The Federal Reserve slashed interest rates by 25 basis points on Wednesday to a target range of 3.5% to 3.75%. However, mixed comments from Federal Reserve Chair Jerome Powell will likely quell a Bitcoin price rally until the rate-cutting cycle resumes in 2026, analysts say.

“In the near term, risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. There is no risk-free path for policy,” Powell said at Wednesday’s Federal Reserve Open Committee (FOMC) meeting.

These comments were not as “hawkish” as some analysts expected, but the Federal Reserve is now expected to issue only one rate cut in 2026 under Powell’s leadership, according to market analyst and Coinbureau founder Nic Puckrin. He added:

“Attention will turn to liquidity and the Fed’s balance sheet policy in early 2026. However, despite the Treasury bill purchase announced today, quantitative easing isn’t coming until things start breaking, and that always means more volatility and potential pain.”

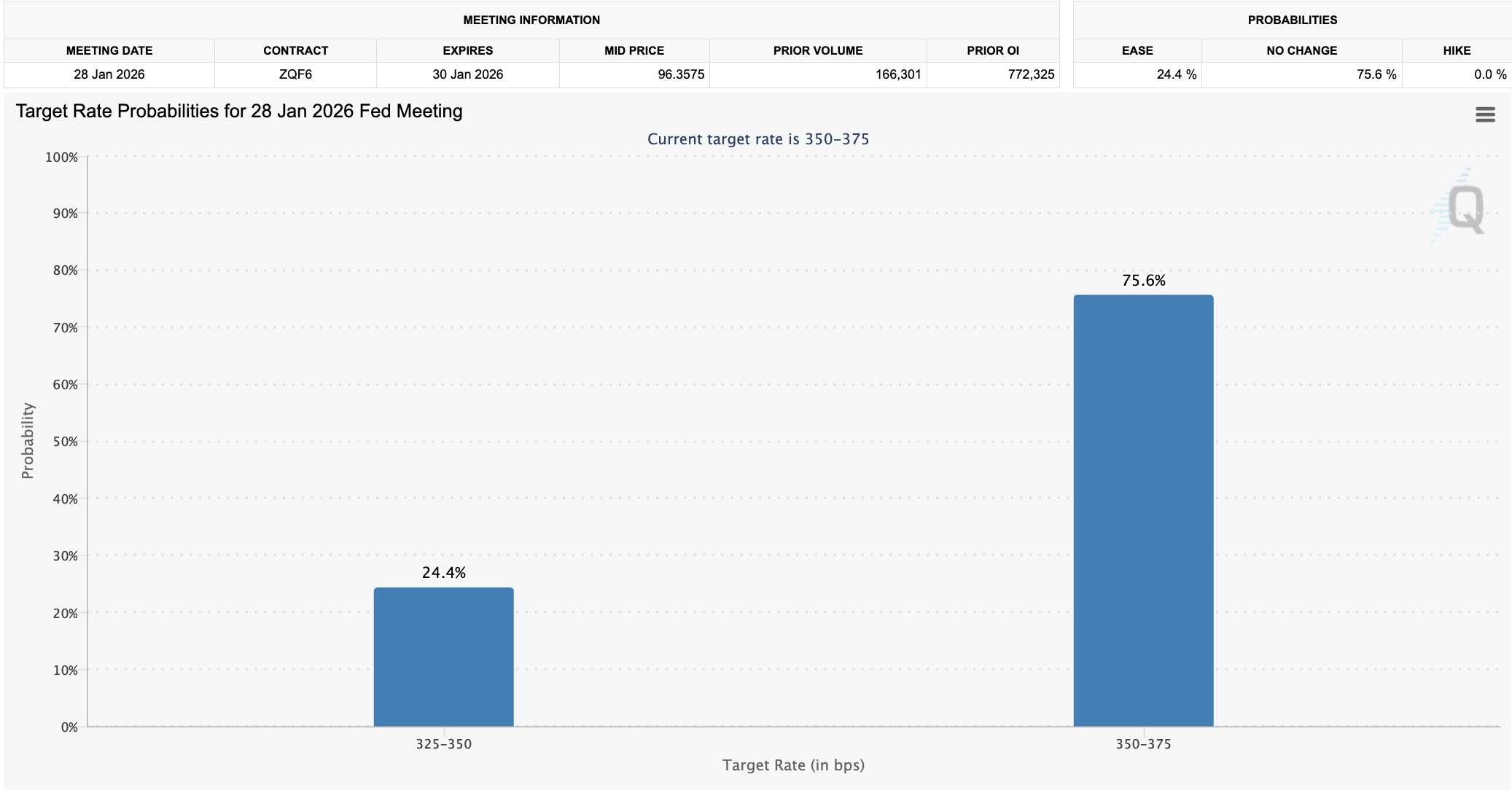

Low Interest rates fuel risk-on assets, such as Bitcoin (BTC), but only 24.4% of traders expect a rate cut at the next FOMC meeting in January 2026, according to data from the CME Group.

US President Donald Trump has been weighing Powell’s replacement, with National Economic Council director Kevin Hassett widely reported as the frontrunner for the position. Hassett is also a former adviser on Coinbase’s Academic and Regulatory Advisory Council

Related: Short the dip and buy the rip? What FOMC outcomes reveal about Bitcoin price action

Powell gives mixed remarks, but Trump says the next Fed chair will slash rates

Powell said consumer spending and business investment remain “solid” and added that layoffs and hiring remain low. However, inflation remains “somewhat elevated” above the Federal Reserve’s 2% inflation target, while the housing sector is considered still “weak.”

The Fed reached these conclusions using available market data, but Powell acknowledged that it is missing months of public economic reports due to the US government shutdown.

Trump has already pressured the next Fed chair to slash rates. Powell’s term is set to expire in May 2026.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops