Sponsored Content

Eco-friendly project Electroneum provides a blockchain with ultra-low energy use and costs.

High electricity bills and a hefty carbon footprint have become defining challenges for many blockchains.

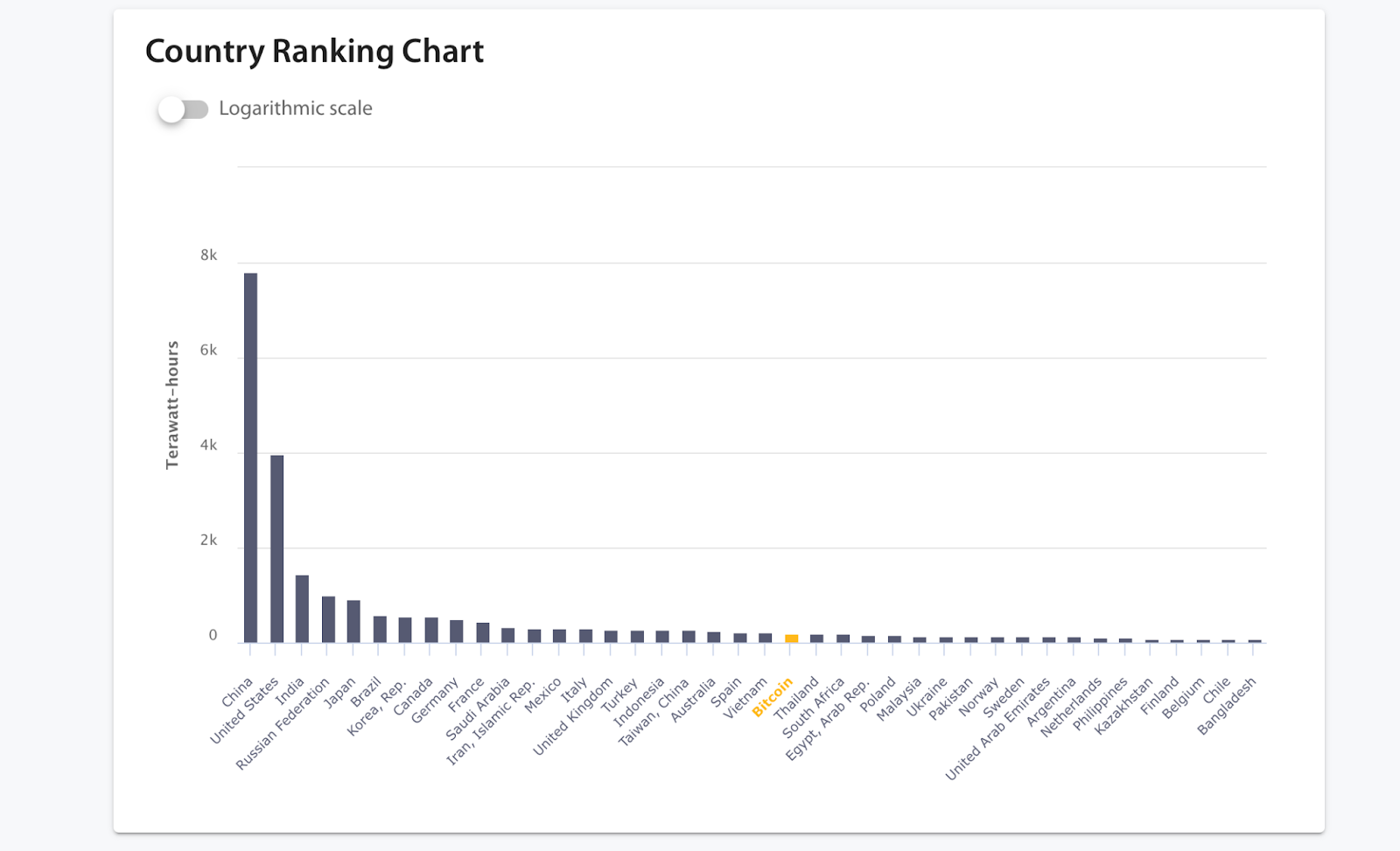

Bitcoin alone is estimated to consume between 150 TWh and 210 TWh of electricity annually. Its energy consumption is on par with that of many nations, such as South Africa, Thailand and the UAE, while doubling the consumption of Finland, Belgium and Austria. Moreover, Bitcoin’s electricity consumption increases by around 25% each year, stressing that its energy needs are an ever-growing concern.

The power-hungry design of proof-of-work (PoW) — Bitcoin’s consensus mechanism — also has serious financial side effects. High energy usage drives up operational costs and creates a barrier for smaller participants while also raising concerns among investors and corporate users striving to meet sustainability targets.

Proof-of-stake (PoS) chains like Ethereum have eased some of these concerns by replacing energy-intensive mining with staking, slashing power requirements and operational costs. Yet, scalability remains a major challenge that hinders global adoption of PoS networks. As transaction demand grows, PoS networks face congestion from time to time, leading to slower confirmations and higher fees.

Electroneum 2.0, a layer-1 blockchain with ultra-low energy consumption, provides a solution to ease these worries. It employs a unique consensus mechanism, called Proof of Responsibility (PoR), to cut energy consumption drastically. Designed to improve the shortcomings of traditional consensus systems, PoR introduces a set of trusted validators — currently standing at 32 — instead of miners and stakers to run the network.

Electroneum is also fully compatible with Ethereum Virtual Machine (EVM). Transactions finalize within 5 seconds, with a cost as low as $0.0001 worth of ETN per transaction. This results in a blockchain environment where developer accessibility meets sustainability, empowering Web2 companies and developers to migrate to Web3 without sacrificing performance for environmental responsibility.

A Web2 project adopting this blockchain solution is AnyTask.com. The project brings together freelancers and service seekers on a digital platform. With the integration with Electroneum, sellers receive payments in ETN on AnyTask.com. The platform has already crossed the 1 million user mark.

Green and Web3 — Win for the world

Electroneum’s partnership with One Ocean Foundation demonstrates the blockchain’s capability to contribute to green causes. Dedicated to marine conservation, the Foundation integrated Electroneum to bring verifiability to donations and tokenize green practices. The partnership was nominated for Areté Award, an excellence award for responsible tech innovation.

Beyond being a green solution, Electroneum appeals to projects with its high scalability as well. Zypto, an all-in-one crypto platform, recently joined forces with Electroneum. The collaboration will allow ETN holders to spend their crypto using a Visa or Mastercard payment card issued by Zypto. The move will also expand ETN’s utility and support its mission of financial inclusion.

Intersection between Web2 world to Web3 vision

The blockchain’s accelerated adoption is evident in statistics. Electroneum is en route to hit 1 million active onchain addresses, with daily transaction count already exceeding 300,000. Since its launch in 2024, nearly 2,000 smart contracts have been deployed on the network.

Electroneum also launched a joint NFT initiative with One Ocean Foundation, Blue Forest. This Electroneum-based NFT collection is dedicated to seagrass reforestation in the Mediterranean, with all proceeds going to the cause.

As Electroneum continues to grow its ecosystem and user base, its focus remains on maintaining a balance between innovation and responsibility. The combination of ultra low-cost transactions, energy efficiency and compatibility with existing Web3 infrastructure positions it as a viable choice for organizations seeking both performance and sustainability.

With ongoing collaborations that bring blockchain technology into practical, socially conscious use cases, Electroneum demonstrates how environmental awareness and digital progress can coexist. Its trajectory suggests a future where scalable and eco-conscious blockchain solutions become standard rather than an exception.