The last quarter of the year has always been quite bearish for the Solana price, marking the highest losses for the altcoin since it was launched back in 2020. Naturally, this has made Q4 a dreaded time for Solana investors, and the year 2025 has not been any different. The last two months have already closed in the red with double-digit losses, and with only December left to go, the Solana price might be on track to complete yet another bearish quarter.

Looking At The Historical Performance Of Solana In Q4

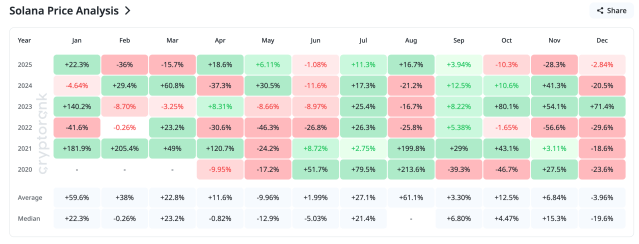

Taking into account data from the CryptoRank website, it shows Solana’s less-than-favorable performance in the last quarter. In the last five years, Q4 has had the highest average losses compared to the other quarters, and the month of December plays a major role in that due to how bearish it is.

December, in particular, boasts the second-highest average losses, second only to May’s -9.96% average. However, when it comes to the median returns, the month of December takes the cake, recording a high average of -19.6% losses over the year.

In the five years of its existence, only one year, in 2023, has the Solana price closed out the month of December in the green with 71.4% gains. The other years have ended with at least 18% losses, and this month is already looking bearish with -0.79% losses so far.

With the months of October and November already closing in the red, it is likely that December will follow. The last time that both October and November closed in the red was back in 2022, and December would follow suit with -29.6% returns for the month.

Analyst Says A Bounce Could Come Instead

While historical data suggests that the Solana price could end up struggling this month, one crypto analyst has presented a scenario where the altcoin could bounce back. This move is predicated on Solana’s ability to actually hold the support and break the next resistance.

Interestingly, though, the analyst’s chart shows an initial 15% dump before the Solana price finds support somewhere around $116. After that, the price is expected to rebound, and the target for the cryptocurrency after this would be the $170 level. The weekly candlestick also supports this possible jump, something that would send Solana to the green in September.

For now, the bulls continue to struggle despite last week’s campaign for $150, suggesting that there is a great deal of resistance at this level. If selling continues to build up, then it is likely that Solana will move down as predicted.