At 21:00 Beijing time on December 8, the Stable mainnet will officially launch. Stable, a Layer 1 blockchain supported by Bitfinex and Tether, focuses on stablecoin infrastructure. Its core design involves using USDT as the native gas fee, achieving sub-second settlement and gas-free peer-to-peer transfers. As of the time of writing, including Bitget, Backpack, and Bybit have announced they will list STABLE spot trading. Additionally, Binance, Coinbase, and Korean exchanges have not yet announced listings for STABLE spot trading.

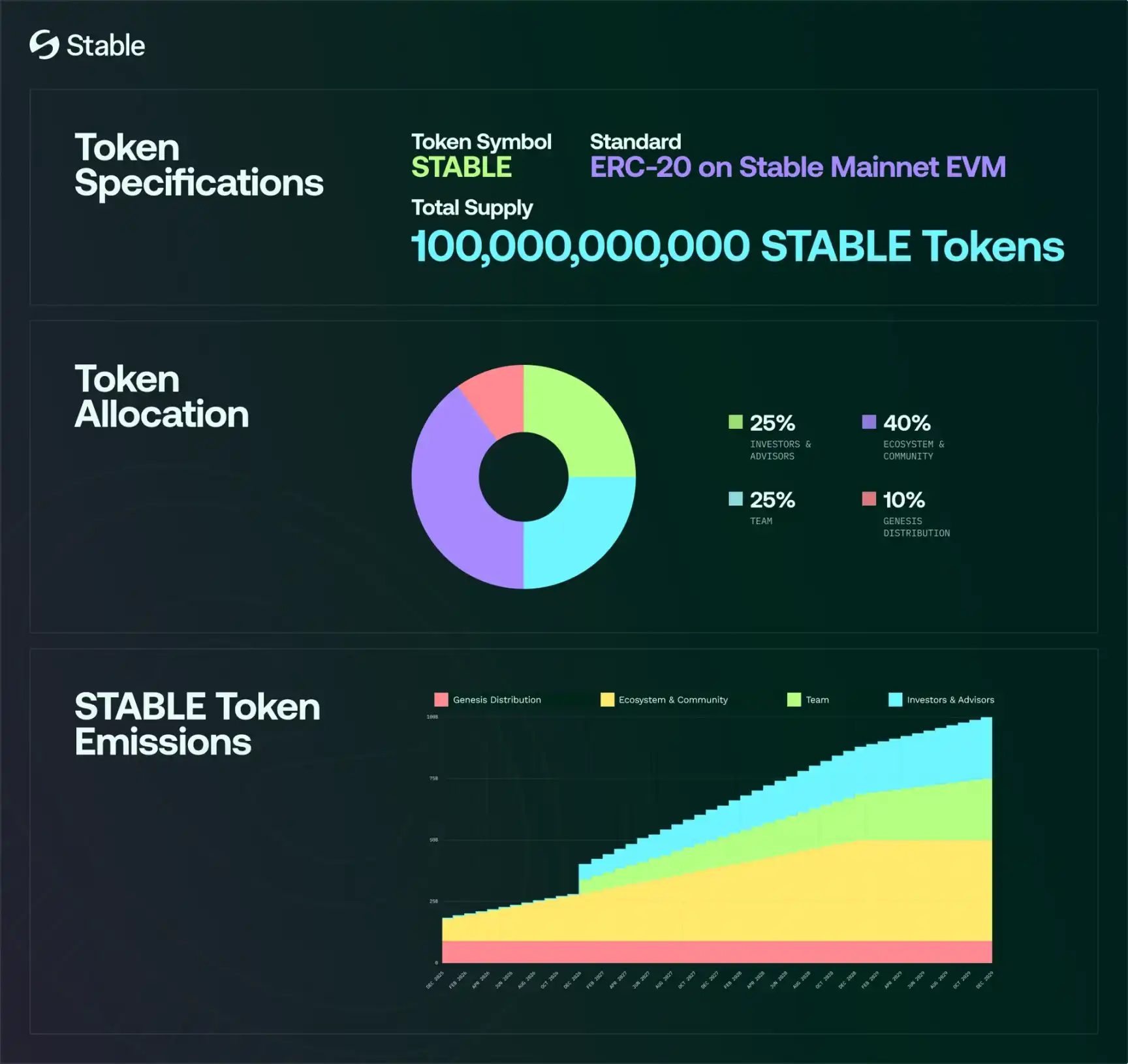

Total Supply of 100 Billion, Token Not Used for Gas Fees

The project team has released the whitepaper and tokenomics details before the mainnet launch. Its native token, STABLE, has a total fixed supply of 100 billion tokens. Transfers, payments, and transactions on the Stable network are settled in USDT. STABLE is not used for gas fees but is instead used to coordinate incentive mechanisms between developers and ecosystem participants. The STABLE token allocation is as follows: Genesis Distribution accounts for 10% of the total supply, supporting initial liquidity, community activation, ecosystem activities, and strategic distribution efforts at launch. The genesis distribution portion will be fully unlocked at the mainnet launch.

The Ecosystem & Community fund accounts for 40% of the total supply, allocated to developer grants, liquidity programs, partnerships, community initiatives, and ecosystem growth; the Team allocation accounts for 25% of the total supply, allocated to the founding team, engineers, researchers, and contributors; Investors & Advisors account for 25% of the total supply, allocated to strategic investors and advisors supporting network development, infrastructure construction, and promotion.

Team and investor allocations are subject to a one-year cliff, meaning zero unlocking for the first 12 months, followed by linear vesting. The Ecosystem & Community fund allocation is 8% unlocked at launch, with the remaining portion vested linearly to incentivize developers, partners, and user growth.

Stable utilizes a DPoS (Delegated Proof-of-Stake) model through its StableBFT consensus protocol. This design supports high-throughput settlement while maintaining the economic security required for a global payment network. Staking STABLE tokens is the mechanism for validators and delegators to participate in consensus and earn rewards. The primary roles of the STABLE token are governance and staking: holders can stake tokens to become validators, participate in network security maintenance, and vote in DAO governance to influence protocol upgrades, such as adjusting fee rates or introducing new stablecoin support.

Additionally, STABLE can be used for ecosystem incentives, such as liquidity mining or cross-chain bridging rewards. The project claims that this separated design can attract institutional capital because USDT's stability is much higher than that of volatile governance tokens.

Pre-deposit Controversy: Front-running, KYC Delays

Like Plasma, Stable also opened two deposit periods before the mainnet launch. The first phase of pre-deposits started in late October with an upper limit of $825 million, which was filled within minutes of the announcement. The community questioned potential front-running by some players. The top-ranked wallet deposited hundreds of millions of USDT 23 minutes before the deposit window opened.

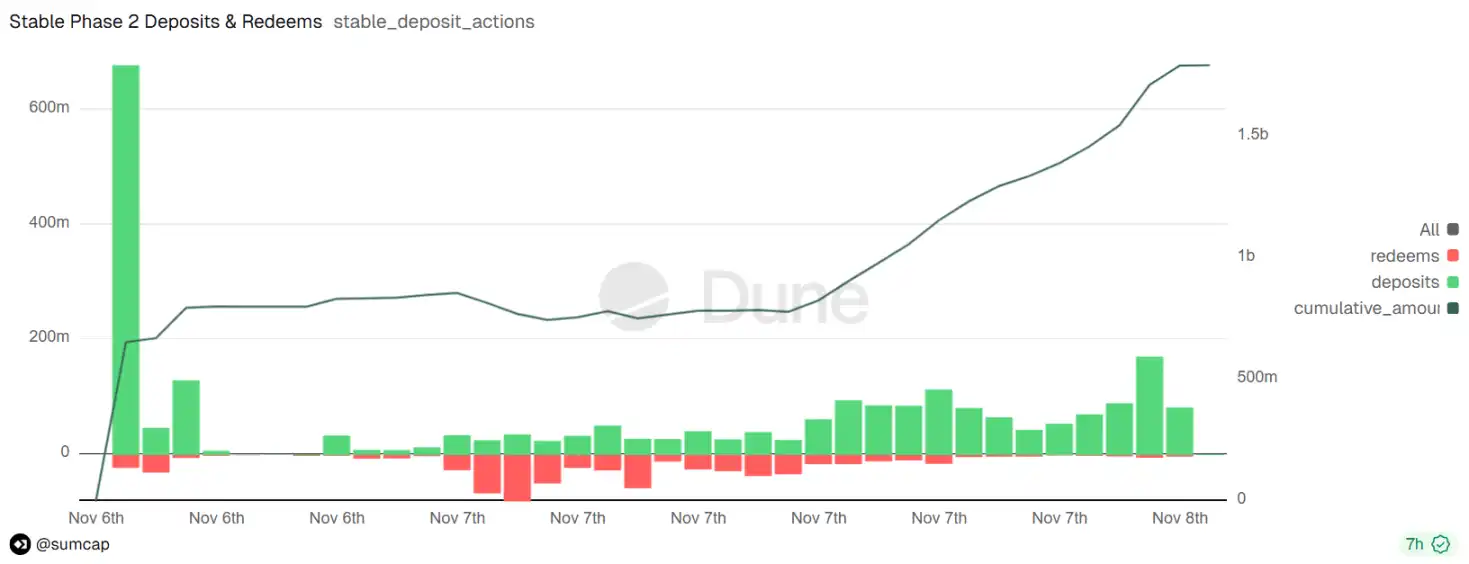

The project team did not directly respond and opened a second pre-deposit event on November 6 with an upper limit of $500 million.

However, Stable underestimated the market's enthusiasm for deposits. The moment the second phase opened, massive traffic surge caused its website to slow down and become unresponsive. Consequently, Stable updated the rules, allowing users to deposit via the Hourglass frontend or directly on-chain; the deposit function was reopened for 24 hours, with a maximum of $1 million per wallet and a minimum deposit amount still set at $1,000.

Ultimately, the total deposits in the second phase reached approximately $1.8 billion, with about 26,000 wallets participating.

The review time ranged from a few days to a week, with some users in the community complaining about system lag or repeated requests for additional materials.

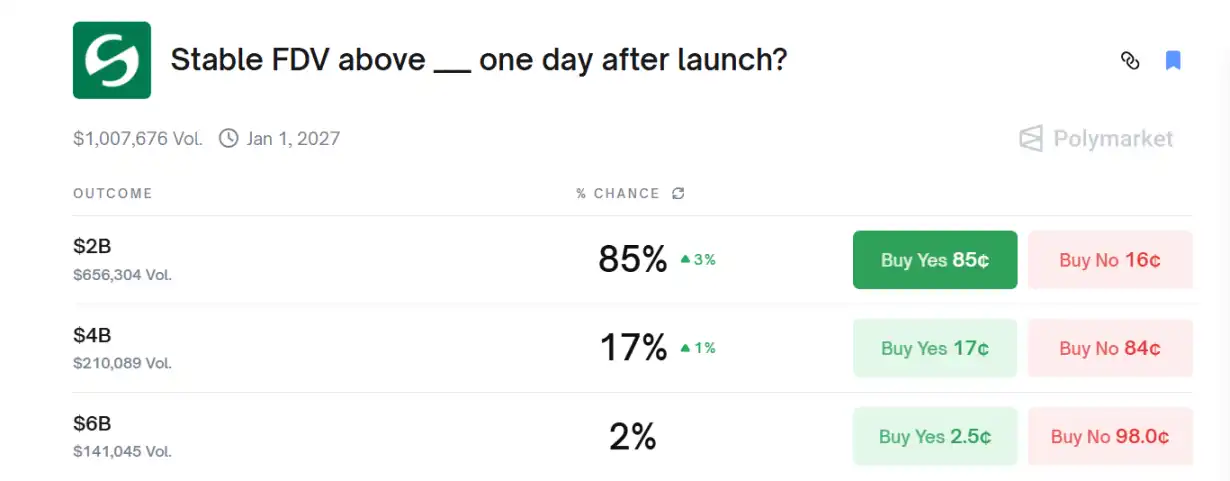

Over 85% Probability of $2 Billion FDV

In late July this year, Stable announced the completion of a $28 million seed round led by Bitfinex and Hack VC, bringing its market valuation to around $300 million.

For comparison, Plasma's current market cap is $330 million, with an FDV of $1.675 billion.

Some optimists believe that the stablecoin narrative, Bitfinex's backing, and Plasma's initial price surge followed by a drop might indicate there is still some hype and potential for price appreciation in the near term. However, pessimistic voices are stronger: since gas is not paid in STABLE, its utility is limited, especially as the market has entered a bear cycle and liquidity has become tight, its token value may decline rapidly.

Current Polymarket data shows that the market is betting with an 85% probability that its FDV will exceed $2 billion the day after launch. Calculating conservatively at $2 billion, the STABLE token price would correspond to $0.02.

In the perpetual futures market, according to Bitget行情 data, STABLE/USDT is currently quoted at $0.032, implying an anticipated FDV rising to around $3 billion.

Stable's first pre-deposit phase reached $825 million, and the second phase actually contributed over $1.1 billion, but after proportional allocation, only $500 million was actually pooled. The total pre-deposit size is $1.325 billion. The tokenomics disclose an initial allocation of 10% (for pre-deposit incentive rewards, exchange campaigns, initial on-chain liquidity, etc.). Assuming Stable ultimately airdrops 3%-7% of the supply to pre-depositors, and based on the pre-listing price of $0.032, the corresponding returns would be approximately 7% to 16.9%, meaning every $10,000 deposit corresponds to $700 to $1,690.