Authored by Derrick Chen, Lucio Lyu, Researchers at Huobi Research Institute

Abstract

This week, we focus on the following events: 1) Celsius’ Third Bankruptcy Hearing Yields Little in the Way of Customer Relief; 2) Second Round of Layoffs at Brazilian Crypto Unicorn 2TM; 3) EU's MiCA Crypto Law Text Ready Within 6 Weeks, Lead Lawmaker Says. ______________________________________________________________________________

Project Analysis: With TVL suddenly increasing by US$80 million in 8 days, CANTO, a new public chain, is quickly coming into the spotlight. This report analyzes the value of CANTO from the team, tokenomics, design, and technical perspectives.

1. Industry overview

I. Overall market trend

Figure 1. Overall market data

Source: CoinMarketCap

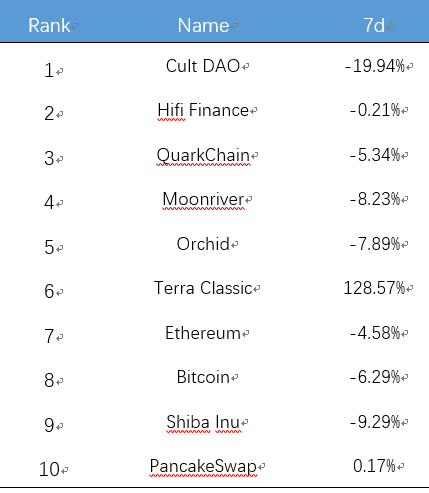

The global cryptocurrency market this week had a 4.65% decrease and the market cap has gone below US$1 trillion to US$0.985 trillion. Bitcoin is currently at US$20,102, decreasing from US$23,102 last week. Meanwhile, Ethereum, the second largest cryptocurrency, currently trading at US$1,588, has a 7-day price change of -4.44%. Terra Classic, the original Terra coin that crashed down during May, had a 24-hour change of 15.68% and a 7-day price change of 129.36%, which shows signs of recovery but could be the result of speculation. Many meme coins took a hit this week – most of them saw a decrease of around 10%. PancakeSwap become the only coin in top 10 that’s still rising in the 24 hour, 7 daysand 30 day periods, apart from Terra Classic.

II.NFT

Table 2. NFT Collections Listed By Sales Volume (7d)

Source: CoinMarketCap

The NFT market last week saw a significant rise of 72.83%, continuing the rise of 344.92% since last week, and market cap for this week is US$2,223,384,049.95. However, 7-day sales volume and the total sales decreased significantly: 7 day sales volume decreased by 62.10% and total sales decreased by 34.69% respectively. Overall, the trend of the NFT market this week has gone in the opposite direction from the crypto market, which dropped significantly. The brand ABC + Virtual Exhibition had 91.8% loss in volume and a 148.2% rise in average price, which is an odd trend, and puts it at the top of the top 10 list NFT collections this week according to CoinMarketCap. Most of the volume and the average price of other top 10 brands, like BAYC and CryptoPunks, remained stable last week (below 0.1% change).

Table 3. Top trending collections on NFTGO (by daily volume)

Source: NFTGO

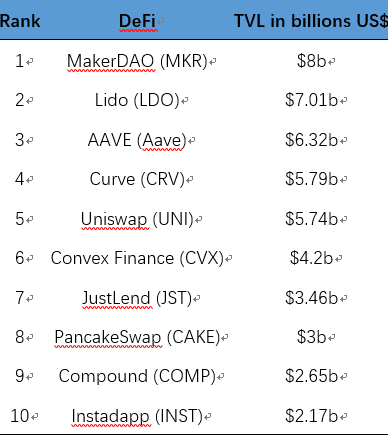

III.DeFi

Table 4. DeFi market TVL ranking

Source: DefiLlama

IV.Layer 2

Table 5. Layer2 protocols ranking and market share

Source: l2beat

2. Market news (Source: Coindesk, Odaily)

I. Industry news

Celsius’ Third Bankruptcy Hearing Yields Little in the Way of Customer Relief

Crypto lender Celsius Networks' customers still want their money back, but a judge appears to be in no hurry to authorize withdrawals – at least right now. Much of Thursday's three-hour hearing focused on whether custodial account holders should be able to get their funds back, and which types of custodial account holders qualify. Celsius clients believe any custodial account holder – meaning any customer who deposited their funds in a custody account but retained ownership of the assets, as opposed to Earn and Borrow customers who expected some sort of yield or benefit – should receive their funds. Celsius maintains that only "pure" custodial account holders are eligible, and not customers who originally deposited funds in the Earn product and later converted to custody.

Web3 Domain Name Service Could Lose Its Web Address Because Programmer Who Can Renew It Sits in Jail

When members of the ENS DAO community go to its eth.link website, all they’ll see now is an empty page with a green domain expiration notice banner at the top. That’s because the only person with the authority to renew the domain, Virgil Griffith, is serving a 63-month prison sentence for helping North Koreans use cryptocurrencies to circumvent sanctions and has been unable to renew the domain from prison. According to a notice domain registrar GoDaddy published on its website late Friday, eth.link expired on July 26 and is set to return to a domain registry on Sept. 5, where it will be up for grabs for anyone who is able to take it.

II. Investment and Financing

Second Round of Layoffs at Brazilian Crypto Unicorn 2TM

2TM – the holding company for Brazil's largest crypto exchange by valuation, Mercado Bitcoin – laid off 15% of its workforce, or about 100 employees on Thursday.

“The economic adversity continues,” said the company in a statement. It’s the second round of job cuts this summer for 2TM, which in June let go of more than 80 workers.

Speaking with CoinDesk, the company also took note of “unbalanced competition” in which foreign crypto exchanges are not following the same reporting and know-your-customer (KYC) standards as domestic players.

Bitcoin Mining Middleman Compass' Georgia Facilities to Close as Energy Prices Soar

Two Georgia facilities used by Compass Mining, a middleman that allows retail investors to participate in bitcoin production, are closing as power costs in the U.S. state soar.

The owner of the sites is shutting down because the local utility provider has increased prices, a major cost for bitcoin mining, by more than 50%, Compass co-CEO Thomas Heller told CoinDesk on Thursday by email. The company heard the news from the facility owner yesterday afternoon, he said.

III. Supervision

EU's MiCA Crypto Law Text Ready Within 6 Weeks, Lead Lawmaker Says

The text for the European Union’s landmark Markets in Crypto Assets (MiCA) Regulation could be ready within six weeks, leading lawmaker Stefan Berger said Thursday.

Lawmakers and governments had reached agreement on the main outline of the legislation, which requires crypto asset providers to register with regulators in to offer services across the bloc, on June 30. But in the absence of a final legal text there is still considerable uncertainty on the law's finer points, such as whether the rules will apply to non-fungible tokens (NFT), which offer proof of ownership of assets such as artworks using distributed ledger technology.

The law is set to create parameters for how each of the European Union's member nations regulates crypto. It's expected to create a common licensing regime, making it easier for companies operating in one member nation to launch in the others, as well as define rules for issues such as stablecoin issuance.

Controversial Crypto Lawyer Kyle Roche Pulls Out of Nexo, Binance.US, Solana and Dfinity Lawsuits

Crypto lawyer Kyle Roche has filed to withdraw from several class-action lawsuits against major crypto companies, according to a series of court filings Thursday, after pulling out of four additional cases the day before.

The relevant lawsuits involve Nexo Capital, BAM Trading (which operates as Binance.US), Dfinity, and Solana Labs. Roche also withdrew from a class-action lawsuit against several universities.

The round of withdrawals come after similar filings on Wednesday revealed that Roche, a founding partner of law firm Roche Freedman, would be stepping away from his law firm’s class action practice.

3. Trending project analysis – Canto

Figure 2. Canto’s TVL

Source: https://defillama.com/chain/Canto

I. What is Canto?

The first iteration of Canto is a permissionless general-purpose blockchain running the Ethereum Virtual Machine (EVM). It was built to deliver on the promise of DeFi – that through a post-traditional financial movement, new systems will be made accessible, transparent, decentralized, and free.

At launch, Canto provides Tendermint consensus secured by Canto validator nodes and an EVM execution layer via Cosmos SDK in addition to core financial primitives designed to support the Free Public Infrastructure (FPI). These primitives include: Canto DEX, Canto Lending Market, and $NOTE.

Figure 3. Canto’s Website

Source: https://canto.io/

Canto DEX — a zero-fee DEX for liquidity providers

For Canto’s DEX, the protocol cannot be upgraded and is kept in no governance. It will run on Canto perpetuity without ever being able to launch a token or implement additional fees over time, preventing the possibility of a predatory evolution toward rent-seeking behaviors.

Like other DEXes, Canto DEX uses an AMM (automated market maker) to price assets. The AMM derives liquidity for trading pairs from user-supplied pools of assets called liquidity pools. Users providing liquidity receive LP tokens that can be supplied in the Canto Lending Market. These tokens can be collateralized and borrowed against.

Canto Lending Market (CLM)

CLM is a pooled lending Compound v2 fork. For the Canto Lending Market, governance is controlled by Canto stakers. Canto stakers have broad interests in the growth of the ecosystem and fostering the best environment for both developers and DeFi users. As such, they have no incentive to extract rent at the application layer.

Canto Lending Market will allow LP tokens from Canto’s native decentralized exchange to be used as collateral. This collateral will be deposited in a lending market as supply but users will not be allowed to borrow LP tokens.

Fgure 4. CLMWebsite

Source: https://lending.canto.io/

$NOTE

$NOTE is the unit of account on Canto. $NOTE is an over-collateralized currency with a value perpetually rebalanced toward $1 through an algorithmic interest rate policy. It is over-collateralized, capital efficient, fully decentralized, and automated.

$NOTE cannot be created – it must be borrowed from the Accountant, a smart contract that implements the algorithmic interest rate policy, via the Canto Lending Market (CLM).

$NOTE is a fully immutable ERC-20 token backed by collateral lent to the CLM. It can only be borrowed by users who post select collateral assets such as USDC, USDT, CANTO, ETH, ATOM, or Canto LP tokens. As a result, for every NOTE in circulation, there is more than US$1 worth of collateral held by the CLM.

Canto Lending Market achieves superior capital efficiency by allowing stablecoin collateral backing NOTE to be lent out to other participants. For example, a DeFi participant can lend USDC to Canto Lending Market and then borrow NOTE. If the borrow rate for $NOTE is less than the supply rate for USDC, that DeFi participant will be getting paid to hold NOTE on Canto.

All interest charged by the Accountant is earmarked for funding public goods. It is held in the Community Treasury and ultimately governed by the Canto DAO.

Figure 5. The $NOTE Architechture

Source: https://docs.canto.io

II. How does $NOTE maintain price stability?

Since $NOTE cannot be created, only borrowed, the Accountant contract utilizes interest rates to manage the circulating supply of $NOTE, and by proxy, its price. The interest rate on $NOTE automatically adjusts up or down every 6 hours based on a TWAP of the market price of $NOTE.

Aiming to provide a public utility, the algorithm responsible for adjusting this interest rate is designed to change the interest rate in order to promote a less volatile value as opposed to maximizing revenue.

If $NOTE is trading under US$1, the interest rate is raised to strengthen the incentive for buying $NOTE on secondary markets and lending it to the CLM. If $NOTE is trading over a dollar, the interest rate is lowered to make borrowing $NOTE from the CLM and selling it on secondary markets more attractive.

For launch, each interest epoch will be 6 hours and the rate will adjust by 0.25 (one-quarter) of the difference between the price of $NOTE and US$1.

The Formula:

newInterestRate = max(0,(1 - price of $NOTE)*Adjuster Coefficient+ priorInterestRate)

Example:

Current Interest Rate: 4%. $NOTE average price over the last 6 hours: 1.04.

New Interest Rate: 3% = max (0, (1 - 1.04)* 0.25 + 4%)

If $NOTE is trading above US$1, the interest rate is lowered to weaken the $NOTE price. If $NOTE is trading below US$1, the interest rate is raised to strengthen the $NOTE price.

III. Canto’s Team

Canto is designed to support free public infrastructure, while eliminating centralized incentives: no official foundation, no presale, no vesting, and no venture backers. The core contributor to the project is s⋐ott @scott_lew_is. Plex (@Plex_Official) is a key contributor to the project, a community of developers with experience in high-frequency trading, mechanism design and software development, dedicated to exploring and developing DeFi.

Figure 6. Scott’s Twitter

Source: https://twitter.com/scott_lew_is

Figure 7. Plex’s Twitter

Source: https://twitter.com/Plex_Official

IV. CANTO Token

At genesis, 1 billion tokens were minted. The tokens will be distributed in the following manner:

• Contributors: 13.0%

• Settlers of Canto: 2%

• Future Grants: 5%

• Medium-Term Liquidity Mining: 35%

• Long-Term Liquidity Mining: 45%

Tokens not yet distributed (Grants and Future Liquidity Mining) will be kept in the community pool.

Liquidity Mining Incentives

In order to compensate LPs for providing capital to Canto’s zero LP fee DEX and to help distribute CANTO in a fair manner, a liquidity mining program will release tokens linearly per block to LP token holders. We ensure that there will be suitable liquidity at launch by partitioning the genesis block into two sets of liquidity mining incentives. The first block of tokens will provide incentives for LPs for the first six months after Canto launches and the second block will provide incentives for a longer-term, multi-year period. Incentives will be sufficiently large enough to ensure that liquidity is freely available for the vast majority of trading activity while accounting for high expected volatility in the initial phases of Canto’s launch.

Liquidity Mining Emissions

Medium-Term Liquidity Mining is expected to consist of six month-long epochs. The first epoch will start at launch and will distribute 5.83% of the token supply. The Canto DAO has on-chain control over all liquidity mining schedules. As the first epoch concludes, the DAO may choose to pass a proposal to begin a second epoch.

Long-Term Liquidity Mining is expected to continue liquidity mining after the Medium-Term Liquidity Mining allocation is emitted. The Long-Term Liquidity Mining reserves may be emitted over the course of 10 years, or any other schedule the DAO chooses.

Staking Incentives

Canto aims to bootstrap network security through a policy of minimum viable issuance of new tokens to stakers. They achieve this objective initially by issuing a flat amount of tokens linearly per block to stakers in a manner similar to LM incentives. Canto’s high inflation allows market participants to effectively price the excess returns on liquidity mining relative to the expected impermanent loss. As Canto’s financial primitives become more liquid over time, this premium is expected to converge rapidly to its fair value as new information enters the market.

Security Emissions

Network security emissions will start around an inflation rate of 200 million Canto per year for the first 30-day period, minting ~16m new CANTO tokens. The LM reward per block mined will be ~37 CANTO. Every subsequent period will face exponentially decaying security emissions.

V. Risks and opportunities

The project is in its early stage and we advise caution due to the large number of meme coins in the market, many of which are prone to collapse. The best way to find new projects is by joining the CANTO discord and checking out the “canto native projects” channel. For the entire Canto Layer1 blockchain, NOTE is an important cornerstone. However, Canto is not a real stablecoin per se, and the price fluctuation will be relatively large. We suggest farming users not to invest too much money in Canto, in order to manage risk.

As a new Layer1 blockchain, Canto has shown no technological innovation. Canto, has, however, made a change in the traditional profit-making model, canceled fee collection, and provided free Defi services. In the long run, Canto will eventually settle down like other normal EVM chains. But the price of CANTO in the short term may be impacted by the high APR from farming.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

https://research.huobi.com/#/

Consulting email:

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see "About Huobi Blockchain Research Institute" for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.