Author:Castle Labs

Compiled by:Yangz,Techub News

Original Title; The Crossroads of US and EU Crypto Regulation: A Testing Ground or a Museum?

When Satoshi Nakamoto released the whitepaper, mining Bitcoin was very simple; any player with a mainstream CPU could easily accumulate what would later become a fortune worth millions. On a home computer, instead of playing The Sims, one could build a substantial family business, allowing future generations to avoid hard labor, with an investment return rate of about 250,000 times.

However, most players were still addicted to Halo 3 on Xbox, and only a few teenagers used their home computers to amass wealth surpassing that of modern tech giants. Napoleon built a legend by conquering Egypt and even Europe, while you, you just needed to click 'Start Mining'.

Over fifteen years, Bitcoin has evolved into a global asset, its mining relies on large-scale operations supported by billions of dollars in capital, hardware, and energy input. The average electricity consumption per Bitcoin is as high as 900,000 kWh.

Bitcoin has spawned a new paradigm, forming a stark opposition to the heavily guarded financial world we grew up in. It is perhaps the first true rebellion against the elite since the failure of the Occupy Wall Street movement. It is worth noting that Bitcoin was born precisely after the Great Financial Crisis of the Obama era—a crisis largely stemming from the indulgence of casino-like high-risk banking practices. The 2002 Sarbanes-Oxley Act was intended to prevent a recurrence of the internet bubble; ironically, the 2008 financial collapse was far more severe.

Whoever Satoshi Nakamoto is, his invention was timely, a rebellion as fierce and sudden as a wildfire, yet deliberate, directly targeting that powerful and ubiquitous Leviathan.

Before 1933, the US stock market was essentially unregulated, constrained only by scattered state-level "Blue Sky" laws, leading to severe information asymmetry and rampant matched orders.

The 1929 liquidity crisis became the stress test that broke this model, proving that decentralized self-regulation could not curb systemic risk (does this sound familiar?). In response, the US government executed a hard reset through the 1933 and 1934 Securities Acts, replacing the principle of "caveat emptor" (buyer beware mode) with a central enforcement agency (SEC) and mandatory disclosure mechanisms, thereby unifying the legal norms for all public assets to restore the credibility of the system's solvency... We are witnessing the exact same process replaying in the DeFi space.

Until recently, cryptocurrency has operated as a permissionless "shadow banking" asset, similar to the pre-1933 era, but dangerously many times over due to a complete lack of regulation. This system used code and hype as its core governance mechanisms, failing to fully consider the enormous risks brought by this financial beast. The successive bankruptcies in 2022 were like the 1929 stress test, showing that decentralization does not equal infinite returns and sound money; on the contrary, it creates risk nodes that could devour multiple asset classes. We are witnessing a shift in the zeitgeist from a libertarian casino-like model to a mandatory shift towards compliant asset classes—regulators are trying to make cryptocurrency perform a U-turn: as long as it's legal, funds, institutions, high-net-worth individuals, and even nations can hold it like any other asset, making it taxable.

This article attempts to reveal the origins of cryptocurrency's institutional rebirth—a transformation that is now inevitable. Our goal is to deduce the inevitable endgame of this trend and precisely define the final form of the DeFi ecosystem.

The Landing of Regulatory Frameworks

Before DeFi truly entered its first dark age in 2021, its early development was defined less by new legislation and more by federal agencies extending existing laws to adapt to digital assets. Indeed, everything had to be done step by step.

The first major federal action appeared in 2013, when FinCEN issued guidance classifying crypto "exchanges" and "service providers" as money services businesses, effectively subjecting them to the Bank Secrecy Act and anti-money laundering regulations. We can consider 2013 as the year DeFi was first acknowledged by Wall Street, which paved the way for both enforcement and suppression.

In 2014, the IRS announced that virtual currencies would be treated as "property" rather than currency for federal tax purposes, complicating the situation, as every transaction triggered capital gains tax obligations; thus, Bitcoin gained legal characterization and, with it, the ability to be taxed—a far cry from its original intention!

At the state level, New York introduced the controversial BitLicense in 2015, the first regulatory framework requiring disclosure from crypto businesses. Finally, the US Securities and Exchange Commission (SEC) brought the feast to an end with the DAO Investigation Report, confirming that many tokens constituted unregistered securities under the Howey Test.

By 2020, the Office of the Comptroller of the Currency (OCC) briefly opened the door for national banks to provide crypto asset custody services, but this move was later questioned by the Biden administration—a common practice of successive presidents.

Across the Atlantic in the Old Continent, equally antiquated practices dominated the crypto world. Influenced by a rigid Roman law system (distinctly different from common law), the same spirit of anti-individual freedom permeated it,禁锢ing DeFi's potential in a regressive civilization. We must remember that the United States is essentially a Protestant nation; this spirit of autonomy shaped America, a country always defined by entrepreneurial spirit, freedom, and a pioneer mentality.

In Europe, Catholicism, the Roman law system, and remnants of feudalism fostered a截然不同的 culture. Therefore, it is no surprise that ancient countries like France, Britain, and Germany took different paths. In a world that崇尚 conformity rather than冒险,加密技术 was destined to be severely suppressed.

Thus, Europe's early characteristics were marked by分散 bureaucratic agencies, lacking a unified vision. The industry achieved its first victory in 2015 when the European Court of Justice (Skatteverket v. Hedqvist) ruled that Bitcoin transactions were exempt from value-added tax (VAT), effectively granting crypto assets the legal status of currency.

Before the introduction of unified EU laws, countries diverged on cryptocurrency regulation. France (PACTE Act, a poor legal system) and Germany (cryptocurrency custody licenses) established strict national frameworks, while Malta and Switzerland competed to attract businesses with first-class regulation.

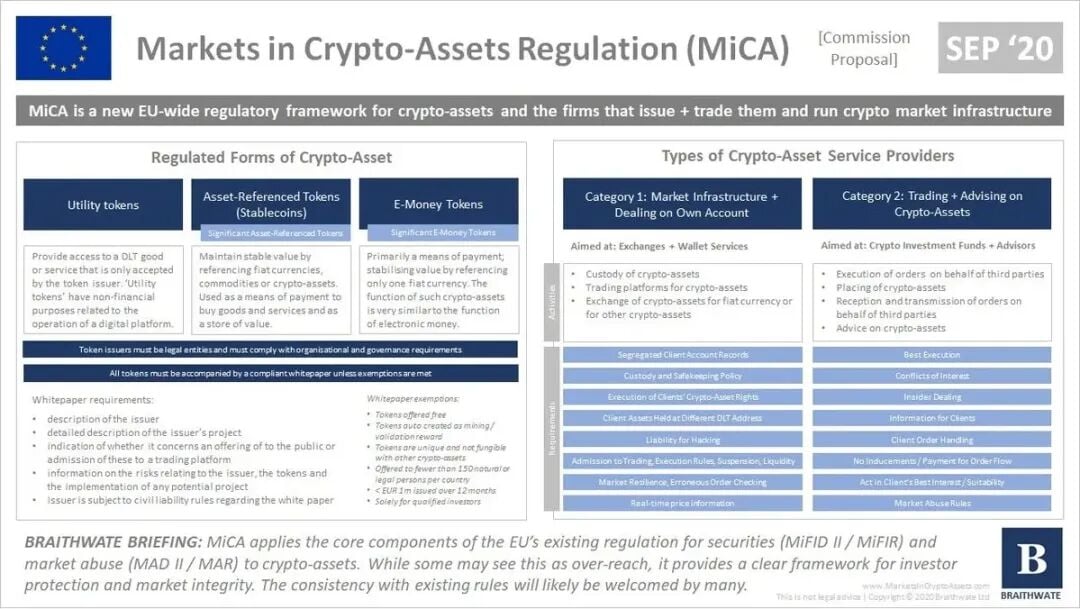

This chaotic era ended with the implementation of the Fifth Anti-Money Laundering Directive (5AMLD) in 2020, which mandated strict KYC across the EU,彻底消灭ing anonymous transactions. Realizing that 27 sets of conflicting rules were unsustainable, the European Commission finally proposed the Markets in Crypto-Assets Regulation (MiCA) at the end of 2020, marking the end of the patchwork regulation era and the beginning of a unified regulatory system... to the frustration of all.

America's Advanced Paradigm

Oh, blockchain, can you see, when Donald cleared the way, what was long禁锢ed now stands legal?

The transformation of the US regulatory system was not a true systemic重构; it was primarily driven by opinion leaders. The power shift in 2025 brought a new philosophy: mercantilism overwhelmed moralism.

Trump's issuance of his infamous meme coin in December 2024, perhaps the climax, perhaps not, showed that the elite were willing to make crypto great again. Several crypto popes now steer the course, always moving towards more freedom and space for founders, builders, and retail investors.

Paul Atkins taking the helm of the SEC was less of an appointment and more of a regime change. His predecessor, Gary Gensler, viewed the crypto industry with pure hostility. He became the bête noire of our generation; Oxford University also published a paper revealing how painful Gensler's reign was. It is believed that due to his aggressive stance, DeFi leaders lost years of development opportunities, hindered by a regulator who should have led the industry but was disconnected from it.

Atkins not only halted lawsuits but essentially apologized for them. His "Project Crypto" plan is a model of bureaucratic转向. This "plan" aims to establish an extremely dull, standardized, and comprehensive information disclosure mechanism, allowing Wall Street to trade Solana like oil. Allen & Overy summarized the plan as follows:

-

Establish a clear regulatory framework for US crypto asset issuance

-

Ensure freedom of choice for custodians and trading venues

-

Embrace market competition and promote the development of "super apps"

-

Support on-chain innovation and decentralized finance

-

Innovation exemptions and commercial viability

Perhaps the most critical shift occurred at the Treasury. Janet Yellen once viewed stablecoins as a systemic risk. Scott Bessent—a man with a bureaucratic seat but a hedge fund mind—saw them for what they are: the only net new buyers of US Treasury bonds.

Bessent understood the tricky arithmetic of the US deficit. In a world where foreign central banks are slowing their purchases of US Treasuries, the insatiable appetite of stablecoin issuers for short-term Treasury bonds was a solid positive for the new Treasury Secretary. In his eyes, USDC/USDT are not competitors to the dollar, but pioneers of the dollar, extending dollar hegemony to turbulent countries where people would rather hold stablecoins than depreciating fiat currencies.

Another "villain" turned supporter is Jamie Dimon, who once threatened to fire any trader touching Bitcoin, but has now executed the most profitable 180-degree turn in financial history. JPMorgan's launch of crypto asset-backed lending business in 2025 was its white flag. According to The Block, JPMorgan plans to allow institutional clients to use Bitcoin and Ethereum holdings as loan collateral by the end of this year, marking Wall Street's further deep dive into cryptocurrency. Also, according to Bloomberg citing people familiar with the matter, the plan will be offered globally and will rely on third-party custodians to hold the pledged assets. When Goldman Sachs and BlackRock started eating into JPMorgan's custody fee income, the war was effectively over. The banks won without a fight.

Finally, the Senate's lone crypto lady, Cynthia Lummis, has now become the most loyal supporter of the new American collateral system. Her proposal for a "Strategic Bitcoin Reserve" has moved from fringe conspiracy theory to serious committee hearings. Her grand discourse, while not truly affecting Bitcoin's price, is sincere in its efforts.

The 2025 legal landscape is defined by matters that have been settled and those that remain dangerously pending. The current administration's enthusiasm for the crypto space is so high that top law firms have set up real-time tracking services for the latest crypto news: for example, Latham & Watkins' "US Crypto Policy Tracker," closely watching the latest dynamics of numerous regulatory agencies tirelessly推出 new rules for DeFi. However, we are still in the exploratory stage.

Currently, the US debate revolves around two major legal systems:

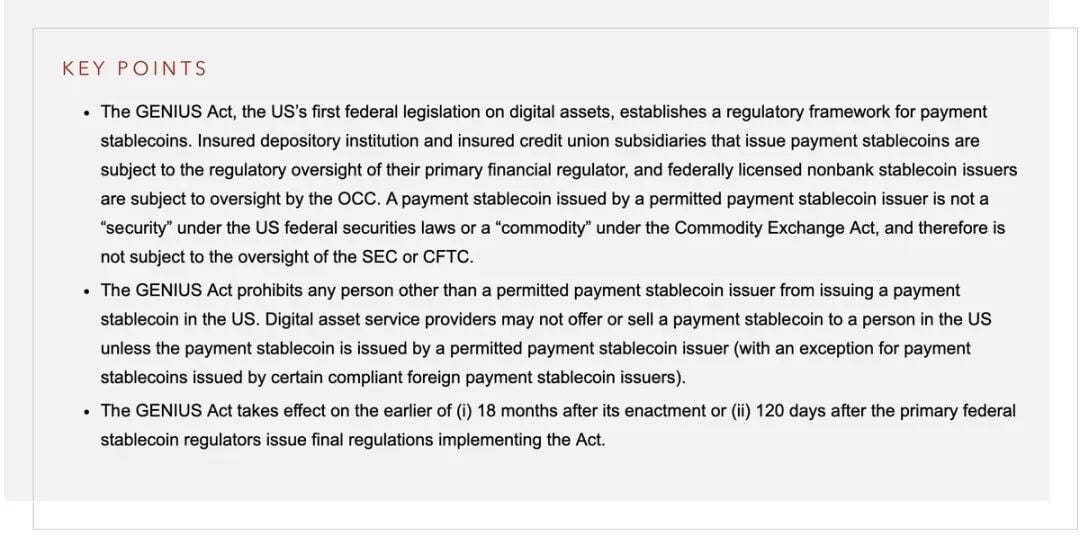

The GENIUS Act (passed in July 2025); This act (full name: The American Stablecoin National Innovation Guidance and Establishment Act) marks Washington finally addressing the most critical asset after Bitcoin—stablecoins. By mandating strict 1:1 Treasury reserve backing, it transforms stablecoins from a systemic risk into a geopolitical tool, similar to gold or oil. The act essentially authorizes private issuers like Circle and Tether to become legitimate buyers of US Treasury bonds. A win-win.

In contrast, the CLARITY Act remains a distant prospect. This market structure bill, aimed at finally clarifying the dispute between the SEC and CFTC over the definition of securities and commodities, is currently stalled in the House Financial Services Committee. Until this bill passes, exchanges will operate in a comfortable but fragile intermediate state—relying on temporary regulatory guidance (as is still the case today) rather than the permanent security of written law.

Currently, the bill has become a point of contention between Republicans and Democrats, both sides seemingly using it as a weapon for political gamesmanship.

Finally, the repeal of Staff Accounting Bulletin No. 121 (a technical accounting rule that required banks to treat custodied assets as liabilities, effectively preventing banks from holding cryptocurrencies) opened the floodgates, marking that institutional capital (even pension funds!) could finally buy crypto assets without fear of regulatory retaliation. Correspondingly, life insurance products denominated in Bitcoin have begun to appear on the market; the future is bright.

The Old Continent: An Innate Aversion to Risk

Antiquity was often filled with slavery, customs, and laws that benefited the powerful and oppressed the common people. — Cicero

What is the point of a mature civilization that gave birth to geniuses like Plato, Hegel, and even Macron (joking), if its current builders are扼杀ed by a group of mediocre bureaucrats who only know how to阻止 others from creating?

Just as the Church once bound scientists to the stake (or merely tried them), today's regional powers have devised complex and obscure laws, the effect of which may be merely to吓退 entrepreneurs. The gap between the vibrant, young, rebellious American spirit and the散漫颓败, faltering Europe has never been greater. Brussels had the opportunity to break free from its usual rigidity, but chose an unbearable固步自封.

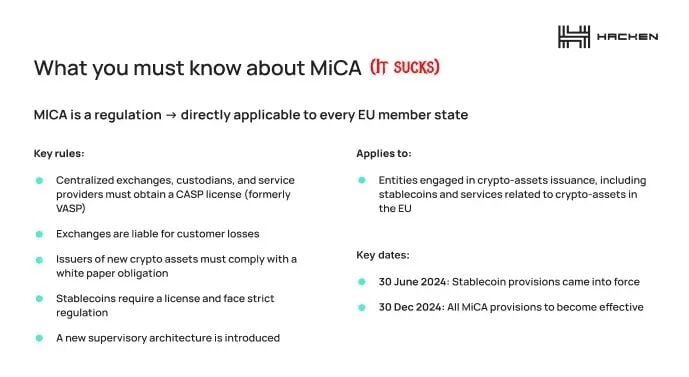

The Markets in Crypto-Assets Regulation (MiCA), fully implemented by the end of 2025, is a masterpiece of bureaucratic intent and an absolute disaster for innovation.

MiCA was marketed to the public as a "comprehensive framework," but in Brussels, this term usually means "comprehensive torture." It did bring clarity to the industry, but clarity to the point of deterrence. MiCA's fundamental flaw is a category mismatch: it regulates startups like sovereign banks. The compliance costs are so high that they are destined to lead crypto businesses to failure.

Norton Rose published a memorandum objectively explaining the regulation.

Structurally, MiCA is actually an exclusion mechanism: it places digital assets into highly regulated categories (asset-referenced tokens and electronic money tokens), while burdening Crypto-Asset Service Providers (CASPs) with a heavy compliance framework copied from the MiFID II regulatory system usually designed for financial giants.

According to Chapters 3 and 4, the regulation imposes strict 1:1 liquidity reserve requirements on stablecoin issuers, effectively banning algorithmic stablecoins by placing them in a state of legal "bankruptcy" from the start (this itself could constitute a major systemic risk; imagine being declared illegal by Brussels overnight?).

Furthermore, institutions issuing "significant" tokens (the notorious sART/sEMT) face enhanced supervision from the European Banking Authority, including capital requirements, making it economically unfeasible for startups to issue such tokens. Today, it is almost impossible to start a cryptocurrency company without a top-tier legal team and capital matching traditional financial businesses.

For intermediaries, Chapter 5彻底消除s the concept of offshore, cloud exchanges. CASPs must establish registered offices within member states, appoint resident directors who undergo "suitability" tests, and implement segregated custody agreements. The "whitepaper" requirement in Article 6 turns technical documentation into binding prospectuses, imposing strict civil liability for any material misrepresentation or omission, thereby piercing the veil of anonymity usually cherished by the industry. This is no different from requiring you to open a digital bank.

Although the regulation introduces a passporting right, allowing a CASP authorized in one member state to operate throughout the European Economic Area without further localization, this "harmonization" (a dreadful word in EU law) comes at a high cost. It creates a regulatory moat where only heavily capitalized institutional participants can bear the costs of AML/CFT integration, market abuse monitoring, and prudential reporting.

MiCA doesn't just regulate the European crypto market; it actually封锁s entry to participants lacking the legal and financial resources (which crypto founders almost always lack).

On top of EU law, the German regulator BaFin has become a平庸 compliance machine, its efficiency evident only in processing paperwork for a日渐式微 industry. Meanwhile, France's ambition to become a European "Web3 hub" or "startup nation" has hit the high walls it built itself. French startups are not coding; they are fleeing. They cannot compete with the pragmatic speed of the US or the relentless innovation of Asia, leading to a massive brain drain to Dubai, Thailand, and Zurich.

But the real death knell is the ban on stablecoins. The EU, under the guise of "protecting monetary sovereignty," effectively banned non-euro stablecoins (like USDT), effectively ending the only reliable area in DeFi. The global crypto economy runs on stablecoins. By forcing European traders to use low-liquidity "euro tokens" that no one outside the Schengen area is willing to hold, Brussels has created a liquidity trap.

The European Central Bank and the European Systemic Risk Board have urged Brussels to ban the "multi-jurisdictional issuance" model, where global stablecoin companies treat tokens issued within the EU as interchangeable with those issued outside. The ESRB, chaired by ECB President Christine Lagarde, stated in a report that non-EU holders rushing to redeem EU-issued tokens could "amplify the risk of a run within the region."

Meanwhile, the UK wants to limit personal stablecoin holdings to £20,000... while leaving altcoins completely unregulated. Europe's risk-averse strategy urgently needs a complete overhaul, lest regulators trigger a full-blown collapse.

I think the explanation is simple: Europe wants its citizens to remain bound to the euro, unable to participate in the US economy and escape economic stagnation, or rather, death. As Reuters reported: The ECB warned that stablecoins could吸走 precious retail deposits from eurozone banks, and a run on any stablecoin could have broad implications for the stability of the global financial system.

This is simply nonsense!

The Ideal Paradigm: Switzerland

There are countries, unburdened by partisan politics, ignorance, or antiquated laws, that have successfully escaped the binary opposition of regulatory "excess and deficiency" and found a compatible and inclusive path. Switzerland is such an extraordinary country.

Its regulatory framework is diverse but effective, with a friendly attitude that actual service providers and users are happy to see:

The Financial Market Supervision Act (FINMASA), enacted in 2007, is an umbrella regulation that established the Swiss Financial Market Supervisory Authority (FINMA) as the unified, independent regulator of the Swiss financial market by merging banking, insurance, and anti-money laundering regulatory agencies.

The Financial Services Act (FinSA) focuses on investor protection. It creates a "level playing field" for financial service providers (banks and independent asset managers) by mandating strict codes of conduct, client classification (retail, professional, institutional), and transparency (basic information sheets).

The Anti-Money Laundering Act is the primary framework for combating financial crime. It applies to all financial intermediaries (including crypto asset service providers) and sets basic obligations.

The Distributed Ledger Technology Act (DLT-Law, 2021) is an "umbrella act" that amended 10 federal laws (including the Code of Obligations and the Debt Enforcement and Bankruptcy Act), thereby legally recognizing crypto assets.

The Virtual Asset Service Provider Ordinance, enforcing the FATF's "Travel Rule" with zero tolerance (no minimum threshold).

Article 305bis of the Swiss Criminal Code defines the crime of money laundering.

The CMTA Standards, published by the Capital Markets and Technology Association, are not mandatory but have been widely adopted by the industry.

Regulators include: Parliament (responsible for enacting federal acts), FINMA (regulating the industry through ordinances and circulars), and self-regulatory organizations (like Relai) supervised by FINMA, which in turn supervise independent asset managers and crypto intermediaries. The Money Laundering Reporting Office is responsible for reviewing suspicious activity reports (same as traditional finance) and forwarding them to the public prosecutor's office.

Thus, the Crypto Valley in Zug became an ideal place for crypto founders: a logically clear framework not only allows them to work but also allows them to operate under a clear legal umbrella, which reassures users and puts banks willing to take small risks at ease.

Onward, America!

The Old Continent's embrace of the crypto space did not stem from a desire for innovation, but from fiscal urgency. Having ceded the Web2 internet to Silicon Valley since the 1980s, Europe sees Web3 not as an industry worth building, but as a tax base to be harvested, like everything else.

This suppression is structural and cultural. Against the backdrop of an aging population and an overburdened pension system, the EU cannot afford a competitive financial industry beyond its control. This is reminiscent of feudal lords imprisoning or killing local nobles to avoid excessive competition. Europe has a terrible instinct: to阻止 uncontrollable change by sacrificing its citizens. This is foreign to the US, which thrives on competition, enterprise, and a certain Faustian will to power.

MiCA is by no means a "growth" framework; it is a death sentence. Its design ensures that if European citizens trade, they must do so within a monitoring grid to guarantee the state gets its share, like a monarch exploiting peasants. Europe is essentially positioning itself as the world's luxury consumption colony, an eternal museum where amazed Americans come to mourn a past that cannot be resurrected.

Countries like Switzerland and the UAE have freed themselves from the shackles of history and structural defects. They carry neither the imperialist burden of maintaining a global reserve currency nor the bureaucratic inertia of a 27-member bloc—a bloc perceived as weak by all its members. By exporting trust through the Distributed Ledger Technology Act (DLT Act), they attract foundations holding actual intellectual property (Ethereum, Solana, Cardano). The UAE has emulated this; no wonder the French are flocking to Dubai.

We are entering an era of surging regulatory arbitrage.

We will witness a geographical split in the crypto industry. The consumer end will remain in the US and Europe, subject to full KYC, heavy taxation, and integration with traditional banks; while the protocol layer will migrate entirely to rational jurisdictions like Switzerland, Singapore, and the UAE. Users will be global, but founders, VCs, protocols, and developers will have to consider leaving their home markets to find more suitable places to build.

Europe's fate is to become a financial museum. It is securing for its citizens a set of exquisite, shiny laws that are completely useless or even致命 to actual users. I can't help but wonder if Brussels' technocrats have ever bought Bitcoin or cross-chain transferred some stablecoins.

Crypto assets becoming a macro asset class is inevitable, and the US will retain its status as the global financial capital. It is already offering Bitcoin-denominated life insurance, crypto asset抵押, crypto reserves, endless VC support for anyone with an idea, and a vibrant soil for builder incubation.

Conclusion

In summary, the "Brave New World" that Brussels is building is less a coherent digital framework and more like an awkward, Frankenstein-like patchwork. It attempts to clumsily graft a 20th-century banking compliance system onto 21st-century decentralized protocols, designed primarily by engineers who know nothing about the ECB's temper.

We must actively advocate for a different regulatory system, one that prioritizes reality over administrative control, lest we completely扼杀 Europe's already weak economy.

Unfortunately, the crypto space is not the only victim of this risk paranoia. It is just the latest target of the dull, postmodernist, highly paid, complacent bureaucratic class entrenched in the corridors of power in various capitals. This ruling class regulates heavily precisely because they lack real-world experience. They have never experienced the pain of KYC for an account, obtaining a new passport, or getting a business license; therefore, despite the so-called tech elites working in Brussels, crypto-native founders and users have to deal with a group of极度无能 people who achieve nothing but produce harmful legislation.

Europe must change course, and it must do so immediately. While the EU is busy strangling the industry with red tape, the US is actively determining how to "normalize" DeFi, moving towards a framework beneficial to all parties. Centralization through regulation is already evident: the collapse of FTX was the writing on the wall.

Investors holding losses crave revenge; we need to break free from the current cycle of meme coins, cross-chain bridge exploits, and regulatory chaos—the "Wild West." We need a structure that allows real capital to enter safely (Sequoia, Bain, BlackRock, or Citi are leading this charge) while also protecting end users from predatory capital.

Rome wasn't built in a day, but this experiment has been going on for fifteen years now, and its institutional foundations are still in the mud. The window of opportunity to build a functional crypto industry is closing rapidly; in war, hesitation means defeat, and both sides of the Atlantic must implement swift, decisive, and comprehensive regulation. If this cycle is really about to end, now is the best time to redeem our reputation and compensate all serious investors who have been harmed by bad actors over the years.

Traders exhausted from 2017, 2021, to 2025 demand a清算 and final adjudication on crypto issues; and most importantly, our most beloved assets deserve the all-time highs they are due.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush