Financial markets have shown unusual ripples this week, unsettling risk assets and leading to outlooks among analysts about how much volatility might be coming for XRP. One important under-the-surface development feeding that nervousness is an event in Japanese financial markets that has broader implications for funding and leverage across different asset classes. This opens up the possibility of volatility not only now but also potentially into the next few days, and this could echo into volatile price behavior for XRP.

Rise In Bond Yields Changes The Macro Backdrop

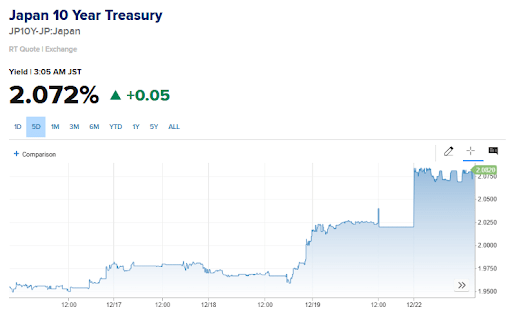

Japan’s government bond market has delivered one massive volatility signal in the past few days. Benchmark yields on the Japanese 10-year government bond have climbed above levels last seen during the 2008 financial crisis, topping 1.8 to 2.0% as markets reassess decades of ultra-low interest rates.

Japan 10 Year Treasury. Source: @Barchart

This huge increase is as a result of a break from the long era of near-zero borrowing costs in Japan that was reflected in global liquidity, encouraging flows into higher-return assets worldwide. However, the surge in Japanese yields is going to unsettle risk markets and tighten liquidity, and this leads to concerns that the effects could ripple through to risk assets such as cryptocurrencies, including XRP.

Expectations of increased volatility are building as several crypto analysts point to the same macro factor developing outside the cryptocurrency market. Among them is crypto analyst Levi, who noted that Japan’s 10-year government bond yield has officially moved above levels recorded during the 2008 financial crisis. In response to that milestone, Levi warned traders to “get ready for XRP volatility next week,” meaning that the bond market move could spill over into crypto pricing.

A similar view was shared by crypto analyst Ted Pillows, who also highlighted the break above the 2008 yield level and cautioned that the next week is likely to be really volatile.

What It Means for XRP Price Action This Week

One major factor of this milestone has been the Bank of Japan’s decision to raise interest rates after decades of ultra-low policy. The BOJ lifted its benchmark short-term rate to around 0.75%, its highest in about 30 years, in response to persistent inflation above its 2% target and stronger wage growth.

A bond’s yield and price move in opposite directions: when yields rise, bond prices fall. As the fourth largest economy in the world, rising yields in Japan matter in terms of a global perspective because they affect global capital flows and risk sentiment.

This change in global liquidity conditions can feed into XRP’s price movements in several ways. Rising yields means tighter financial conditions, meaning leveraged positions become more costly to maintain. Bonds also offer higher yields, which means investors are less likely to invest in stocks and cryptocurrencies, including XRP.