Cryptocurrency investment products maintained upward momentum last week, logging two consecutive weeks of gains following substantial outflows.

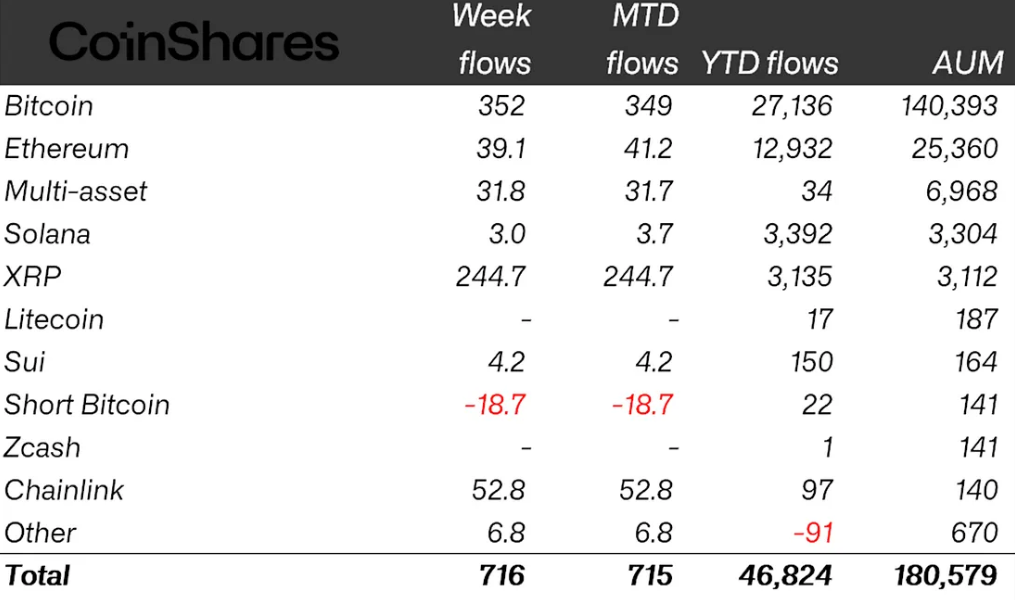

Crypto exchange-traded products (ETPs) attracted $716 million in inflows last week, adding to the previous week’s gains of $1 billion, European crypto asset manager CoinShares reported Monday.

“Daily data highlighted minor outflows on Thursday and Friday in what we believe was a response to macroeconomic data in the US alluding to ongoing inflationary pressures,” CoinShares’ head of research, James Butterfill, said in the update.

The new inflows pushed total assets under management (AUM) above $180 billion, marking an 8% rebound from November lows following $5.5 billion of four-week outflows. However, AUM remains well below its all-time high of $264 billion, Butterfill noted.

Bitcoin leads inflows, Chainlink posts record inflow

Bitcoin (BTC) led crypto ETP gains last week, attracting $352 million in inflows, followed by XRP (XRP) funds with $244 million.

Chainlink (LINK) stood out with a record inflow of $52.8 million, which represented 54% of its AUM.

On the other hand, Ether (ETH) funds saw minor inflows of $39 million, while short Bitcoin ETPs posted around $19 million in outflows, potentially indicating a lessening of negative sentiment.

ProShares tops inflows, while BlackRock’s iShares bleeds

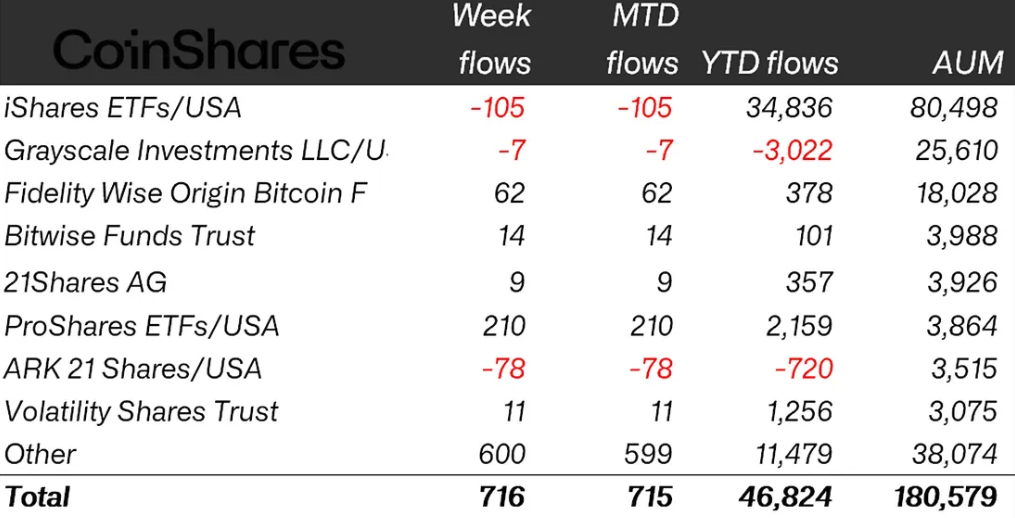

Among issuers, ProShares led inflows with $210 million, while BlackRock — the largest issuer by AUM — experienced $105 million in outflows.

Cathie Wood’s ARK and Grayscale Investments also saw outflows, recording $78 million and $7 million, respectively, last week.

Geographically, almost all regions globally saw inflows, with the most notable being the US, Germany and Canada, with inflows of $483 million, $97 million and $80.7 million, respectively.

Related: Sweden eyes entering the Bitcoin ‘digital arms race’

On the other hand, Sweden saw $5.6 million in outflows last week, pushing its year-to-date outflows to $836 million, topping global outflows.

Magazine: Koreans ‘pump’ alts after Upbit hack, China BTC mining surge: Asia Express