Author: Bitget

Today's Outlook

1. U.S. Senator Moreno calls crypto bill negotiations "frustrating," with year-end legislative progress advancing under pressure.

2. Strategy CEO: The company will hold Bitcoin at least until 2065, maintaining a long-term accumulation strategy. Meanwhile, Strategy founder and executive chairman Michael Saylor is pitching a Bitcoin-backed banking system to governments.

3. U.S. CFTC launches a digital asset pilot program, allowing BTC, ETH, and USDC to be used as collateral.

Macro & Hot Topics

1. U.S. Bureau of Labor Statistics: Temporarily suspends the release of October PPI data, rescheduled to January next year alongside November data.

2. U.S. releases November New York Fed 1-year inflation expectations at 3.2%, previous value 3.24%. Additionally, U.S. October JOLTs job openings will be released today at 23:00 (UTC+8).

3. Strategy recently spent approximately $963 million to purchase an additional 10,624 Bitcoins.

Market Trends

1. Over the past 24 hours, the cryptocurrency market saw $201 million in liquidations, with short positions accounting for $106 million. BTC liquidations totaled $64 million, ETH liquidations $51 million.

2. U.S. Stocks: Dow down 0.45%, S&P 500 down 0.35%, Nasdaq Composite down 0.14%. Additionally, Nvidia (NVDA) up 1.72%, Strategy (MSTR) up 2.63%.

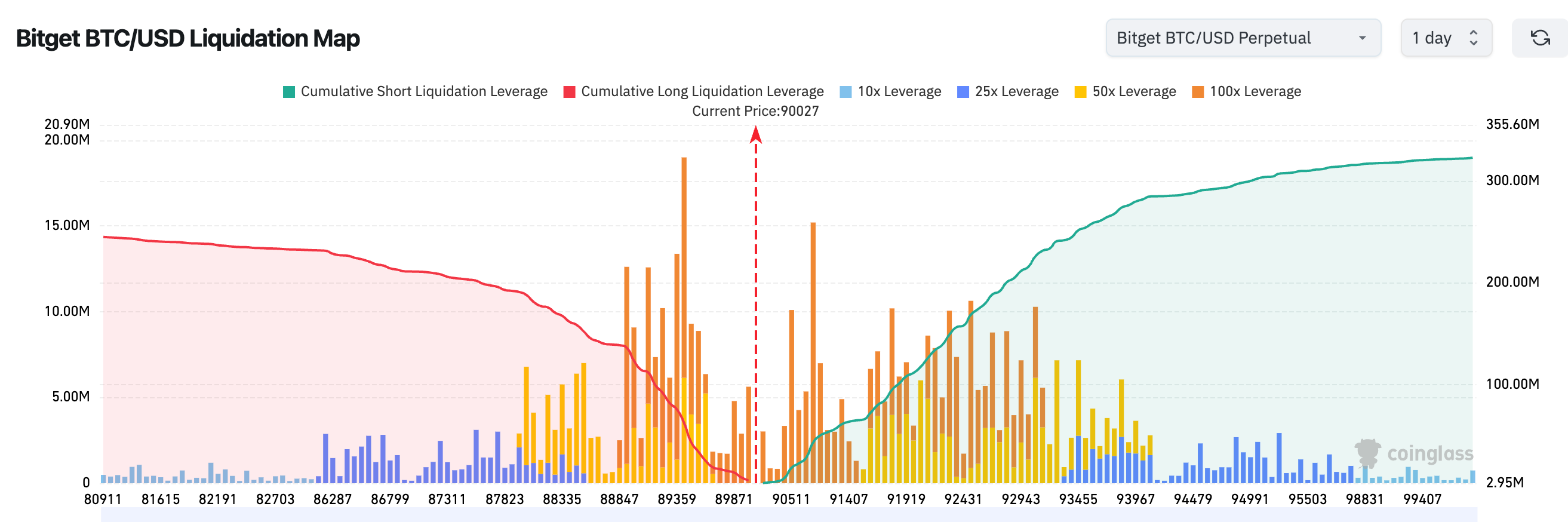

3. Bitget BTC/USDT liquidation map shows: A large number of highly leveraged long positions have accumulated near the current price (around $90,000). A slight pullback could trigger concentrated long liquidations. Short positions are relatively lighter below; if the price continues to rise, short liquidations could drive further upside.

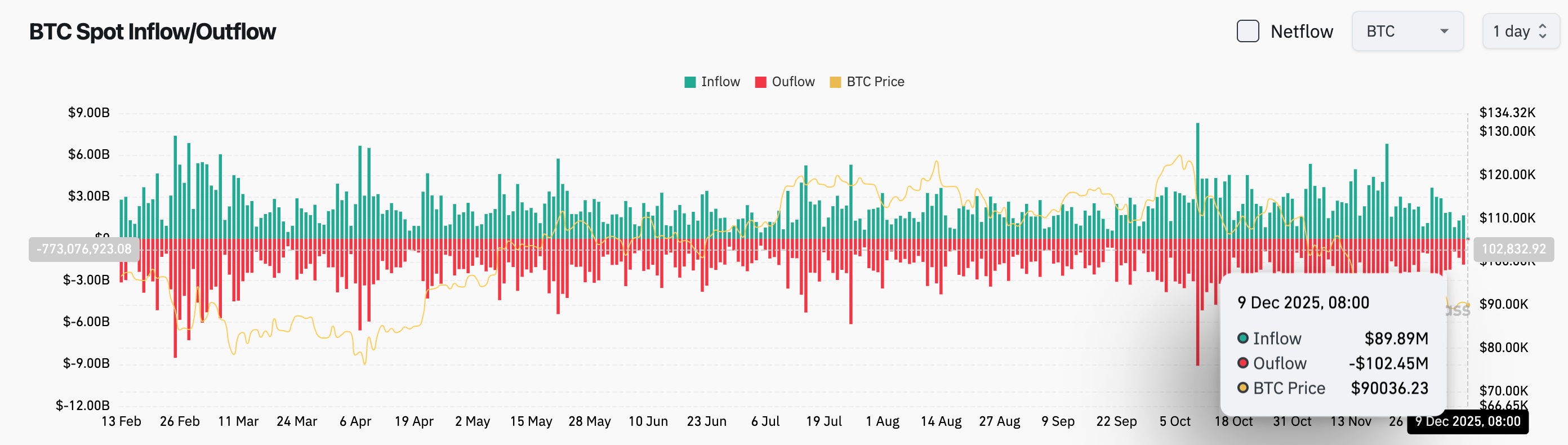

4. Over the past 24 hours, BTC spot inflows were $80 million, outflows $102 million, resulting in a net inflow of $22 million.

News Updates

1. Judge reviews charges faced by Do Kwon in South Korea before U.S. sentencing investigation.

2. CEOs of Bank of America, Wells Fargo, and Citigroup will meet with U.S. senators on Thursday to discuss crypto market legislation.

3. Tether's USDT receives key regulatory approval in Abu Dhabi, enabling use on multiple major blockchains.

4. UK FCA proposes simplifying retail investment rules, allowing high-net-worth individuals to choose higher-risk products.

Project Developments

1. H token team-linked wallets transferred $2.9 million worth of H tokens to CEXs early this morning.

2. Jupiter: WET token public sale has restarted, with 30 million tokens available in a limited offering.

3. USDC Treasury mints an additional 500 million USDC on Solana; Tether issues 1 billion USDT on Tron.

4. Magma Finance completes $6 million strategic funding to build an adaptive liquidity engine on the Sui network.

5. BitMine increased holdings by 138,452 ETH last week, total holdings exceed 3.86 million.

6. MegaETH: Frontier will be available to application developers next week.

7. U.S. SEC concludes two-year investigation into Ondo Finance, no charges recommended.

8. BlackRock files application for iShares Staking Ethereum Trust ETF.

9. Ripple's $500 million stock sale revealed to have "profit protection" buyback clause. Ripple completed approximately $500 million in stock sales (valuation around $40 billion) in November. Some investors estimate about 90% of Ripple's net assets come from its XRP holdings (held around $124 billion in July, released in batches under lock-up). The agreement includes protective terms: investors can sell back shares at a 10% annualized return over 3-4 years; if Ripple chooses to repurchase, the return is 25% annualized. Additionally, liquidation preferences are included.

10. An address turned $716 into $244,000 by trading Franklin tokens, a return of 340x.

Disclaimer: This report is AI-generated, with human verification for information only, not as investment advice.