The crypto world is now directly上演 "some are building momentum while others panic"! SHIB appears to be lying flat but is actually quietly蓄力, ZEC is holding firm at the $400关口, ADA has triggered a danger signal, and only BEAT is疯狂蹦迪 with a 480% surge. This剧情 is more exciting than a TV drama~

? SHIB: Pretending to Slack Off, Are Big Players Secretly Accumulating?

Shiba Inu is主打 "deceptive operations" this time! On the surface, the price seems平平无奇, but it actually hides a key signal — after falling for several months, it's no longer accelerating downward but instead starting to "横盘压缩". This isn't a sign of weakness; it's selling pressure slowly decreasing!

The most crucial point is the "volume-price divergence": the price drops slightly, but the trading volume doesn't follow at all. The recent几次下跌的成交量 is much weaker than during the previous抛售. Technically, it's even more interesting: although the long-term trend is still bearish, there are already "higher lows", indicating that big players aren't chasing the decline but are instead secretly布局 during low market sentiment and low volatility.

QQ:326035359

DingTalk:msp252580

The RSI indicator is also in the neutral zone, not oversold but showing signs of increasing momentum. The bears haven't succeeded in smashing it down completely. However,普通交易者 are still panicking, as the moving averages are still压制在上面. To summarize: SHIB is now in "蓄力模式". As long as the volume放大 and it holds the recent highs and lows, it might suddenly reverse and rise!

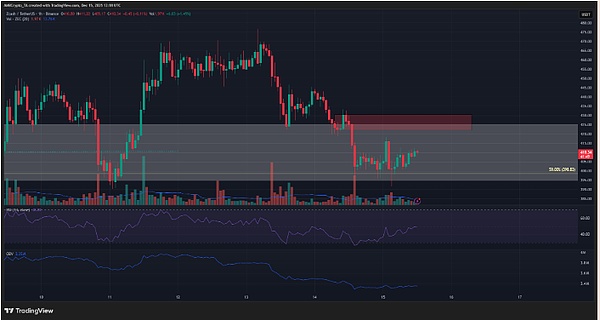

?️ ZEC: Holding Firm at $400! Privacy Coin Sector Drags It Down, Needs to Break $425 for Prospects

The privacy coin leader ZEC is having a tough time! It fell 3.82% in the past 24 hours, didn't follow Bitcoin's rebound, and is being dragged down by the entire privacy coin sector — Monero fell 0.89%, and Dash was even worse, falling 14.5% in four days. Truly, "teammates aren't helping".

Fortunately, the psychological support level at $400 is still holding strong. It has been tested three times in the past week and held. Moreover, after breaking through $409.3 on December 9th, the area around $410 has become a stable demand zone. OBV and RSI also hint at a shift.

But the problems are also obvious: selling pressure on lower time frames is intensifying, and多次测试支撑 has weakened its strength. A break below $400 is not impossible.

QQ:326035359

DingTalk:msp252580

Don't rush to go long! Wait for ZEC to break through the local resistance at $425 and successfully retest and hold above it before considering the trend aligned. Otherwise, remain neutral and wait for improved Bitcoin capital inflows and better market sentiment~

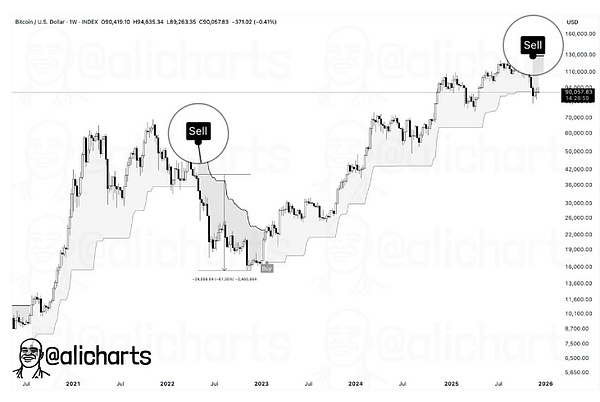

? ADA: SuperTrend Turns Bearish! Last Time This Happened, It Fell 80%, Are You Worried Now?

ADA has triggered a "danger signal" this time! Analyst Ali Martinez revealed that the weekly "SuperTrend indicator" for ADA has turned bearish — this indicator is a key line for judging rises and falls; price above it is bullish, below it is bearish.

Even scarier is that the last time ADA showed this signal was in 2022, and it directly fell 80%! And it's not just ADA; Bitcoin's SuperTrend has also turned bearish. The last time this happened was during the bear market, and BTC fell 60%.

Now ADA is even worse. It just反弹到 $0.48 last week, then turned around and fell back to $0.40. This downtrend is likely to continue.

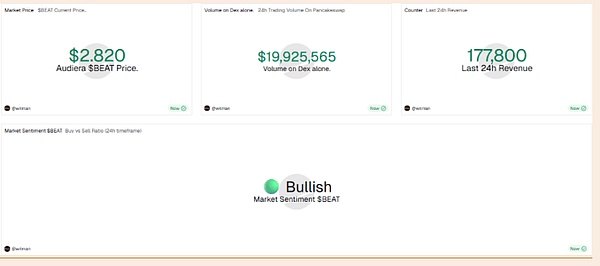

? BEAT: Meme Coin Surges 480%! AI Burning + Scarcity, But Hides a Correction Risk?

The new sensation on BNB Chain, BEAT, has gone crazy! It's only been listed for a month, surged 84% in 24 hours, and累计暴涨 480% in the past 30 days, directly rushing into the top 100 by market cap. In a weak market, it's like "a breath of fresh air".

Why such a猛 surge? Three key points:

1. Speculative sentiment is maxed out, with $20 million in volume on DEX platforms alone, and nearly 7000 more buyers than sellers;

2. Scarce circulating supply, only 16% of the total supply — scarcity drives value;

3. AI-driven token burning, plus integrated AI payments, reducing supply while generating income, maximizing deflationary pressure.

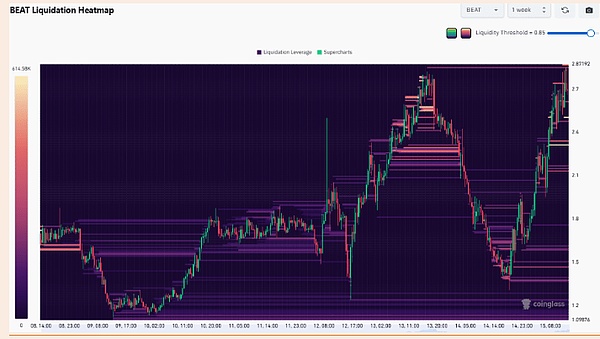

But don't blindly FOMO in! BEAT encountered resistance when冲击 the $3 all-time high. Capital is starting to flow out, the MACD shows buying cooling down, and more liquidity is聚集 below. If the bulls run out of steam, it could fall towards $2.40 (where there is $1 million in leverage liquidations below) or even retest the $1.25 support level that hasn't been broken in three tests. If you want to chase, wait for it to successfully break through the all-time high~

To summarize: SHIB is building momentum waiting for a reversal, ZEC is guarding $400 watching for a break above $425, ADA is警惕大跌风险, and BEAT has surged but has significant回调隐患. The crypto circle is now severely分化. Don't blindly follow the trend; keep a close eye on key levels before making a move!QQ:3260353596

DingTalk:msp252580