Michael Saylor, CEO of the world’s largest Bitcoin treasury holder, is pushing nation-states to develop Bitcoin-backed digital banking systems that offer high-yield, low-volatility accounts capable of attracting trillions of dollars in deposits.

Speaking at the Bitcoin MENA event in Abu Dhabi, Saylor said countries could use overcollateralized Bitcoin (BTC) reserves and tokenized credit instruments to create regulated digital bank accounts that offer higher yields than traditional deposits.

Saylor noted that bank deposits in Japan, Europe and Switzerland offer little to no yield, while euro money-market funds pay roughly 150 basis points, and US money-market rates are closer to 400 basis points. He said this explains why investors turn to the corporate bond market, which “wouldn’t exist if people weren’t so disgusted with their bank account.”

Saylor outlined a structure in which digital credit instruments comprise roughly 80% of a fund, paired with 20% in fiat currency and a 10% reserve buffer on top to reduce volatility. If such a product were offered through a regulated bank, depositors could send billions of dollars to institutions for higher returns on deposits.

The account would be backed by digital credit with 5:1 overcollateralization held by a treasury entity, he said

According to Saylor, a country offering such accounts could attract “$20 trillion or $50 trillion” in capital flows. The CEO argued that a nation adopting this model could become “the digital banking capital of the world.”

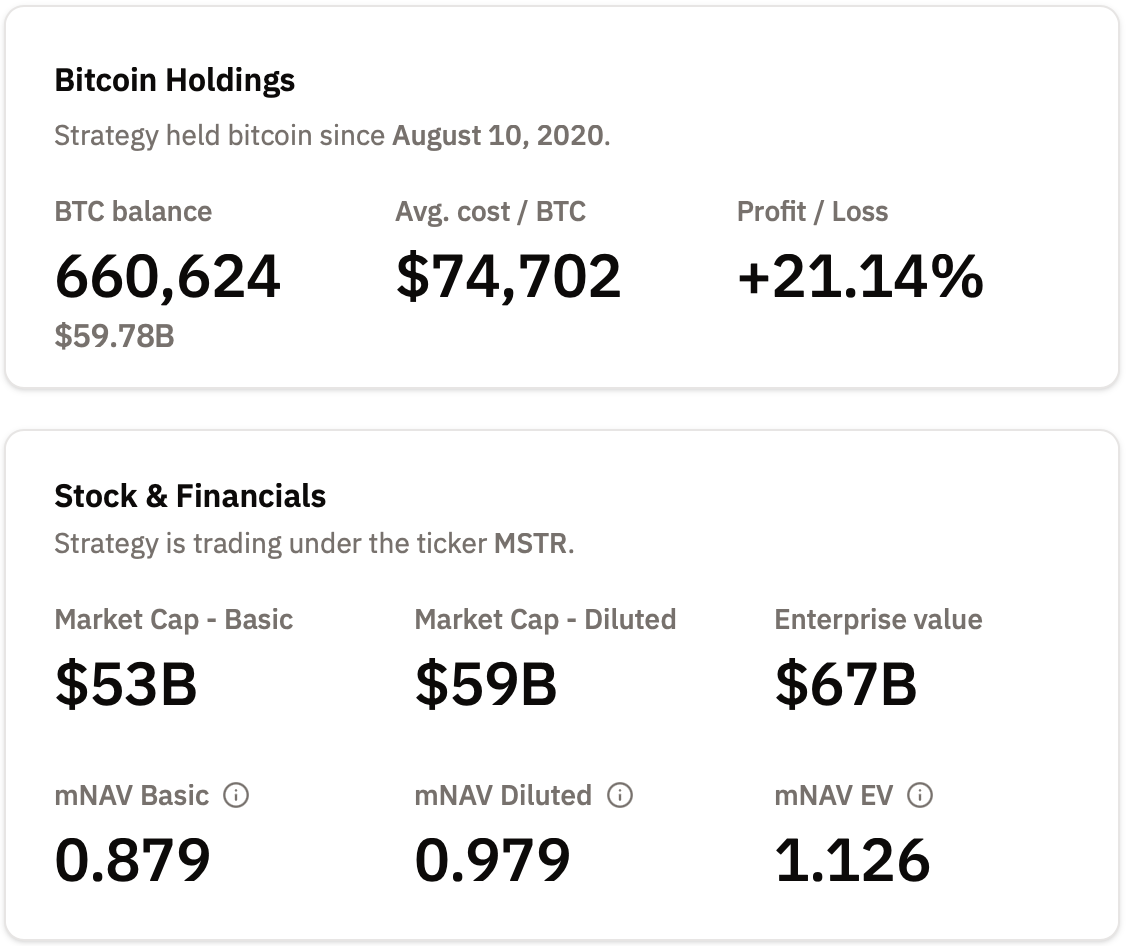

The remarks followed Saylor’s revelation on X that the company purchased 10,624 BTC for about $962.7 million last week. The latest buy raises Strategy’s holdings to 660,624 BTC, acquired for roughly $49.35 billion at an average cost of $74,696.

Related: Cantor slashes Strategy target by 60%, tells clients forced-sale fears are overblown

STRK tests the viability of Bitcoin-backed debt products

Saylor’s description of a high-yield, low-volatility digital bank product echoes elements of Strategy’s own offerings. The company introduced in July STRC, a money-market-style preferred share with a variable dividend rate of around 10% and a structure designed to maintain its price near par while being backed by Strategy’s Bitcoin-linked treasury operations.

Although the product has already grown to around $2.9 billion in market cap, it has also been met with some skepticism.

Bitcoin’s volatility is one reason some observers question Saylor’s push for Bitcoin-backed, high-yield credit instruments. Bitcoin has delivered strong long-term returns, but its short-term performance remains difficult to predict.

At the time of writing, Bitcoin was trading around $90,700, about 28% below its Oct. 6 all-time high of $126,080 and roughly 9% lower over the past 12 months, according to CoinGecko. Over a five-year horizon, however, BTC has climbed 1,155% from $7,193 on Jan. 1, 2020.

In October, Josh Man, a former Salomon Brothers bond and derivatives trader, called Saylor’s moves “folly” and suggested STRC could suffer a liquidity event. He wrote:

“The fiat banking system has been around a long time and has figured out how to build a moat around demand deposits so that they don't break the buck. Hiking rates on STRC to maintain/defend a peg or price level is not going to work when depositors want to get their money back out.”

Magazine: 6 reasons Jack Dorsey is definitely Satoshi... and 5 reasons he’s not