Ethereum whales have opened massive long positions on Ether (ETH), totalling $425.98 million, in what looks like a bold bet that the downside is over.

Key takeaways:

Ethereum whales opened leveraged long positions totaling $426 million.

Ether’s ascending triangle targets $4,030 ETH price.

Top traders open new ETH long positions

Data from Cointelegraph Markets Pro and TradingView showed the ETH/USD pair trading at $3,140, 20% above the $2,621 low reached on Nov. 21.

Holding above $3,000, Ether offered some cause for optimism ahead of some key volatility triggers.

Related: Vitalik Buterin floats gas futures on Ethereum to hedge fee spikes

The Fed rate cut decision is expected on Wednesday, Dec. 10, where markets are pricing in a 25-basis-point rate cut.

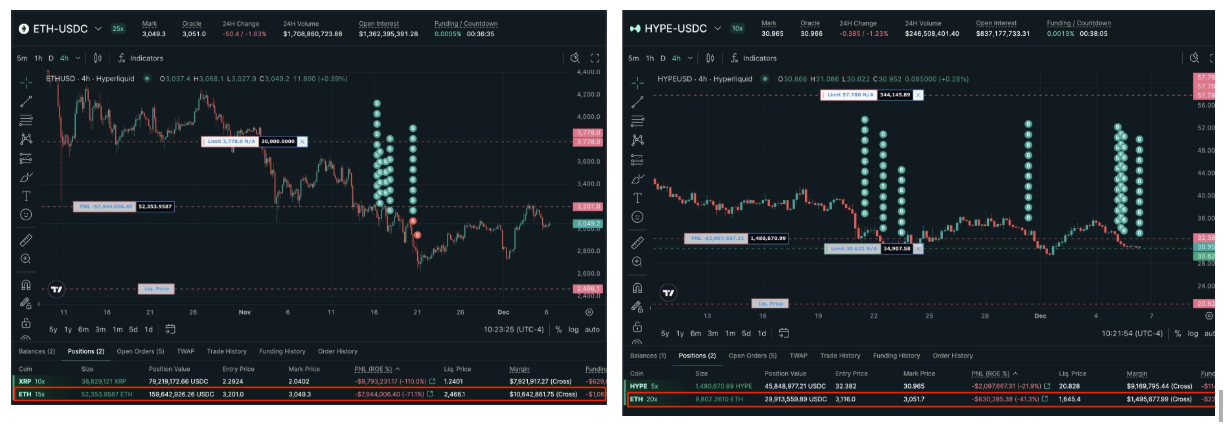

As market participants waited for triggers, attention has shifted to three “smart” whales with impressive track records, who have opened long positions, totaling 136,433 ETH, worth about $425.98 million, according to data from Lookonchain.

One whale, BitcoinOG (1011short), has a long position of $169 million in ETH, while Anti-CZ has a long exposure of $194 million.

Smart whales are all unanimously going long on $ETH!#BitcoinOG(1011short), with $105M in total PNL, is long 54,277 $ETH($169.48M).

— Lookonchain (@lookonchain) December 8, 2025

Anti-CZ whale, with $58.8M in total PNL, is long 62,156 $ETH($194M).

pension-usdt.eth, with $16.3M in total PNL, is long 20,000 $ETH($62.5M).... pic.twitter.com/idHbyTePTv

A third whale, pension-usdt.eth, is long 20,000 ETH, worth approximately $62.5 million at current rates.

Besides these whales, Arkham Intelligence noted that another whale, “0xBADBB,” is using two accounts to go long for a total of $189.5 million in ETH.

These moves coincide with BitMine’s continued push into Ethereum. Last week, the company added $199 million more ETH, bringing its total holdings to 3.73 million ETH ($13.3 billion), thereby cementing its position as the largest corporate holder of ETH.

This reinforces the narrative that whales and institutions view the recent ETH price rebound above $3,000 as a good entry point.

Ether’s ascending channel targets $4,000 ETH price

Ether’s price action has formed a classic ascending triangle on the daily chart, as shown below. The break above the multimonth downtrend line on Dec. 2 increased the prospects of a sustained recovery.

The pattern will resolve once the price breaks above the triangle’s resistance line at $3,250. If this happens, the price could rise by as much as the maximum distance between the triangle’s trendlines.

That puts Ether’s breakout target at about $4,020, up by more than 28% from current price levels.

The relative strength index has increased to 50, from oversold conditions at 28 on Nov. 28, suggesting increasing upward momentum.

However, the recovery could be curtailed by resistance from the $3,350-$3,550 resistance zone, where both the 50-day and 100-day SMAs currently sit. Beyond that, the next major hurdle is the 200-day SMA at $3,800.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.