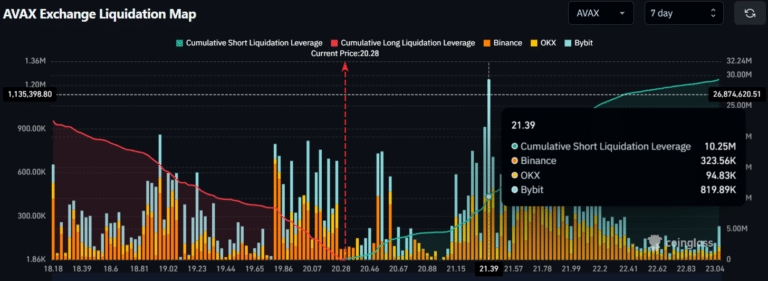

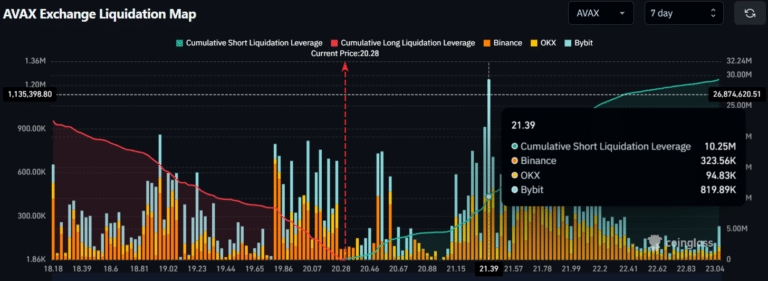

Data from the on-chain analytics tool CoinGlass revealed that, over time, traders have shifted their sentiment toward the bearish side.

AVAX hovered near $20.28 at press time

However, its derivatives map shows heavy short positioning stacked above $21.39. The Cumulative Short Liquidation Leverage hit 10.25 million, far outweighing long interest.

In contrast, only $8.43 million in long leverage sat between $19.80 and $21.39, hinting at nervous long bets beneath key resistance.AVAX dropped over 3.10% in the past day, and its 24-hour trading volume fell 22% as traders moved to the sidelines.

With a bearish divergence in momentum and declining whale confidence, the probability of another leg down grows stronger.

#Check In Daily, Win Prizes Daily — Join the Fun!#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge

31Share

All Comments0LatestHot

No records