来自:@Phyrex_Ni

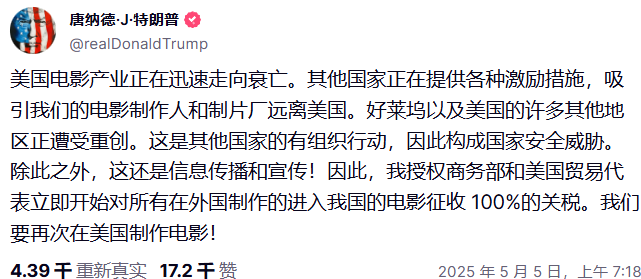

一大早看到美股期货下行,几乎在期货开盘的同时 $BTC 也跟随下行,翻了翻市场的信息,没有发现什么强烈的利空,标普500和纳指期货早晨的时候下跌了超过 0.7% ,现在开始逐渐回升。也就是川普在早晨的时候公布了要对美国引进的电影征收 100% 的关税。

这事本身对美国经济的影响不大,查了下数据外国电影在美国院线票房占比通常仅为 10%以内,而且影视行业占美国GDP比重不到 1.5% ,进口电影的影响更多的还是在 Netflix ,Amazon Prime 等等。

加上目前美股的驱动主要是在科技和Ai板块,所以因为影视关税导致的下跌可能性不大,那么我个人猜测主要是因为两个原因导致的。

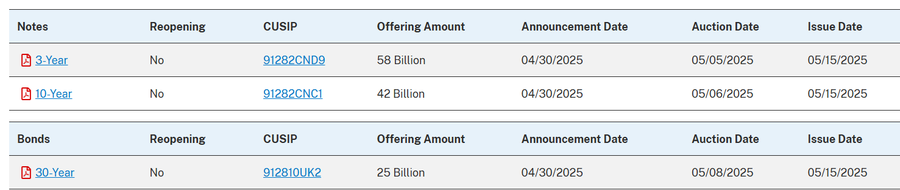

1.本周要开始拍卖3年,10年和30年期的美债。总金额为 1,250亿美元,在当前高利率环境下,很大的概率会向市场抽取流动性。

当然我并不觉得这事是多大的利空,毕竟卖债是早就被市场预期的,但虽然卖债本身不算大利空,但买债的是否顺利就会对市场产生影响。

简单来说如果本次需求强劲,利率温和中标,市场短期波动有限,但如果需求不足或中标利率飙升,说明市场对美国债务可持续性或未来利率环境缺乏信心。

说人话就是若美债拍卖中标利率飙升或需求不足,可能引发债市暴跌、美股估值压缩、加密市场承压、美元波动加剧,甚至引发系统性流动性担忧,触发美联储干预预期。这是一个典型的“长端利率突然失控”风险窗口。

再简单点就是股市下跌。当然这说的是在拍卖不利的情况下,不过近期美国国债拍卖整体表现稳定,尤其是10年期国债(四月份拍卖)显示出强劲的市场需求。只是短期债券的外国投资者参与度下降,可能预示着市场对短期经济前景的担忧。

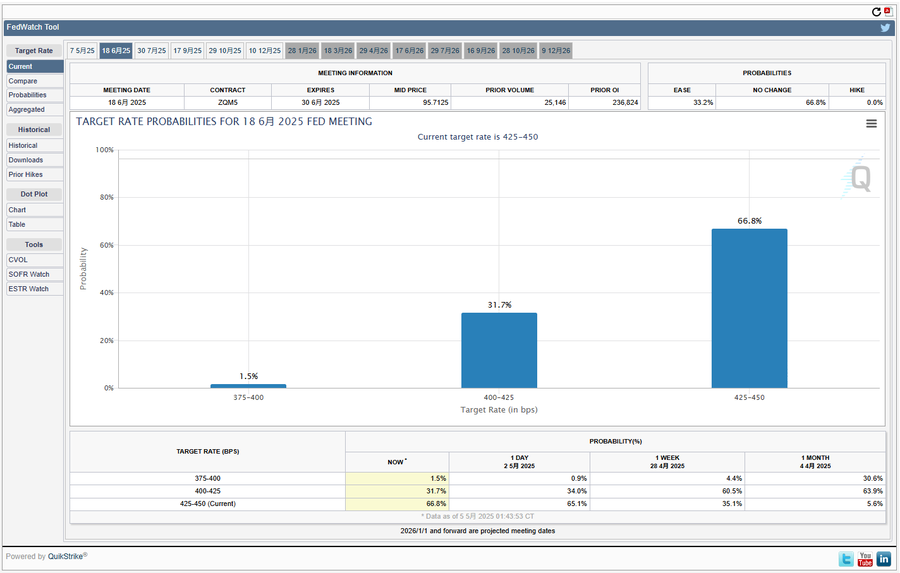

2. 本周四凌晨的美联储议息会议。五月不会调整利率想来应该没有疑问了,重点就是六月和七月是不是会有调整的可能,从 CME 提供的数据来看,六月不降息的预期已经上升到了 66.8% ,GDP 和 非农数据后,市场已经不太预测美联储会在六月降息了。

这已经被市场预期过了,所以不降息本身并不算是利空,而鲍威尔会在议息会议上说什么才是投资者所紧张的,早晨的时候我读了华尔街日报对前美联储官员,现任高盛董事长 Kaplan 的采访,标题就是“谈降息困境”,所以大概是什么内容想来大家也知道了。

采访中 Kaplan 甚至引用了 鲍威尔 在2022年的一段警告“为了将通胀率降至 2%,我们可能不得不接受经济衰退。”并且认为现在美国之所以还没有进入经济衰退的主要原因是政府财政支出一直处于历史高位,财政赤字占 GDP 的比例超过 6.5% 。但目前美国正在扭转这个情况减少财政支出。

所以 Kaplan 认为美国发生经济风险的概率挺大的,并且表示如果自己还在美联储的话,是支持2025年仅降息2次的,还认为美联储将更多地采取反应性措施,而非先发制人。

说人话就是,美联储仍然会以看数据为主,除非是明确的经济可能下行(衰退)的结果出现后才会对市场进行干预。需要重点关注鲍威尔讲话中对关税通胀的表态。如果他明确将关税推高的通胀视为“暂时性”,可能缓解市场对鹰派政策的担忧。

所以总的来说,虽然本周缺乏明确利空数据,但长端利率不稳定 + 美联储保持数据依赖的环境决定了市场将继续以宏观事件为驱动,情绪受到信息面影响,利好减少的话将FOMO逐步降温。风险资产(如BTC、科技股)缺乏明确上行动力,除非出现超预期的美联储鸽派转向或美债拍卖超额认购,否则大概率进入 93,000 美元到 98,000 美元的支撑位震荡整理期。