Key takeaways:

Economic uncertainty, a delayed jobs report and weakness in the housing market are causing traders to retreat from Bitcoin.

Pro traders are incurring high costs to protect against Bitcoin price drops, while in China, stablecoins are being sold at a discount to exit the crypto market.

Bitcoin (BTC) faced a $2,650 pullback after failing to break above $92,250 on Monday. The move followed a reversal in the US stock market amid uncertainty over job market conditions and growing unease about stretched valuations in artificial intelligence investments.

Traders now wait for the US Federal Reserve (Fed) monetary policy decision on Wednesday, but the odds of a quick recovery to $100,000 depend on risk perception.

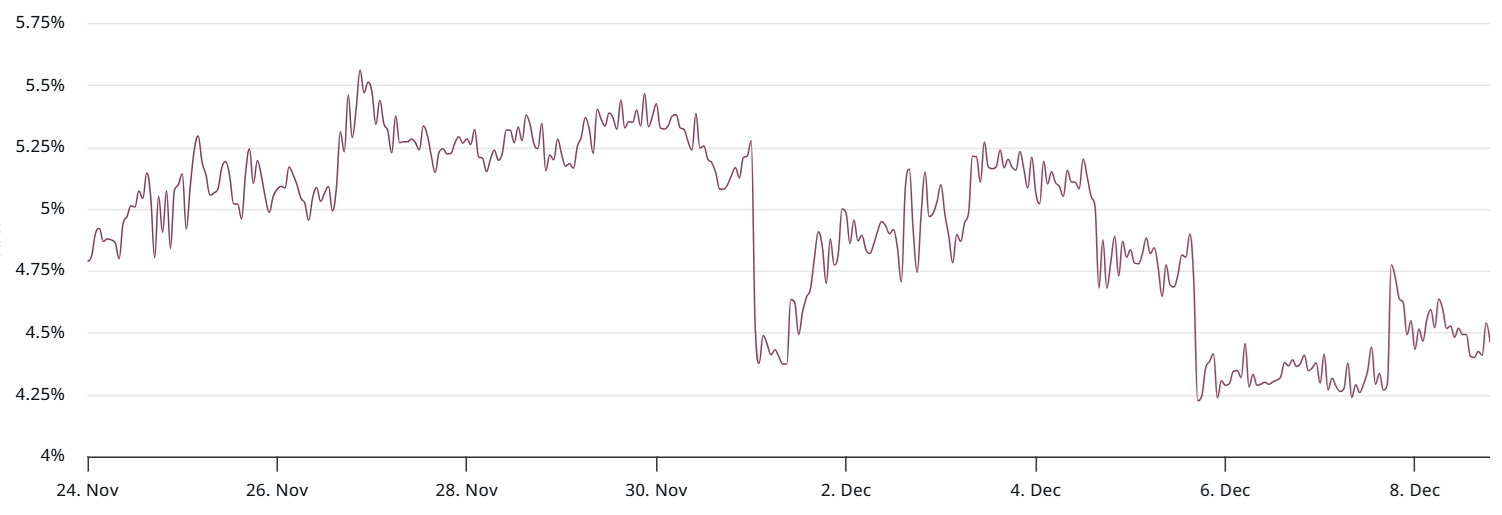

The Bitcoin monthly futures premium relative to spot prices (basis rate) has remained below the neutral 5% threshold for the past two weeks. The weak demand for bullish leverage mirrors Bitcoin’s 28% decline since its October all-time high. Still, worries about global economic growth have also influenced sentiment.

Official US government data on employment and inflation has been delayed due to the 43-day funding shutdown that ended in November, resulting in reduced visibility into economic conditions. As a result, the consensus around a 0.25% interest rate cut in December has not been enough to spark optimism, especially after a private job report showed 71,321 layoffs in November.

Additional pressure came from the US real estate market after Redfin data showed that 15% of home purchase agreements were cancelled in October, citing high housing costs and rising economic uncertainty. Moreover, CNBC reported that delistings rose 38% from October 2024, while the median list price in November slipped 0.4% from a year earlier.

Bitcoin underperformed the stock market, signaling risk-aversion

Bitcoin’s drop to $90,000 accelerated after the forceful liquidation of $92 million in bullish leveraged BTC futures. The weak macroeconomic outlook may have pressured Bitcoin traders’ sentiment, yet the S&P 500 index stood just 1.2% below its 6,920 all-time high.

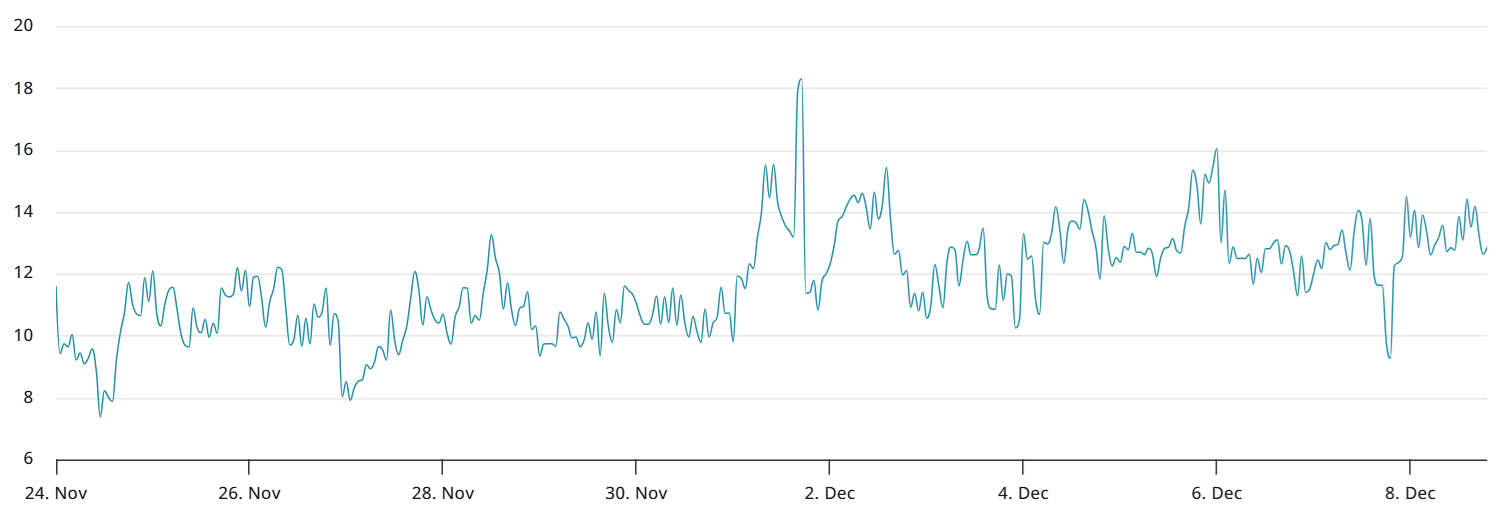

Whales and market makers are demanding a 13% premium to sell Bitcoin put options on Deribit. The inflated cost of downside protection is typical of bearish markets. Still, the rejection at $92,000 on Monday did not affect traders’ positioning, reinforcing the $90,000 support level.

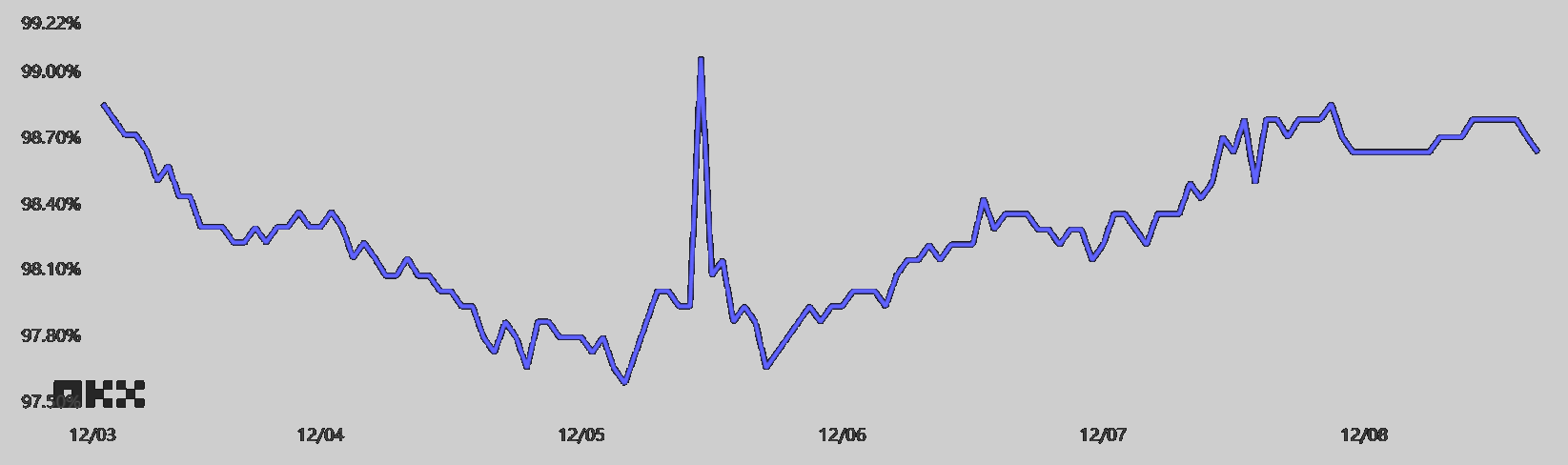

Traders have also been retreating from the cryptocurrency market in China as stablecoins have traded below parity against the local currency. This risk-off signal supports a short-term bearish outlook for Bitcoin, but it does not necessarily imply that traders expect prices to fall to $85,000 or lower.

Under neutral conditions, USDT should trade at a 0.2% to 1% premium versus the official USD rate to offset cross-border frictions, regulatory hurdles, and related fees. A discount relative to the official rate indicates strong demand to exit cryptocurrency markets, a pattern often seen during bearish phases.

The lack of inflows into US spot Bitcoin exchange-traded funds (ETFs) over the past couple of weeks has also weighed on demand for bullish exposure. Whether Bitcoin can reach $100,000 in the near term will depend largely on improved visibility in the US job market and real estate conditions, which may take longer to develop than a single Fed decision.

Related: Bitcoin buries the tulip myth after 17 years of proven resilience says ETF expert

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.