Crypto Express

07/08 07:26

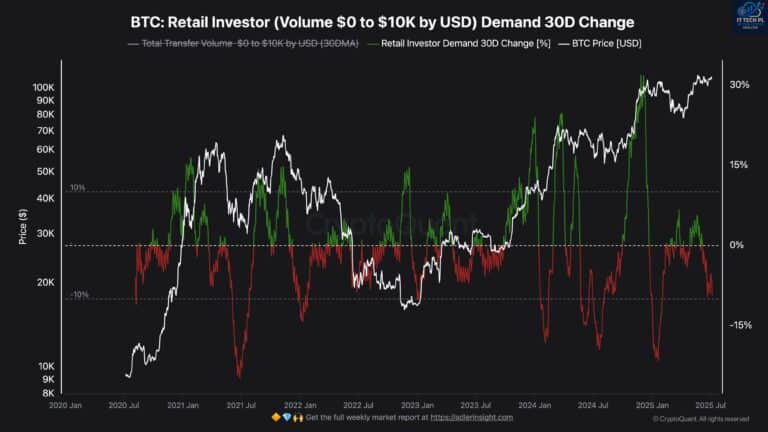

BTC : Retail exhaustion vs. whale accumulation

A sharp decline in retail investor activity resulted in wallets holding 0-10K declining by 10% in the 30-day demand, the lowest in a year. The divergence showed a declining flow in retail, as IT Tech reported on X.

Traditionally, retail is at its highest in turning points. Their absence may be a warning that neither more sales nor excess demand would happen.

In the meantime, this low retail activity suggested that capital was flowing into bigger wallets. That showed possible passive accumulation of whales.

This scenario was quite like the conditions in the middle of 2023, when a similar decrease in retail demand was followed by the 10-percent correction and then a bigger breakout.

Retail frustration and whale hunger may help to decide the next serious steps of Bitcoin.

#BTC price hits a new high of $120,000! #Check In Weekly, Win Prizes Weekly — Join the Fun!#Claim1,200 USDT in the Monthly Creation Challenge

44Paylaş

Tüm Yorumlar0En yeniPopüler

Kayıt yok