撰文:1912212.eth,Foresight News

Crypto 领域「合作」是常态,「冲突」也不例外,近日 World Liberty Financial(WLFI)与 Aave 的提案纷争引市场关注。这一事件源于一个看似互利的 DeFi 合作提案,却因信息不对称和否认声明引发轩然大波,导致 AAVE 代币价格短期跌 8% 以上。

WLFI 作为特朗普家族背书的开放金融项目,本意是借 Aave 的 DeFi 基础设施扩展影响力,但纷争暴露了加密生态中治理透明度的痛点。

代币分成提案成泡影?

WLFI 项目于 2024 年推出,由特朗普家族成员推动。其代币总供应量为 1000 亿枚,作为新兴项目,WLFI 此前寻求与成熟 DeFi 协议合作,以提升流动性。

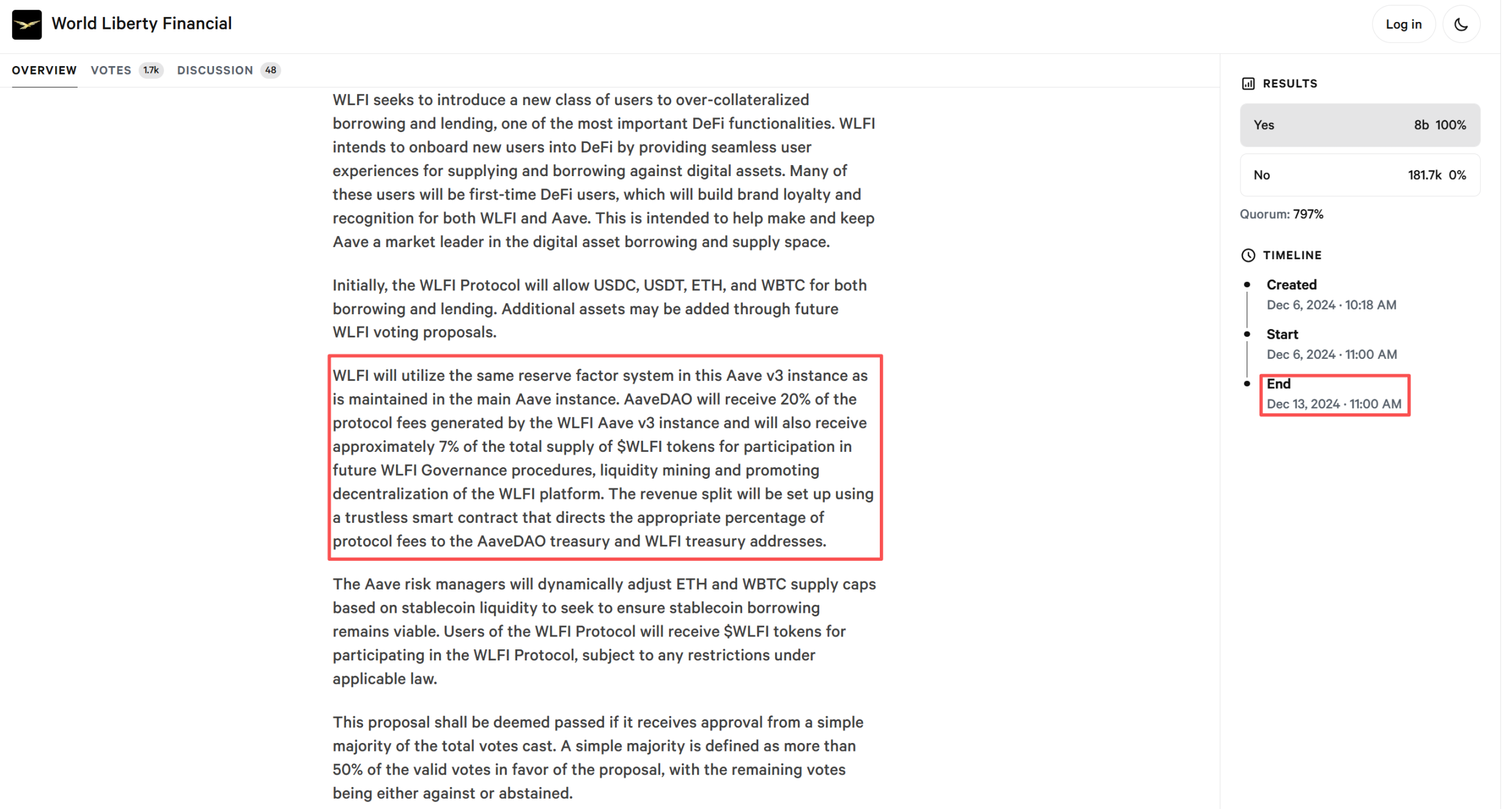

此前,Aave DAO(去中心化自治组织)通过一项提案:WLFI 将在 Aave V3 上部署其平台。作为回报,Aave DAO 将获得 WLFI 协议产生的 20% 费用分成,并分配约 7% 的 WLFI 总供应量(即 70 亿枚代币)。

这一条款初时被视为利好——Aave 作为领先的借贷协议,能借此注入新资产提升 TVL,而 WLFI 则借助 Aave 的用户基盘加速采用。

时间来到 8 月 23 日,Aave 创始人 Stani.eth 回应有关「WLFI 与 AAVE 协议还有效吗?他们真的在 Aave 上构建吗?外界有很多不同的传言」疑问时表示,协议仍然有效,并高调转发「按当前价格计算,Aave 国库将获得价值 25 亿美元的 WLFI,使其成为本轮周期中最大的赢家之一」观点,称此为交易的艺术,随后 AAVE 拉升触及 385 美元。

不过,很快疑似 WLFI Wallet 团队成员 Dylan_0x(@0xDylan_)发文否认「Aave 将获得 WLFI 总量 7% 代币」的提案关联消息,AAVE 短时下跌 5%。

8 月 24 日,WLFI 团队对吴说区块链称否认「7% 代币分配」的真实性,称其为「假新闻」。WLFI 官方表示,提案虽存在,但分配条款并非事实,并强调项目重点在于代币化创新而非外部分成。

Aave 创始人 Stani.eth 在其推文下方回应表示,WLFI 团队创建的提案已在 Aave DAO 上投票并通过,得到了 WLFI 的批准,并附上了提案链接。

截止目前,WLFI 官方账号并未对此事进行正式回应,也导致其市场众说纷纭。

WLFI 即将于 9 月 1 日在以太坊上线,并开放领取和交易。早期支持者(0.015 和 0.05 美元轮次)将解锁 20%,剩余 80% 将由社区投票决定。创始团队、顾问,以及合作伙伴的代币不会解锁。

9 月 25 日,据 Bitget 行情显示,其盘前价格一度为 0.45 美元,使其 FDV(完全稀释估值)高达数百亿美元,目前回落至 0.25 美元。AAVE 则回落至 350 美元下方。

治理算数吗?

DAO 治理难题从上个周期延续至今。

Aave 创始人 Stani.eth 回应称提案仍有效,或许只是单方面一厢情愿。

dForce 创始人 Mindao 对此事评论表示,该提案「像是 WLFI 实习生写的,完全不像川普家族会签的 deal。Aave 和 Spark 的合作只给了 10% 收入分成。WLFI 有川普品牌加持,合理来说 Aave 还得倒贴点对价才说得过去。即便 WLFI 当时为了公募,也不至于搞出这么差的条款。 再后来,加密新政起飞,WLFI 发行 USD1, 叙事直接从「加密银行」跃迁到 「Aave + Circle」,估值 10x,毕竟川普写过 Art of the Deal,这种 deal 绝对是耻辱性的。」

此外,Mindao 猜测后续剧本「WLFI 完全弃用 aave,这样之前的合约就自然作废。大规模缩减代币分发份额。把分配用在激励 USD1 的借贷铸币,左手右手,也不吃亏,就当定向稳定币铸币运营补贴了。」

推特 KOL Laolu 则表示,若 WLFI 不打算给 AAVE 7% 的代币也不必惊讶,「SPK 违约过 10% 收益最后只给 1%,最后不了了之。WLFI 公募时候说得好听全解锁,现在改成部分解锁」。

Polygon 与 Aave 曾上演类似剧情

2024 年 12 月,Polygon 与 Aave 爆发冲突,起因是 Polygon 社区提案:将桥接资金(约 1.1 亿美元)用于收益策略,如质押收益。

Aave 贡献者 Marc Zeller 反对,称此为「风险策略」,并提议 Aave 放弃 Polygon 支持,以防资金滥用。Aave 甚至调整了 Polygon 借贷平台的参数,LTV 设为 0,意味着存款再多也无法借款。

Polygon 创始人 Sandeep Nailwal 指责 Aave「垄断行为」和「酸葡萄心态」,认为 Aave 试图压制竞争,维护其在借贷市场的霸权。

冲突升级至私信威胁和公开指责,Polygon CEO Marc Boiron 与 Zeller 甚至打赌:若 Aave 退出 Polygon,后者将证明其独立性。

最终,提案调整,Aave 未完全退出,但关系紧张。

值得一提的是,2021 年 4 月,Polygon(市值约 40 亿)拿出价值 4000 万美元的 1% MATIC 激励 Aave(当时市值约 65 亿)。