Strategy, the largest Bitcoin treasury company, submitted feedback to index company MSCI on Wednesday about the proposed policy change that would exclude digital asset treasury companies holding 50% or more in crypto on their balance sheets from stock market index inclusion.

Digital asset treasury companies are operating companies that can actively adjust their businesses, according to the letter, which cited Strategy’s Bitcoin-backed credit instruments as an example.

The proposed policy change would bias the MSCI against crypto as an asset class, instead of the index company acting as a neutral arbiter, the letter said.

The MSCI does not exclude other types of businesses that invest in a single asset class, including real estate investment trusts (REITs), oil companies and media portfolios, according to Strategy. The letter said:

“Many financial institutions primarily hold certain types of assets and then package and sell derivatives backed by those assets, like residential mortgage-backed securities.”

The letter also said implementing the change “undermines” US President Donald Trump’s goal of making the United States the global leader in crypto. However, critics argue that including crypto treasury companies in global indexes poses several risks.

Related: Strive calls on MSCI to rethink its ‘unworkable’ Bitcoin blacklist

Crypto treasury companies can create systemic risks and spillover effects

Crypto treasury companies exhibit characteristics of investment funds, rather than operating companies that produce goods and services, according to MSCI.

MSCI noted that companies capitalized on cryptocurrencies lack clear and uniform valuation methods, making proper accounting a challenging task and potentially skewing index values.

Strategy held 660,624 BTC on its balance sheet at the time of this writing. The stock has lost over 50% of its value over the last year, according to Yahoo Finance.

Bitcoin (BTC) is also 15% below its value at the beginning of 2025, when it was trading over $109,000, meaning that the underlying asset has outperformed the equity wrapper.

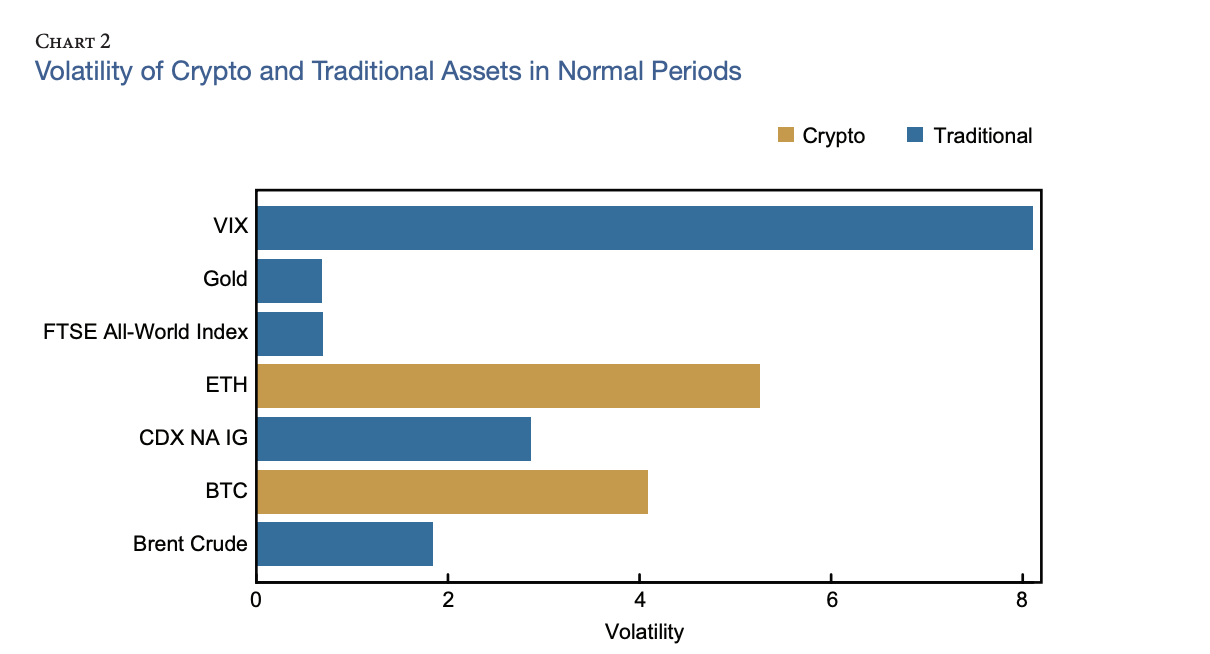

The high volatility of cryptocurrencies may heighten the volatility of the indexes tracking these companies or create correlation risks, where the index performance would mirror crypto market performance, according to a paper from the Federal Reserve.

The “common use” of leverage by crypto traders amplifies volatility and lends to crypto’s fragility as an asset class, the Federal Reserve wrote.

MSCI’s proposed policy change, set to take effect in January, could also prompt treasury companies to divest their crypto holdings to meet the new eligibility criteria for index inclusion, creating additional selling pressure for digital asset markets.

Magazine: The one thing these 6 global crypto hubs all have in common...