Bitcoin (BTC) gave back recent gains on Wednesday as traders predicted fakeout moves around the Federal Reserve interest-rate announcement.

Key points:

Bitcoin fails to hold on to its recent trip past $94,500 as nerves accompany the Fed interest-rate decision.

Traders are prepared for unreliable moves in both directions around FOMC.

Japan-centered risk-asset volatility is already on the horizon as the next key issue.

Bitcoin price fluctuations ignore the yearly open

Data from Cointelegraph Markets Pro and TradingView showed that the BTC price trajectory was heading lower at the Wall Street open.

Having reached $94,650 the day prior, BTC/USD failed to hold higher levels, including the 2025 yearly open.

At the time of writing, the pair traded around $92,000 as market participants expected unreliable price maneuvers around the rates announcement and press conference.

“FOMC meetings can be pretty tricky,” crypto trader, analyst and entrepreneur Michaël van de Poppe wrote on X.

“The price action usually traps everyone before the actual move, so even if Bitcoin drops to $91K, I'm not putting too much weight on it.”

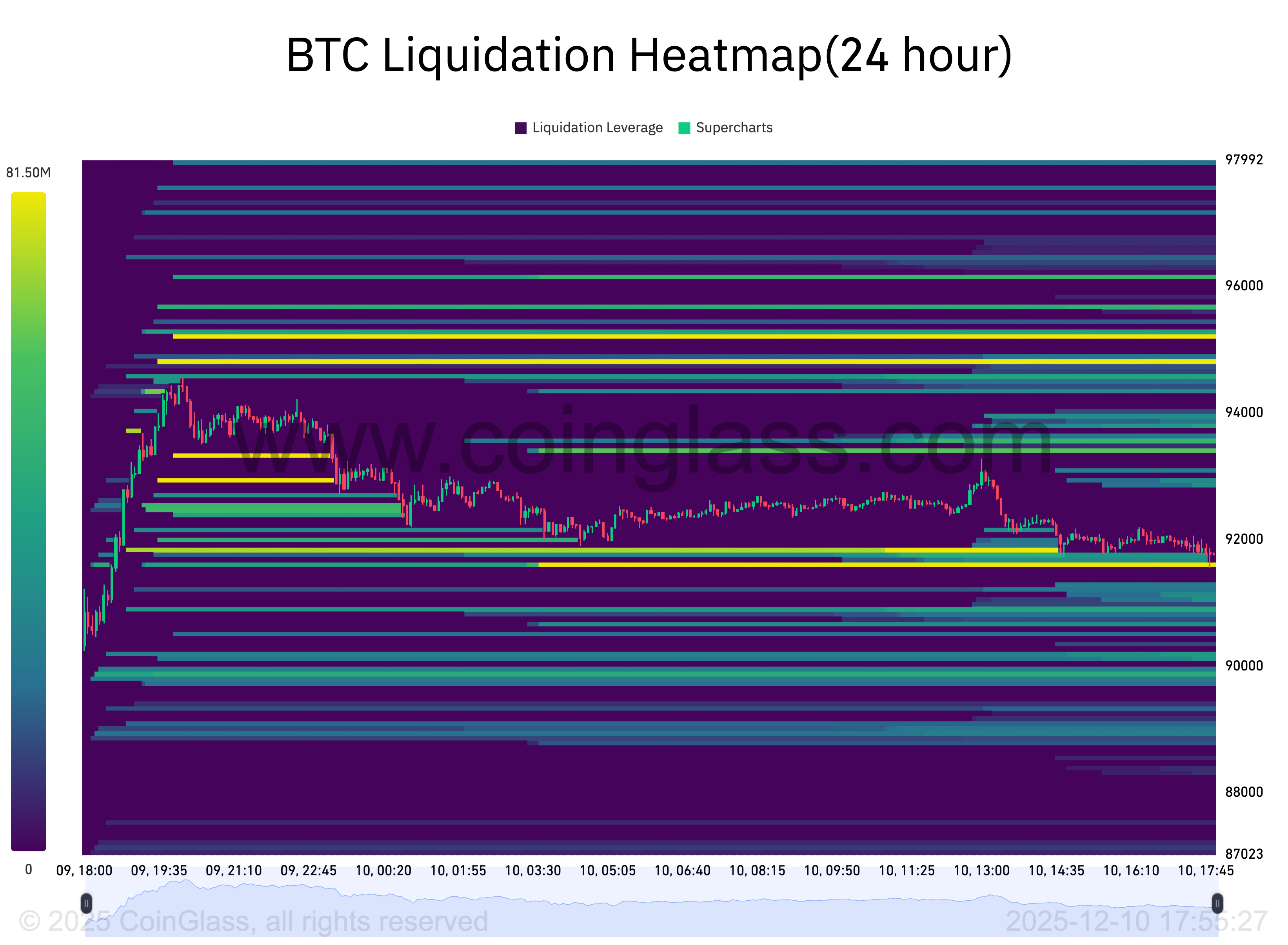

Trader Daan Crypto Trades noted that exchange order books lacked major liquidity clusters on either side of the price after the move higher.

“$BTC Took out that $93K-$94K liquidity cluster as mentioned yesterday. This was the most logical place to go from a liquidity perspective. With that taken out, there's no major area in close proximity,” he told X followers alongside data from monitoring resource CoinGlass.

“But as price is now consolidating, we can see some clusters building up around the $90K & $95K levels.”

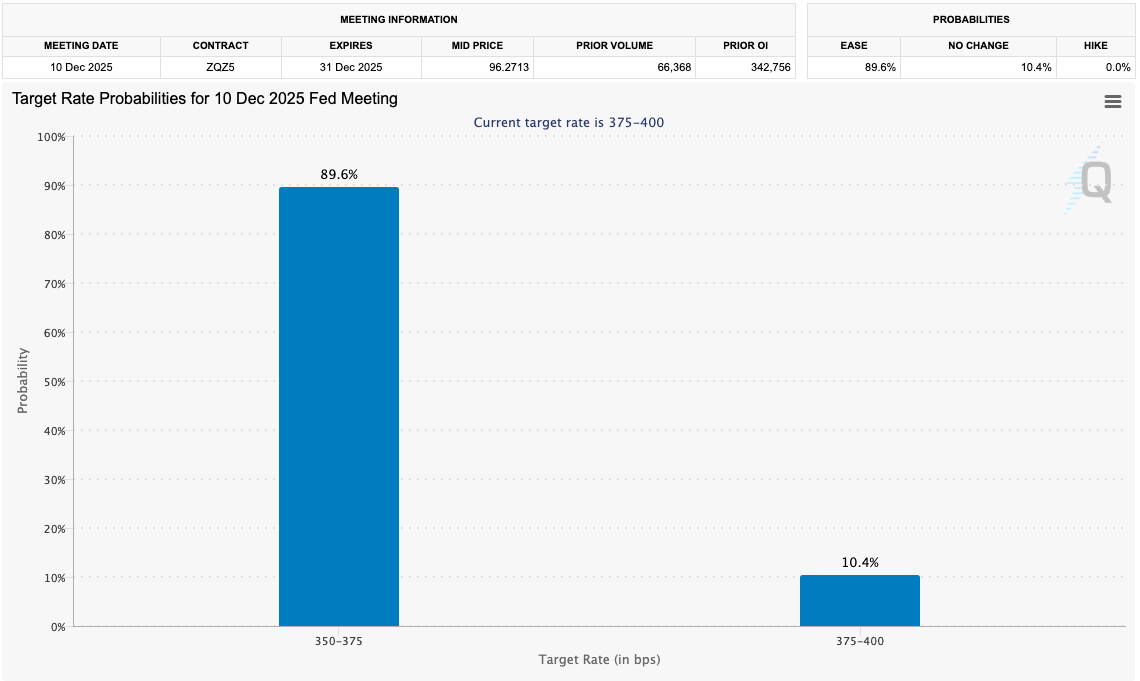

As Cointelegraph reported, markets already saw an overwhelming chance of the Federal Open Market Committee (FOMC) cutting rates by 0.25%. The outlook on future policy from Fed Chair Jerome Powell, however, remained uncertain.

“The rate decision is almost fully priced, but the real focus will be on Powell’s tone,” trading company QCP Capital explained in its latest “Asia Color” market update on the day.

“With little new data since the last meeting, the Fed is unlikely to pre signal a January move, leaving traders to dissect every nuance of the press conference.”

Japan brings back familiar crypto risk

Continuing, QCP said that after the FOMC reaction, risk-asset traders would switch their focus to Japan, with its bond market in unusual territory.

Related: Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

“The BOJ meeting on 19 December has become the next major risk event,” it explained.

“JGB yields are sitting at multi decade highs, with the 10Y near 1.95%, its highest level since 2007, and the 30Y around 3.39%, a record level and more than 100bps higher than a year ago.”

Potential volatility could result from bonds impacting the yen carry trade — an issue already seen in 2024, when crypto markets reacted in real time to the phenomenon.

Japan’s central bank signaled that it could diverge from the global trend and raise interest rates next.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.