There's a fundamental truth in business: if a product is free, you are the product.

Lighter DEX is promoting "zero fees" to retail traders. It sounds too good to be true—and it is.

What Lighter doesn't highlight in bold letters is the latency structure behind these "free" trades.

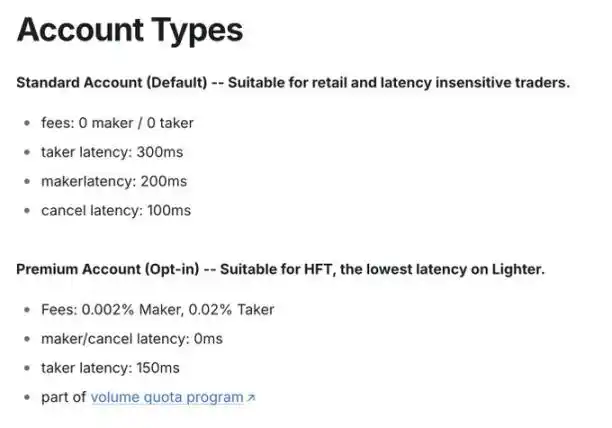

Lighter offers two account types: once you understand how latency works, you realize that the 0% fee tier is actually the most expensive option on the platform.

That 200–300 milliseconds of latency is the entire foundation of their business model.

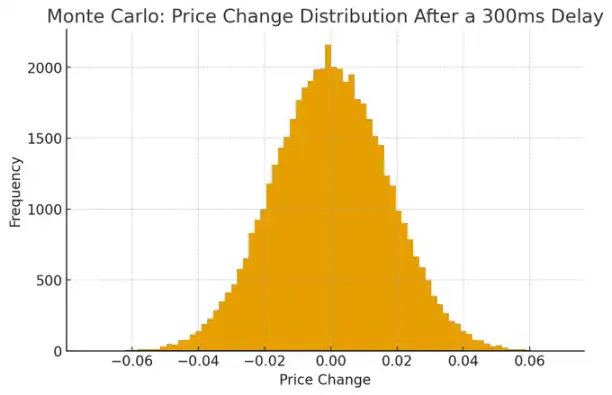

What Does 300 Milliseconds Really Mean?

The average human blink takes 100–150 milliseconds. In the time it takes you to blink twice, faster traders have already captured price movements, adjusted their positions, and traded against you.

Crypto markets are highly volatile. At typical volatility levels (50–80% annualized), prices move roughly 0.5 to 1 basis point per second.

This means that within 300 milliseconds, random market fluctuations alone cause prices to move by an average of 0.15–0.30 basis points.

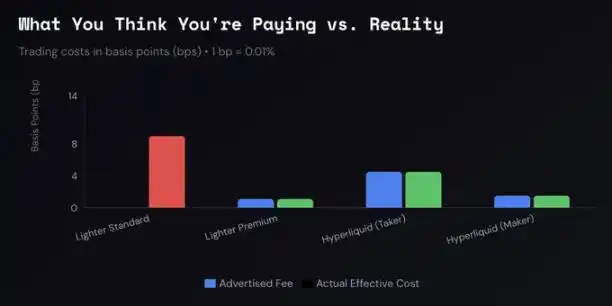

The True Cost of "Free"

If we quantify it:

Academic research on adverse selection costs (Glosten & Milgrom, Kyle's Lambda, etc.) suggests that informed traders typically have an advantage of 2–5 times the magnitude of random price fluctuations.

If the slippage due to randomness over 300 milliseconds is about 0.2 basis points, adverse selection would add an additional 0.4–1.0 basis points.

For active traders and market makers, the actual cost looks something like this:

· Standard Account Actual Cost: 6–12 basis points per trade (0.06%–0.12%)

· Premium Account Actual Cost: 0.2–2 basis points per trade (0.002%–0.02%)

The "free" account is 5–10 times more expensive than the paid account.

Zero fees are just a marketing number—the real cost is hidden in the latency.

The Premium Account Is Clearly the Better Deal

Under no circumstances is the Standard Account (0% fee) the better choice.

Not for small retail traders, not for large traders, not for scalpers, swing traders, or even passive investors. Especially not for market makers. Not for anyone.

"I'm just a small retail trader; I don't need a premium setup."

Wrong.

Small retail traders can afford slippage even less. If you trade $1,000 and lose 10 basis points per trade, that's $1 gone each time. After 50 trades, 5% of your account has silently disappeared.

"I don't trade frequently; latency doesn't affect me."

Also wrong.

If you trade infrequently, the fee for a Premium Account is negligible anyway.

But even in those few trades, you're still getting worse execution. Why accept any disadvantage when the cost to avoid it is almost zero?

Just upgrade to the Premium Account.

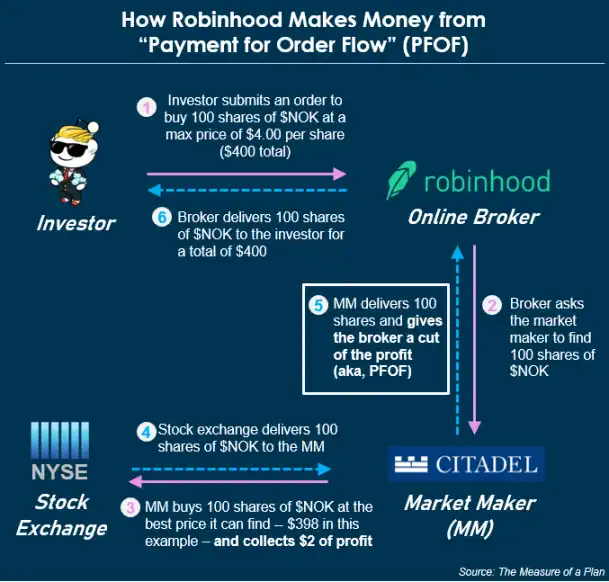

This Model Isn't New

Traditional financial markets have seen this before—it's called payment for order flow.

@RobinhoodApp popularized this model by attracting retail traders with "free trades," then routing their orders to market makers who profited by trading against the uninformed retail flow.

Lighter's model is structurally similar. Standard Account users aren't getting free trades—they're getting slower trades. That latency is being monetized by faster participants.

The exchange doesn't need to charge you a fee because you're paying with execution quality.

What Lighter Is Doing Right and Wrong

Lighter isn't hiding the latency data—it's in the documentation.

But transparency isn't the same as clarity.

Highlighting "0% fees" in headlines while burying "300ms latency" in the fine print is a strategy that prioritizes sign-up conversions over user understanding.

Most retail traders don't understand what latency means, what adverse selection is, or how to calculate the equivalent real cost.

And Lighter knows it.

The Premium Account is a better deal in every way than the "zero-fee" Standard Account—no argument needed.