This week's Federal Reserve policy meeting will be one of the most controversial decisions in recent years.

Against the backdrop of a 43-day U.S. government shutdown that has led to a lack of key economic data, this meeting has transcended the realm of pure monetary policy, evolving into a stress test for the Fed's independence and decision-making mechanisms.

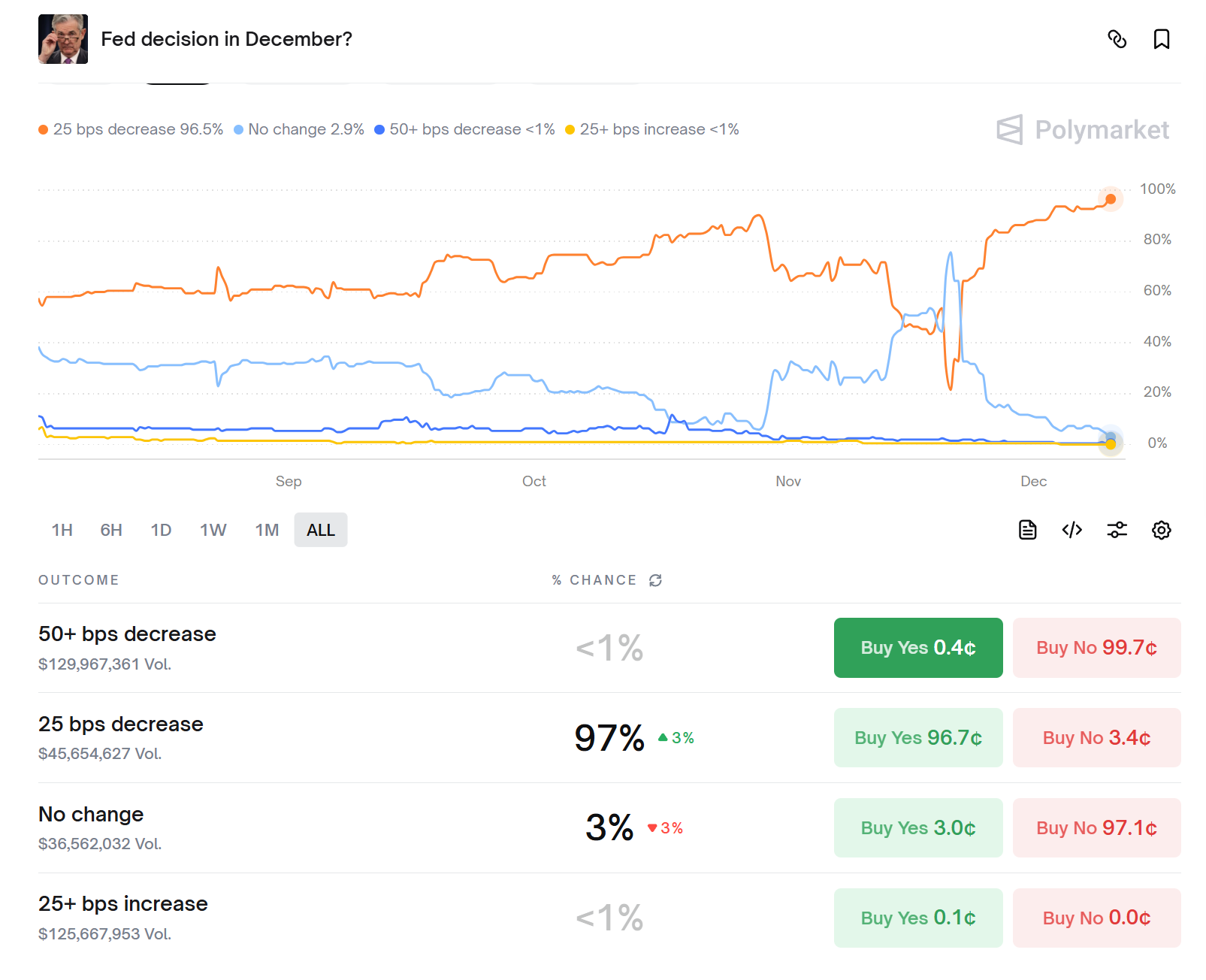

Market expectations for a rate cut have surged from 30% three weeks ago to 97% currently. This dramatic shift not only reflects collective anxiety in a data vacuum but also reveals that political pressure's influence on monetary policy is becoming more explicit.

Data Fog and Internal Divisions

The decision-making environment for the Fed at this meeting is exceptionally unique—the record 43-day U.S. government shutdown has resulted in the absence of most key economic data. This leaves the Fed, which has long emphasized being "data-dependent," seemingly navigating through a fog without clear coordinates for decision-making.

The absence of key official economic data, combined with the "mixed" nature of other alternative data, means the macroeconomic situation lacks a clear, objective anchor, leading to significant divergence in interpretations from various parties. Internal disagreements have become public and are trending toward polarization.

Currently, the stance on rate cuts among Federal Reserve Board members plus the New York Fed President presents a delicate 4-to-4 deadlock. This division is directly reflected in the dot plot, showing a rare "bimodal distribution"—7 officials support keeping rates unchanged for the full year, while 8 believe rates should be cut by 50 basis points.

More notably, the reasoning from both sides is equally compelling. Dovish officials argue the job market has clearly deteriorated, with the unemployment rate rising to 4.3% in August, a four-year high, and nonfarm payrolls increasing by only 22,000, far below expectations. Hawkish officials, however, are focused on inflation issue, with the core PCE price index rising 2.7% year-on-year, still above the Fed's long-term 2% target.

Pathways of Political Pressure Infiltration

The uniqueness of this meeting stems not only from the lack of economic data but also from the fact that political pressure is介入 (intervening in) the monetary policy arena in an unprecedentedly direct manner.

The Trump administration is directly influencing the structure of the Fed's decision-making layer through personnel appointments, breaking the long-standing tradition of "political neutrality" at the Fed.

The appointment of new Governor Stephen Milan is of symbolic significance. As a Fed governor simultaneously serving as Chairman of the White House Council of Economic Advisers, Milan cast a dissenting vote just one day after taking office, advocating for a more aggressive 50 basis point rate cut.

This policy stance highly aligns with Trump's public demand to "cut rates immediately and by a larger margin," raising deep concerns about the Fed's independence. More alarmingly, the Trump administration has clearly indicated that a nomination for the next Fed Chairperson might be announced before the end of December.

For the current core Fed decision-makers, this meeting might be their last chance to state their position and choose sides. Policy decisions during this power transition period inevitably involve considerations of personal career prospects.

The Fed faces not just a technical decision on interest rate adjustments but a severe test of its institutional independence. The balance between political pressure and professional judgment has become a key variable affecting the outcome of this meeting.

The Dilemma of Risk Management

Under the dual challenges of data absence and political pressure, the Fed's decision this time is essentially a complex risk management practice, requiring finding a balance between conflicting objectives. On one hand, the Fed needs to address the downside risks from a weakening labor market. Nonfarm payrolls increased by only 22,000 in August, a significant drop from the revised 79,000 in July, and the unemployment rate rose to a four-year high of 4.3%. If this slowing trend continues, it could trigger a vicious cycle of consumption contraction and economic recession.

On the other hand, inflation risks persist. Although current price pressures mainly stem from supply-side factors (such as import costs pushed up by tariff policies) rather than demand-pull from an overheating economy, whether inflation expectations can be effectively anchored remains uncertain. If the rate cut is too large, it could increase inflation risks, even triggering a wage-price spiral.

Making it more complex, the U.S. government's interest expense on debt has reached $1.1 trillion annually. While rate cuts could ease fiscal pressure, they might also fuel asset bubbles. This权衡 (trade-off) under multiple objectives complicates the Fed's decision-making framework, going beyond the traditional "dual mandate."

Institutional Resilience and Communication Challenges

This meeting tests not only the Fed's decision-making wisdom but also its institutional resilience and communication capabilities. With serious internal divisions, how to form a consensus and effectively communicate policy signals is a key challenge facing Chair Powell.

The divergence in the dot plot is phenomenal. Among the 19 policymakers, 6 believe no further rate cuts are needed, 9 support two more cuts, and there is also one clear outlier (likely Milan) hoping for an additional 125 basis points of cuts this year. This dispersed forecast distribution increases market skepticism about the Fed's communication strategy.

The Fed might address this challenge by strengthening forward guidance. A possible strategy is to emphasize the principle of "deciding meeting-by-meeting," avoiding clear commitments to the future path while stressing that policy will remain flexible. While this strategy might temporarily sidestep internal disagreements, it could weaken the effectiveness of policy signals.

A more profound challenge is how to gain market trust for decisions made in a data-deficient environment. The Fed may rely more heavily on high-frequency data (like weekly jobless claims) and alternative indicators (such as business surveys and the Beige Book) as references for decision-making. This shift in decision-making mode itself is a test of its communication ability.

As 2025 draws to a close, the Fed's future path remains full of unknowns. The分散的 (scattered) predictions on the dot plot indicate that officials hold differing views on the economic outlook and policy path for 2026. This meeting might inaugurate a全新的 (brand new) monetary policy framework: data absence will become the norm, not the exception; political pressure will move from behind the scenes to the forefront; and the Fed's independence will depend on its ability to maintain policy resolve in a complex environment.