Stablecoin issuer Circle is developing a privacy-enhanced version of its US dollar-pegged USDC token, aiming to spur institutional adoption by offering greater confidentiality than traditional public blockchains allow.

The new stablecoin, called USDCx and targeting banking and enterprise users, is being built in partnership with the privacy-focused blockchain company Aleo, Fortune reported on Tuesday, citing Aleo co-founder Howard Wu.

Unlike most existing stablecoins, which have wallet addresses and transaction details fully visible onchain, USDCx is designed to provide “banking-level privacy.” Circle would still be able to provide a compliance record if law enforcement or regulators request information on specific transactions, according to the report.

The initiative aims to address a key hurdle for major financial institutions, many of which have been hesitant to utilize blockchain-based payment rails because their transaction flows would be publicly visible.

Aleo has long argued that privacy is essential for the next phase of stablecoin adoption. In a May post, the company wrote that while transparency is often promoted as a core blockchain advantage, “it becomes a liability when dealing with sensitive, confidential payment data.”

Aleo isn’t the only company pushing for privacy in stablecoins. As Cointelegraph reported, digital asset infrastructure provider Taurus has developed a private smart-contract system for stablecoins, designed to enable anonymous transactions. This approach aims to boost the use of stable assets for intracompany payments and employee payrolls.

Related: Bank lobby is ‘panicking’ about yield-bearing stablecoins

Stablecoins take center stage in corporate America

Circle’s move into privacy-focused stable assets comes as more major institutions begin exploring stablecoins in the wake of the US GENIUS Act, the new regulatory framework governing US dollar–pegged tokens.

As Cointelegraph reported, a corporate stablecoin race is emerging in the wake of GENIUS. Citigroup has partnered with Coinbase to test stablecoin-based payment rails for its clients, while other Wall Street companies, including JPMorgan and Bank of America, are reportedly in the early stages of experimenting with similar technologies.

Global remittance provider Western Union is also building a digital asset settlement system on Solana, with plans to introduce a US Dollar Payment Token as part of its infrastructure overhaul. Meanwhile, global payments giant Visa has expanded its stablecoin offerings amid growing competition in the space.

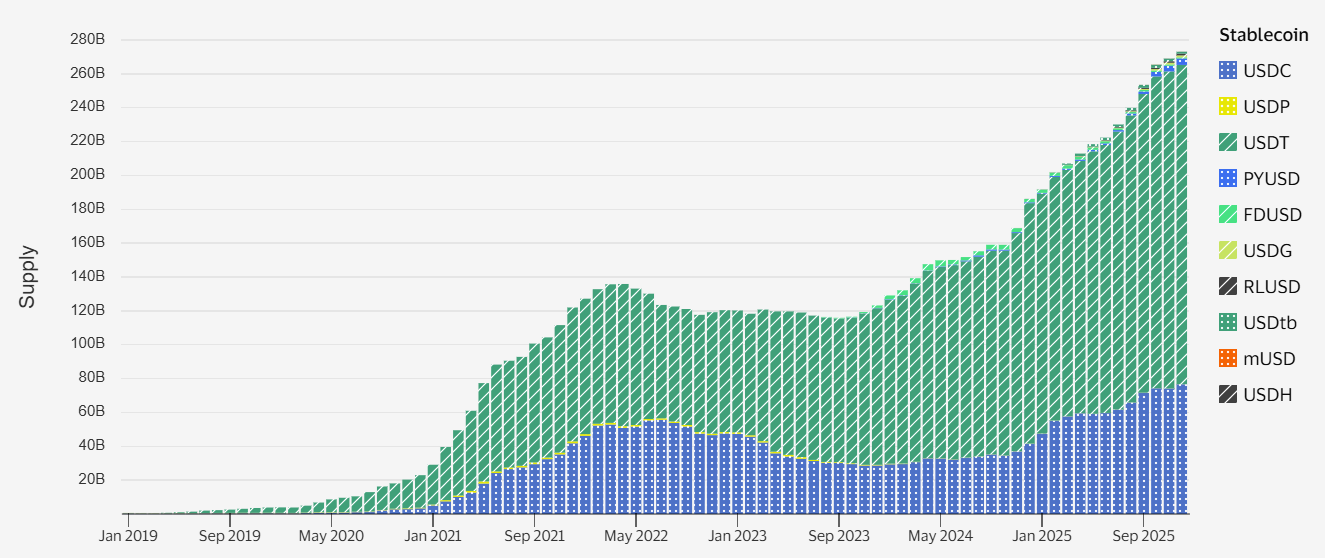

The US dollar underpins the vast majority of global stablecoin activity. USDC (USDC) and Tether’s USDt (USDT) together account for roughly 85% of the market, while other dollar-linked tokens, including synthetic dollars and PayPal USD (PYUSD), also rank among the largest.

Related: Crypto Biz: Wall Street giants bet on stablecoins