Original / Odaily Planet Daily (@OdailyChina)

Author / Wenser(@wenser2010)

New Changes in the Prediction Market Sector!

Just yesterday, Kalshi, one of the duopoly players in the prediction market, joined forces with platforms like Crypto.com, Robinhood, Coinbase, and Underdog to establish the Coalition for Prediction Markets (CPM). This is also the first joint external action taken by Kalshi in response to regulatory pressure after being deeply embroiled in the "market-making" crisis. Following the federal judge Victor Bolden's order for Connecticut to suspend enforcement against Kalshi, this move by Kalshi is undoubtedly a new attempt at "indirect salvation"—as Kalshi CEO Tarek Mansour stated: "CPM aims to speak for the prediction markets and resist negative traditional lobbying groups." To some extent, the establishment of the Prediction Market Alliance also marks a footnote for the prediction market sector's expansion from the cryptocurrency industry to a broader stage. Odaily Planet Daily will provide a brief analysis of this event and its potential impact in this article.

The Underlying Battle Between Prediction Markets and Traditional Gambling: Using Industry Associations to Counter Traditional Lobbying

Regarding prediction markets, we have previously provided detailed introductions and analyses in multiple articles (recommended reading: "The Future of Prediction Markets: Left is the Casino, Right is News" and "Why Prediction Markets Are Truly Not Gambling Platforms"). The reason Kalshi had to unite with Coinbase, Robinhood, and other "major players" to establish the CPM prediction market alliance is relatively simple—either there are common interests or common enemies.

Currently, the biggest enemy facing Kalshi and other prediction market platforms is not regulatory agencies but the traditional gambling industry.

According to Kalshi CEO Tarek Mansour, "In recent months, many lobbying groups have attacked prediction markets, spreading misinformation about how they operate and how they should be regulated." The crux of the issue is that the "cake" of prediction markets has already encroached on someone else's "rice bowl"—traditional gambling platforms in the United States.

After all, this is an emerging sector with an annual trading volume exceeding $150 billion. Last month, the combined trading volume of Kalshi and Polymarket approached $10 billion, and both have valuations exceeding $10 billion. The former raised $1 billion in its latest Series E round, valuing it at $11 billion; the latter previously completed a $2 billion financing round led by NYSE's parent company ICE and is seeking a new round of financing at a valuation of $12–15 billion.

Based on current information, Kalshi and the numerous exchanges and trading platforms entering the prediction market are adopting a strategy similar to industry associations and "lobbying counterattacks" to address their regulatory crisis—traditional gambling platforms cannot tolerate their user base being taken away by prediction markets and lobby local governments to exert pressure? Then I will "return the favor" by uniting all forces that can be团结ed through an industry association to争取 the broadest possible unified alliance阵营.

Behind the investigations and user lawsuits initiated by local regulatory agencies in Connecticut, Nevada, and other states against Kalshi are the employment opportunities and high tax revenues provided by the gambling industry, which supports local finances.

On this point, Kalshi CEO Tarek Mansour sees it very clearly, as he said—just as banking lobbying groups attack cryptocurrencies as 'unsafe,' the attacks on prediction markets are not to protect consumers but to protect monopolies and the profits they fear losing.

All the hustle and bustle in the world is for profit; all the coming and going is for gain.

Faced with a "new emerging industry" and platforms like prediction markets that are developing rapidly and can see their valuations multiply tenfold in a few months, traditional gambling industry monopolies are naturally unwilling to be quietly swept into the dustbin of history.

And the reality is that, as an industry distinct from traditional gambling, the real demand for prediction markets is far stronger than it appears, and the information value they reflect is far more important than commonly believed.

Prediction Markets Rapidly Penetrate the U.S. Market: Nearly 50% of Americans Under 45 Are Users

According to the official introduction of the Coalition for Prediction Markets (CPM),

- Prediction markets have become one of the most accurate and user-friendly tools for the public to understand evolving economic, cultural, and political trends; nearly half of U.S. citizens under 45 have already used prediction markets, and market expansion continues to accelerate;

- In October this year, the prediction market industry valuation reached $28 billion;

- Prediction markets' forecasting performance is approximately 30% higher than traditional polls.

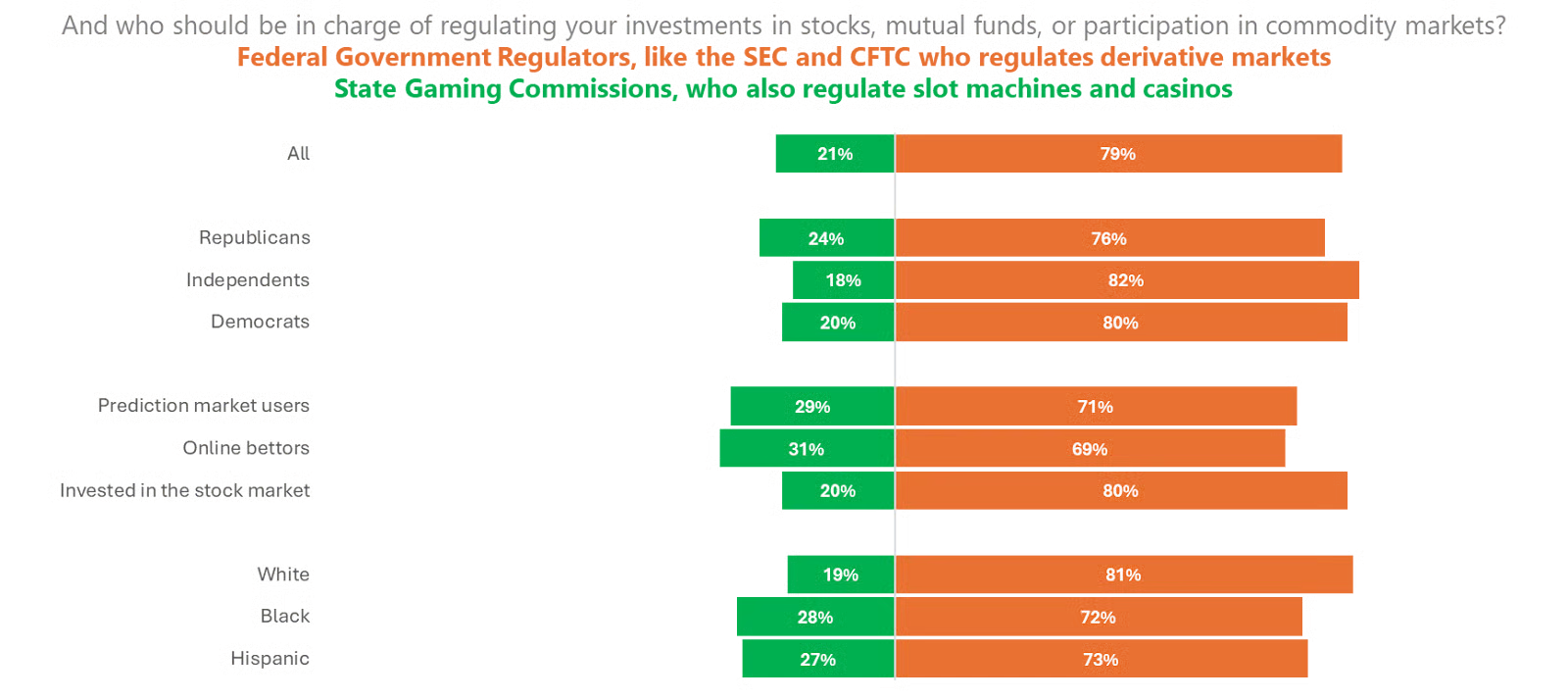

- Over 70% of Americans believe prediction markets should not be treated as gambling.

In addition, prediction markets differ from the traditional gambling industry in the following three aspects:

First, prediction markets have no "house" and no penalty for winning (as in casinos). Prediction markets aggregate information from thousands of people to generate real-time probabilities of outcomes and should be considered more analytical than gambling; participating in prediction markets requires knowledge and analysis similar to financial investment, rather than purely probability-based gambling; prediction markets create public information value by generating predictions useful to media, alliances, and owners (such as辅助 policy decisions, public opinion screening, event trend prediction, etc.).

Second, as a CFTC-designated contract market, Kalshi enjoys exclusive federal jurisdiction. In short, local laws have no right to adjudicate the business legality of prediction market platforms like Kalshi. "Prediction markets deserve the same rigor as modern financial markets—clear rules and federal regulation. The best way to protect consumers is to have these markets federally regulated with consistent user protection measures."

Third, prediction markets cover a wider and more diverse range of fields, capable of generating public information value. "Millions of Americans have become active users of prediction markets, which have become the most powerful way to leverage collective wisdom and often outperform traditional polls. Economists, news networks (CNN, CNBC), journalists, policymakers, and readers now rely on prediction markets to obtain quality information in the noisy舆论 field."

Kalshi's Strategy of Alliances: Combining Top-Down and Grassroots Approaches

It is evident that in the face of tightening "regulatory chains" from local agencies, Kalshi's solution is to break through in a different direction—

On the one hand, by establishing the Coalition for Prediction Markets (CPM), Kalshi emphasizes that it will subsequently protect industry transparency, market integrity, and customer protection standards;

On the other hand, Kalshi CEO Tarek Mansour reiterated the jurisdiction scope, defining prediction markets as a new industry distinct from local gambling, and may subsequently leverage forces at the federal government level to escape the quagmire of lawsuits and the regulatory traps of local protectionism.

Unlike Polymarket, which focuses more on providing content for on-chain prediction events and重返 the U.S. market through the acquisition of the derivatives exchange QCX, Kalshi, which has always emphasized "compliance," places greater importance on the long-term stable operation of its business. After completing financing with a valuation of $11 billion, it cannot and will not allow itself to face endless regulatory obstacles on its path to commercial success.

Perhaps this is also why Kalshi chose to join forces with industry players like Coinbase, Robinhood, Crypto.com, and Underdog to launch the Prediction Market Alliance—it needs both同行利益 binding and a united front against external pressures; it also needs to "make a big deal out of it" and "take the top-down route" to involve federal-level regulatory agencies, highlighting its identity and status as an "industry innovation pioneer."

Conclusion: Prediction Markets Will Surpass the Gambling Industry to Grow into a "New Internet Sector"

At the end of the article, I would like to conclude with two interesting recent incidents involving Kalshi and Polymarket, the two "prediction market oligopolies"—

One is the recent criticism by Paradigm co-founder Matt Huang, a lead investor in Kalshi, of a "bug in Polymarket's duplicate calculation of trading data." Subsequently, this was clarified by deployer, co-founder of the AI agent platform Bankr: "Polymarket's trading data is correct; Paradigm is smearing competitors due to its investment in Kalshi." One can't help but感叹, real-world business competition is always so朴实无华; even capital新星 with billion-dollar valuations cannot avoid the cliché剧情 of "spreading black material and engaging in verbal sparring on the internet";

The other is Kalshi CEO Tarek Mansour's recent statement on the 20VC podcast that the rivalry between Kalshi and Polymarket is more like a showdown between sports legends, similar to NFL quarterback stars "Tom Brady vs. Eli Manning," or in soccer, "Messi vs. Ronaldo." "The prediction market industry is maturing faster due to competition."

As event betting in prediction markets extends far beyond sports events and the加密 field, this new species combining news products, trading标的, and博弈 competition is gradually emerging from the cryptocurrency领域 to become the next "new internet sector," much like how Uber, Didi, and Meituan开创ed the sharing economy.

As for the inefficient, zero-sum, and non-incremental traditional gambling industry, it may eventually be crushed, replaced, and ground into a pile of碎泥 on the "golden road" of the industry.