A crypto market expert has predicted a strong altcoin season in the first quarter of 2026, pointing to recent price action for Bitcoin (BTC) and Ethereum (ETH) as key indicators. The analyst noted that Bitcoin’s steady consolidation and Ethereum’s recovery from price dips are laying the groundwork for a bullish shift in the altcoin market.

Bitcoin And Ethereum Trends Signal Altcoin Season In Q1 2026

A market analyst identified as ‘ChainHub’ on X has announced that the crypto market is showing signs of an altcoin season in Q1 2026. He shared a detailed breakdown of Bitcoin and Ethereum setups that indicate and support a strong altcoin performance in February and March this year.

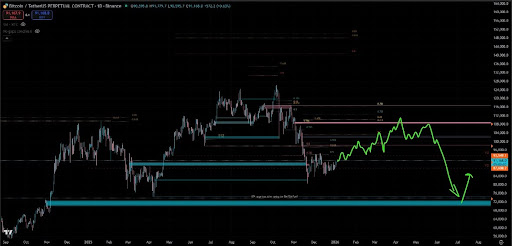

Compared to 2021, which saw the last altcoin season, this cycle’s rally has been delayed by three months, pushing a potential altseason into Q1 after Bitcoin completed its distribution phase. ChainHub notes that BTC’s price bottom came a little earlier than expected. He highlighted that refined lower-time-frame cycles initially suggested a bottom would form between mid-January and early February in 2026. However, BTC bottomed out by late December 2025.

Notably, the analyst disclosed that while Bitcoin remains extremely bearish, this creates an ideal opportunity for altcoins to lead when BTC dominance weakens. Due to its ongoing bear market, ChainHub has predicted that BTC is unlikely to reach a new all-time high soon. He estimates that the cryptocurrency’s next price top could be around $107,000 to $108,000, representing a more than 15% decline from its ATH above $126,000.

While BTC’s slow performance supports an altcoin season in 2026, Ethereum is showing mixed signals. ChainHub disclosed that on shorter timeframes, the ETH price is less bullish, but longer-term charts point to the potential for a new all-time high near $5,000-$5,500. He revealed that Ethereum bottoming around $2,600- $2,700 is not a reliable indicator of an upcoming altseason. However, its overall bullish nature supports long-term upward momentum.

The analyst also noted that the ETH/Silver ratio points to a rotation from precious metals into cryptocurrencies, signaling renewed investor interest in alts after October 2025’s missed rotation expectations. According to ChainHub, these developments suggest a strong altcoin season in Q1, especially as BTC’s dominance declines and demand for alts rises.

Analyst Sees Alt Rally As Market Strengthens

ChainHub has remained bullish and confident that an altseason will occur in Q1, after setups in Q4 2025, such as Dogecoin and SUI, successfully reversed and found their bottoms. He revealed that Total3 and others are the primary focus of the pump. Because of this, he is targeting filling gaps from October 10, though the altcoin sector’s strength could push prices beyond these levels.

According to ChainHub, some altcoins may even reach their extreme highs from summer 2025, with bullish continuation providing opportunities to buy during price dips. The analyst noted that, since Bitcoin and Ethereum are not performing as well as alts in the current market, he expects a pivot by mid-January. He says this pivot could act as a retest, which could be even more bullish for alts and provide additional fuel for upward moves.