Folks, Dogecoin (DOGE) is quietly building up momentum for something big! Despite recent volatility in the crypto market and a collective pullback in the meme coin sector, DOGE has been subtly releasing a bunch of bullish signals. Two top analysts have made explosive predictions—a long-term target aiming for $0.6, with a short-term potential surge to $0.21—directly igniting market enthusiasm!

First, the latest market update:

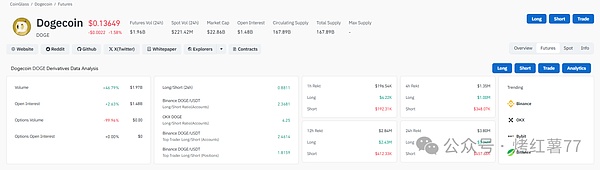

DOGE has strongly rebounded by 3.5% in the past 24 hours, currently holding steady above the $0.14 mark. Interestingly, while the price is recovering, trading volume has plummeted by 41% to $696 million, and the overall decline over the past 30 days has reached 19%, with the price oscillating between $0.1324 and $0.1657 during this period.

The RSI indicator is currently at 42, sitting in the neutral zone—neither overbought nor oversold—as if holding back a major move. Is it gearing up for a rebound or hiding a risk of correction? Don’t worry, on-chain data has the answer!

Data shows that DOGE futures open interest has surged nearly 7%, approaching the $1.5 billion mark. This indicates that traders' bullish sentiment is soaring, with funds quietly entering the market.

More importantly, the market structure holds the key to a breakthrough.

Analyst Ali Martinez points out: DOGE is currently in a triangular consolidation pattern, with $0.14 being the key resistance level. Once it firmly holds above this level, it is highly likely to trigger a sharp short-term rally, directly rushing towards $0.21!

Another analyst, Trader Tardigrade, has given an ultimate target: DOGE's current price action highly resembles its historical strong cycles. Combined with the explosive nature of meme coins, it has the potential to soar all the way to $0.6 in the future, directly replicating past doubling rallies!

However, there are also minor uncertainties to note:

Although on-chain data and analysts are bullish, there are recent signs of market funds shifting towards safer assets. DOGE's sideways movement has also made many investors nervous. But the continuous rise in futures open interest precisely indicates that smart money is quietly accumulating positions. After all, for a meme coin like DOGE, which boasts a massive community and inherent hype, a key breakout could likely lead to an unstoppable rally!

Right now, the most crucial thing is to keep a close eye on the $0.14 level—this is the line in the sand. A breakout opens the short-term path to $0.21, followed by steady progress towards $0.6. If it fails to hold, it will likely retest previous support levels. Currently, the RSI is in the neutral zone, meaning there's no pressure from an overbought correction nor an opportunity for an oversold bounce, making it a perfect window for observation and positioning.

In summary:

DOGE is experiencing a triple resonance of "fundamentals + technicals + on-chain sentiment." The $0.14 breakout drama is about to unfold, with a short-term surge to $0.21 and a long-term vision of $0.6. Are you ready to get on board and witness the miracle?