近期加密货币市场风起云涌,两极分化明显:一边是老牌模因币狗狗币(DOGE)潜在大幅反弹,一边是智能合约巨头Solana(SOL)持续承压。投资者情绪起伏不定,短线机会与风险并存。

DOGE:潜在反弹迎来新机?

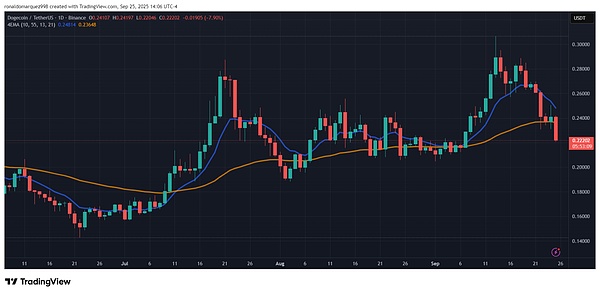

狗狗币,这枚诞生于模因文化的加密货币,本周遭遇 22% 的跌幅,价格一度跌破 0.22 美元,较历史最高价 0.73 美元下跌近 70%。尽管如此,多位分析师依然看好其反弹潜力。

Bitcoinsensus 的分析显示,DOGE 的周线图仍有上升趋势线支撑,且目前的价格回调模式,与去年 9 月至 11 月 DOGE 曾经上涨 300%-500% 的走势类似。如果关键支撑位 0.14 美元能够守住,狗狗币有望迎来快速反弹,潜在目标价被看高至 1.30 美元——意味着可能出现高达 800% 的涨幅!

此外,宏观经济数据也为风险资产带来正面支撑。美国最新每周失业救济申请人数下降至 218,000 人,GDP 增长预期上调至 3.8%,显示消费支出强劲。这些都可能引导资金从传统资产流向包括狗狗币在内的加密货币市场,为山寨币季提前开场。

不过,DOGE 仍面临阻力考验。0.27-0.28 美元是短期关键阻力位,若成功突破,则有望迈向 0.30 美元以上。相反,一旦回撤,历史支撑点 0.21、0.19 甚至 0.16 美元将成为投资者重点关注的安全边界。

Solana:从高峰滑落,空头主导市场

相比之下,Solana 近期表现疲软,从 232 美元的高位开始新一轮下跌,目前价格已跌破 220 美元和 200 美元关键支撑。技术面显示,SOL/USD 小时图上形成了明显看跌趋势线,阻力位在 204 美元附近,如果未能突破,可能进一步跌向 180 美元甚至 174 美元支撑区域。

短期技术指标也偏空:MACD 在看跌区域加速,RSI 低于 50 水平,显示空头占据优势。若价格未能站稳 204 美元,投资者需警惕短期进一步回撤的风险。反之,如果成功收复 215 美元阻力位上方,则可能开启稳步反弹,为下一轮上涨奠定基础。

加密总结:机会与风险并行

当前市场呈现明显分化格局:狗狗币(DOGE)在低位徘徊,但若守住关键支撑 0.14 美元并突破 0.28-0.30 美元阻力区,潜在反弹空间高达 800%,有望重现往年暴涨行情。而 Solana(SOL)则承受下行压力,若无法突破 204-215 美元阻力位,可能继续下探至 188 甚至 174 美元支撑区。

宏观经济数据表现强劲,就业与 GDP 的上修为风险资产带来积极情绪,但流动性和传统市场波动仍可能左右加密板块。

对投资者而言,这既是潜在的高收益窗口,也是风险考验。灵活把握关键支撑与阻力位,合理控制仓位,才能在多空交织的市场中立于不败。DOGE 可能迎来爆发,SOL 则需时间修复——市场的胜负手,就藏在下一次突破与回调之间。

点赞、转发,关注我,带你捕捉更多市场风口,陪你笑看牛熊起伏!

现在市场活跃,新的明星板块和币种正等待爆发!抓住趋势抄底,就是下个牛市的巨大机会,我们不是挣工资的,是来发财的!小云实时分享波段与长线策略,让你站在巨人肩膀上,快速跨越财富阶层,错过一波可能就要错过百倍收益!加入我们!

---END