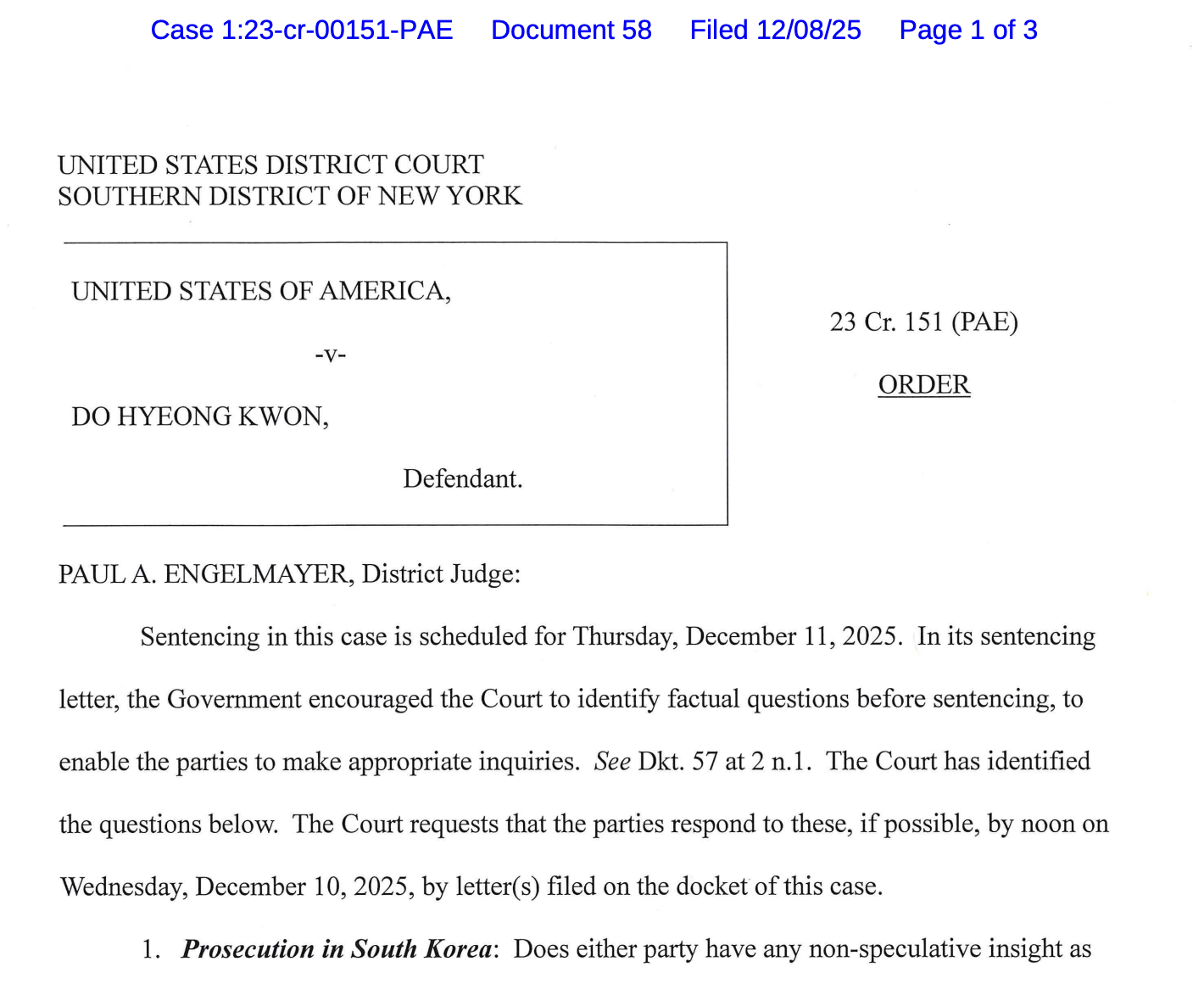

With Do Kwon scheduled to be sentenced on Thursday after pleading guilty to two felony counts, a US federal judge is asking prosecutors and defense attorneys about the Terraform Labs co-founder’s legal troubles in his native country, South Korea, and Montenegro.

In a Monday filing in the US District Court for the Southern District of New York, Judge Paul Engelmayer asked Kwon’s lawyers and attorneys representing the US government about the charges and “maximum and minimum sentences” the Terraform co-founder could face in South Korea, where he is expected to be extradited after potentially serving prison time in the United States.

Kwon pleaded guilty to two counts of wire fraud and conspiracy to defraud in August and is scheduled to be sentenced by Engelmayer on Thursday.

In addition to the judge’s questions on Kwon potentially serving time in South Korea, he asked whether there was agreement that “none of Mr. Kwon’s time in custody in Montenegro” — where he served a four-month sentence for using falsified travel documents and fought extradition to the US for more than a year — would be credited to any potential US sentence.

Judge Engelmayer’s questions signaled concerns that, should the US grant extradition to South Korea to serve “the back half of his sentence,” the country’s authorities could release him early.

Kwon was one of the most prominent figures in the crypto and blockchain industry in 2022 before the collapse of the Terra ecosystem, which many experts agree contributed to a market crash that resulted in several companies declaring bankruptcy and significant losses to investors.

Defense attorneys requested that Kwon serve no more than five years in the US, while prosecutors are pushing for at least 12 years.

Related: There’s more to crypto crime than meets the eye: What you need to know

The sentencing recommendation from the US government said that Kwon had “caused losses that eclipsed those caused” by former FTX CEO Sam Bankman-Fried, former Celsius CEO Alex Mashinsky and OneCoin’s Karl Sebastian Greenwood combined. All three men are serving multi-year sentences in federal prison.

Will Do Kwon serve time in South Korea?

The Terraform co-founder’s lawyers said that even if Engelmayer were to sentence Kwon to time served, he would “immediately reenter pretrial detention pending his criminal charges in South Korea,” and potentially face up to 40 years in the country, where he holds citizenship.

Thursday’s sentencing hearing could mark the beginning of the end of Kwon’s chapter in the 2022 collapse of Terraform. His whereabouts amid the crypto market downturn were not publicly known until he was arrested in Montenegro and held in custody to await extradition to the US, where he was indicted in March 2023 for his role at Terraform.

South Korean authorities issued an arrest warrant for Kwon in 2022, but have not had him in custody since the collapse of the Terra ecosystem. The country’s prosecutors applied to extradite Kwon from Montenegro simultaneously with the US, while they were pursuing similar cases against individuals tied to Terraform.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice