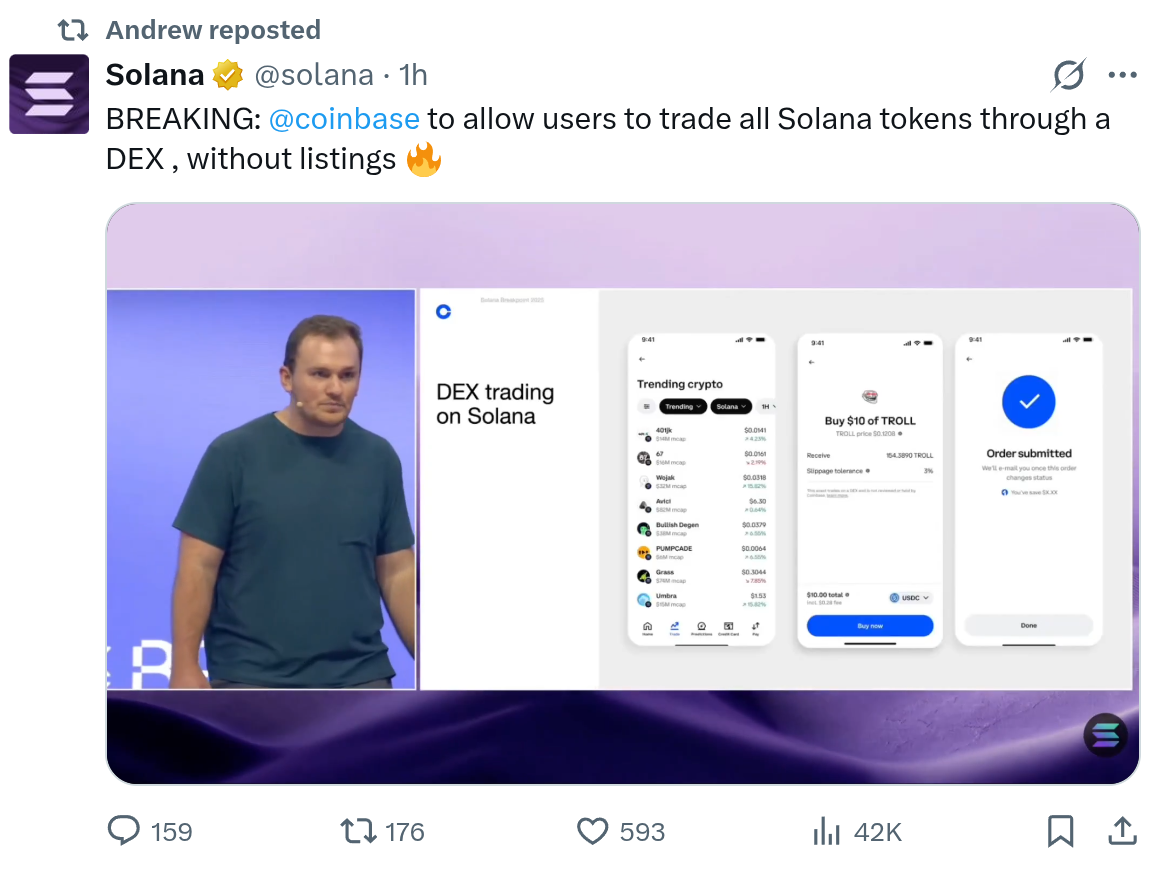

Coinbase is moving deeper into the Solana ecosystem, letting users trade native Solana tokens through a decentralized exchange integration rather than traditional listings.

Andrew Allen, Coinbase protocol specialist, said in an X post that Coinbase now allows its users to trade all Solana (SOL) tokens through a decentralized exchange (DEX) integration, “without listings,” he noted, adding that “very soon you will be able to open the Coinbase app and see native Solana assets on Coinbase.”

“For issuers and builders, if your token has sufficient liquidity, this means you can be accessible to the millions of users on Coinbase without getting listed,” Allen said.

The announcement follows Coinbase’s integration of tokens from its Base blockchain through a similar DEX integration in early August. The announcement noted that the exchange plans to “expand DEX support to include additional networks, starting with Solana.”

Related: Coinbase to roll out its new ‘DeFi Mullet’ offering in Brazil

Solana’s DeFi ecosystem is booming

Coinbase’s integration comes amid a slew of developments in Solana's decentralized finance (DeFi) ecosystem.

Earlier Thursday, DeFi company Ellipsis Labs announced the launch of its Solana-based perpetual swap DEX. The announcement claims that the platform is fully onchain — including the risk and matching engine — allowing anyone to build on top of it. Still, the platform is currently in private beta and not yet open to the general public.

The launch coincides with a new “Solana Lending Markets Report 2025,” shared with Cointelegraph by DeFi infrastructure firm Redstone. The report argues that “DeFi strategies on Solana have reached institutional-grade sophistication” and points to strong growth in Solana’s onchain lending and trading activity.

Redstone claims that “Solana has become a dominant force in on-chain finance” and “processed $35.9 billion in peak daily DEX volume.” The company expects the next wave of growth to focus on “tokenized real-world assets and institutional capital deployment.”

“Bringing traditional finance onchain at scale can unlock trillions in Internet Capital Markets. Solana's infrastructure is positioned to capture a significant share of this expansion.“

Related: How perp DEXs quietly took over 26% of the futures market

Centralized and decentralized exchanges collide

The Coinbase integration is just the latest manifestation of a broader trend: centralized exchanges are increasingly integrating DEX platforms and serving as a user-friendly front end for them. In early October, Sergej Kunz, the co-founder of DEX aggregator 1inch, stated that centralized crypto exchanges will gradually fade and serve only as frontends for decentralized finance.

The landscape is shifting, with DEX platforms seeing growing liquidity, faster order execution times, lower fees, and an increasingly simplified user experience. DeFi data platform DefiLlama shows that all DEX platforms processed nearly $12 billion worth of trades over the last 24 hours — this is more than Coinbase’s 24-hour spot volume of $2.566 billion and comparable to Binance’s nearly $18 billion as reported by CoinMarketCap.

So far, Kunz’s prediction is holding up, with Coinbase far from the only centralized exchange to roll out similar integrations. In mid-November, crypto exchange OKX also began offering DEX trading on its platform. At the end of March, the world’s top cryptocurrency exchange, Binance, also introduced centralized-to-decentralized exchange trades on Ethereum, Solana, Base, and the BNB Smart Chain.