Trove once had a perfect narrative.

As a Perp DEX targeting collectibles and RWA, Trove claimed to be able to transform illiquid "cultural assets," such as Pokémon cards, CSGO skins, and luxury items like high-end watches, into tradable financial assets, providing a hedging venue for collectors.

However, within just ten days, the Trove team staged a farce through a series of astonishing operations. In the process, they emptied the pockets of onlookers.

Bait

At the end of October last year, Trove founder @unwisecap discussed the concept of "Everything Can Be Perped" in several articles and announced that Trove would be built based on HIP-3, building up the community's anticipation.

Over the following month, Trove successively announced collaborations with Kalshi and CARDS (Collector_Crypt), receiving official Twitter replies as "endorsements" from these well-known project teams (P.S. As of the time of writing, Kalshi had already completed the "cutting off," deleting their reply under Trove's official tweet).

In mid-December, Trove announced that it had spent over $20 million to acquire 500,000 HYPE tokens to meet the integration requirements of HIP-3. Shortly after, the testnet points program was launched, and the trading volume on the platform exceeded $1 million within two weeks. Everything seemed to be progressing as expected. Until...

A Textbook Case of Insider Trading

On January 6th, Trove suddenly announced an ICO with a $20 million FDV. The public sale adopted an "oversubscription" model, offering priority allocation rights to points holders. Accompanied by concentrated promotions from a group of KOLs sporting Trove badges, Trove successfully raised $11.5 million, oversubscribed by 4.6 times.

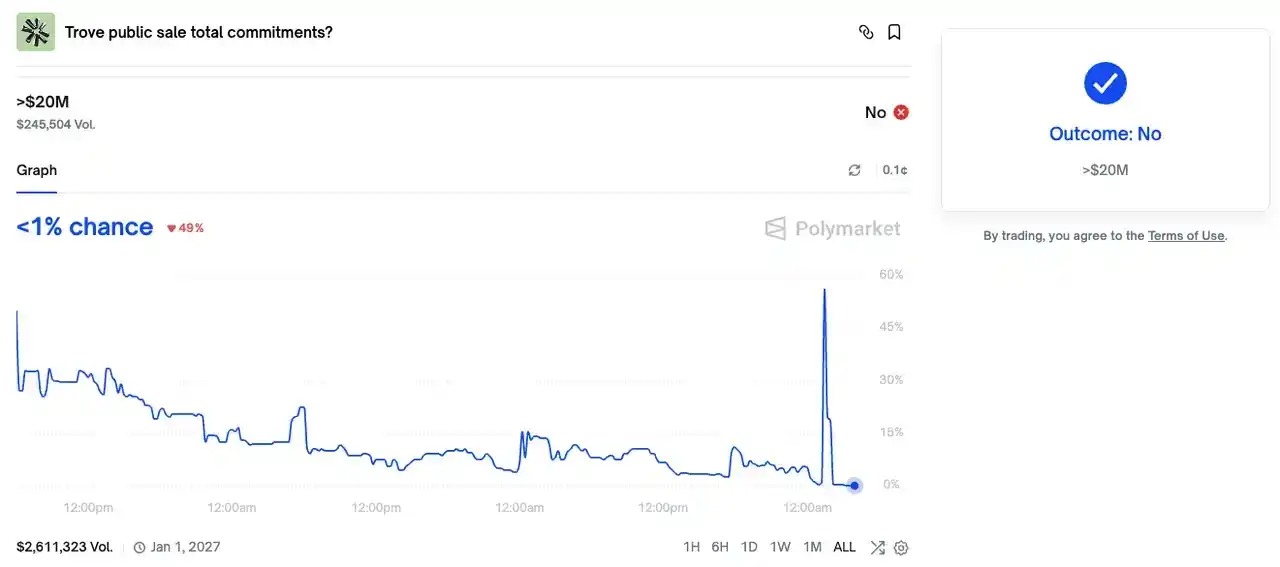

At this point, with less than two hours left until the ICO deadline, the probability of the "Trove ICO total fundraising amount greater than $20 million" prediction market on Polymarket had approached zero.

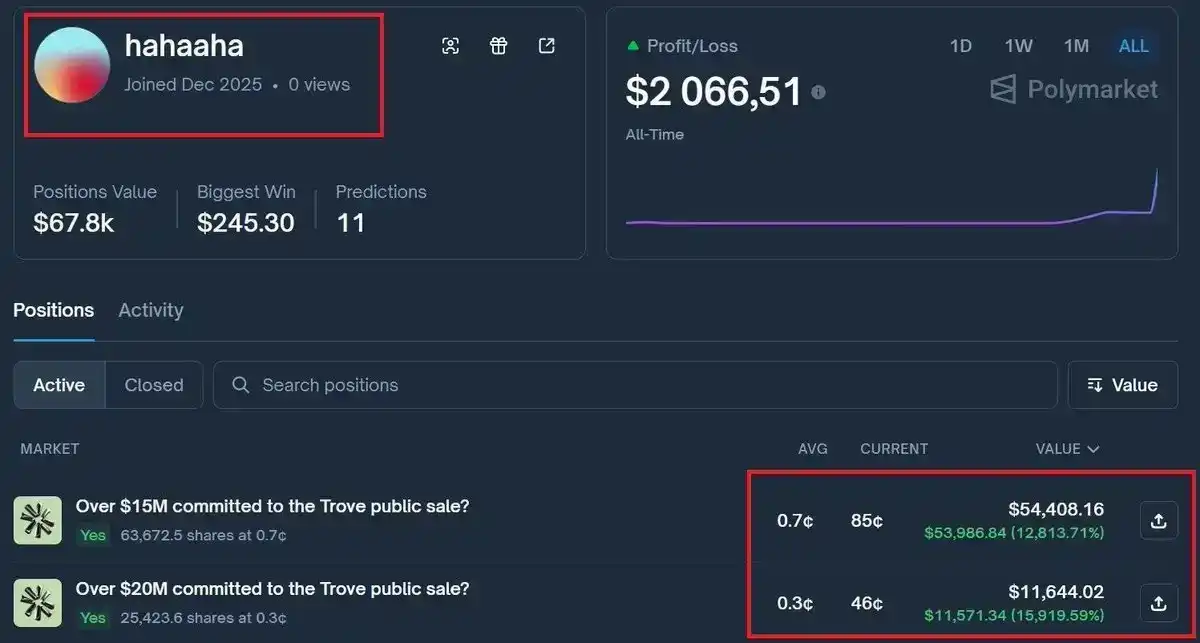

The real show began shortly after. The team suddenly broke the rules, announcing an extension of the ICO by five days to ensure fair allocation. The "YES" option on Polymarket instantly skyrocketed from the bottom to nearly 60%. Insider funds were clearly a step ahead; on-chain data showed that specific wallets placed precise bets before the announcement was made and quickly exited after the price surge.

Perhaps deeming the liquidity of the prediction market insufficient to satisfy their appetite, and amidst a wave of community skepticism, the Trove team seized the opportunity to stage a dramatic "crying wolf" scenario: they announced the withdrawal of the extension decision, ending the ICO as originally planned.

Following this announcement, the corresponding market directly zeroed out and settled. Polymarket data indicated that related wallets had placed precise bets before the news was released and continued to profit from the subsequent reversal.

The Great Retreat

On January 17th, Trove suddenly announced it was abandoning Hyperliquid and would instead issue its token on Solana. For a project that had been fundraising under the banner of the Hyperliquid ecosystem, this was nothing short of pulling the rug out from under everyone.

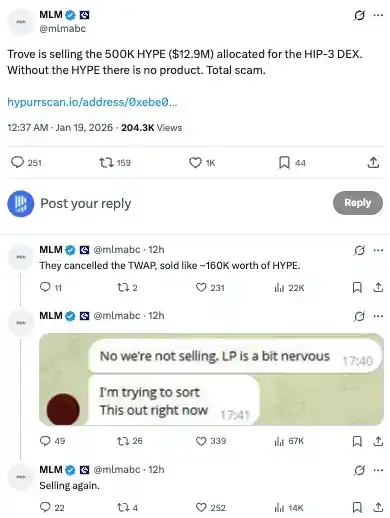

Simultaneously, on-chain detective MLM caught the Trove team using a timed sell function, attempting to sell half of their HYPE tokens within 40 minutes.

Choosing to sell tens of millions worth of tokens in 40 minutes on a weekend, during the lowest trading volume, showed the Trove team was truly desperate.

Faced with质疑 (queries/doubt), the explanation provided by the Trove team seemed feeble: "The backers got nervous and decided to exit." However, on-chain transaction records showed these sell-offs were conducted simultaneously while the team was publicly denying "we are selling tokens."

This inconsistency between words and actions彻底击穿了 (completely shattered) the community's trust底线 (bottom line). As trust collapsed, more shady details were uncovered.

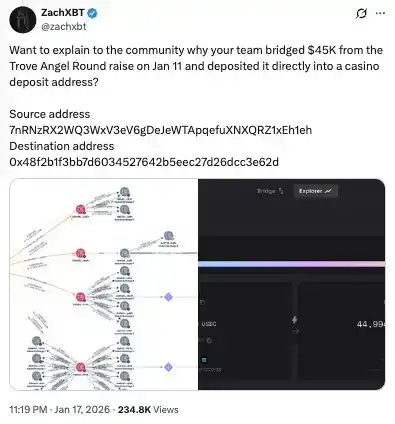

Renowned on-chain detective ZachXBT disclosed that the Trove team paid @TJRTrades a hefty marketing fee of $45,000, directly depositing it into the KOL's online gambling site top-up address.

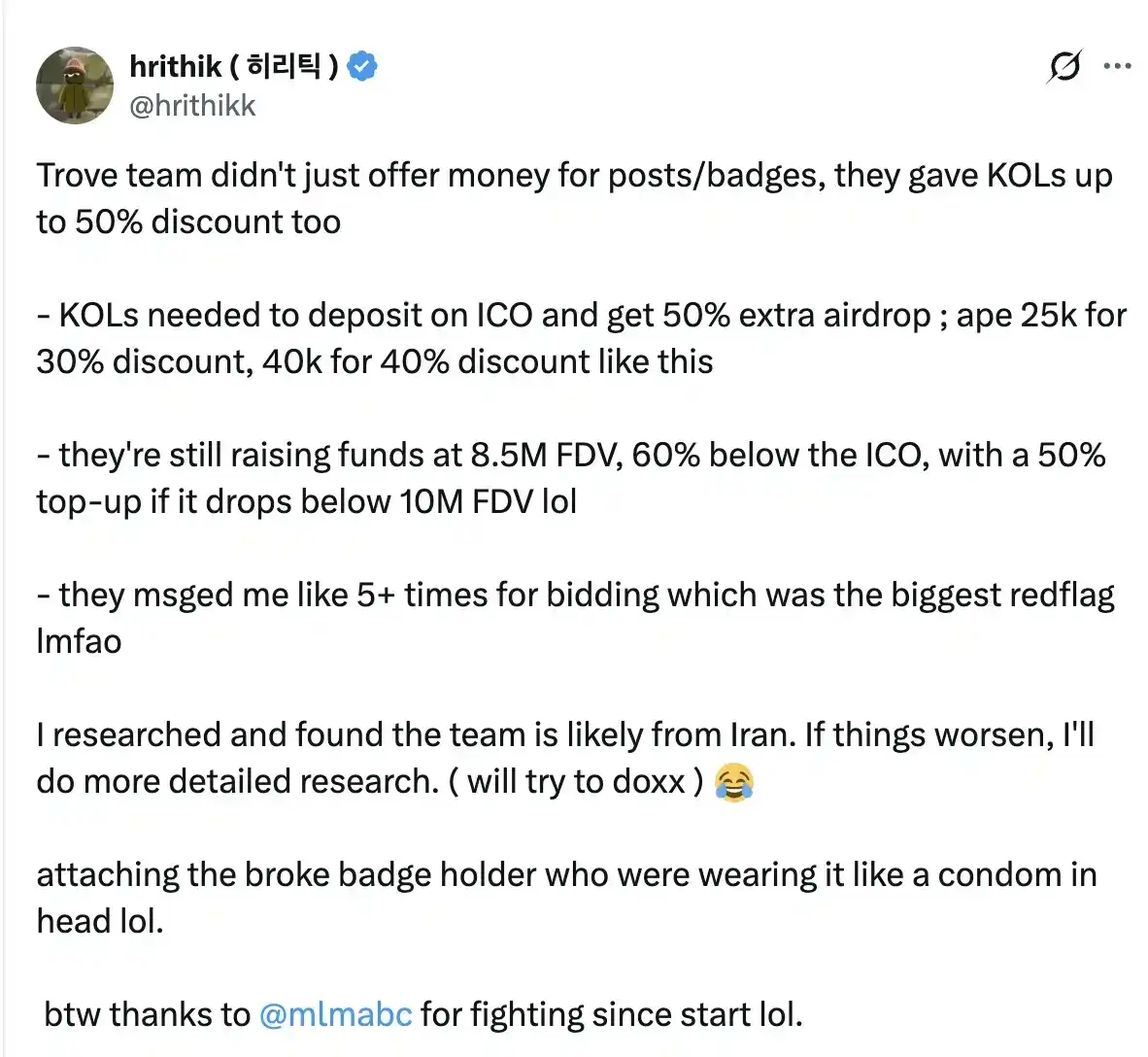

KOL @hrithikk stated that the Trove team not only provided KOLs with substantial marketing fees but also privately offered ICO allocations at valuations as low as $8.5 million, a discount of up to 60%, accompanied by huge airdrop rewards. Trove is still selling shares at low prices and has contacted him over 5 times asking if he would invest in Trove.

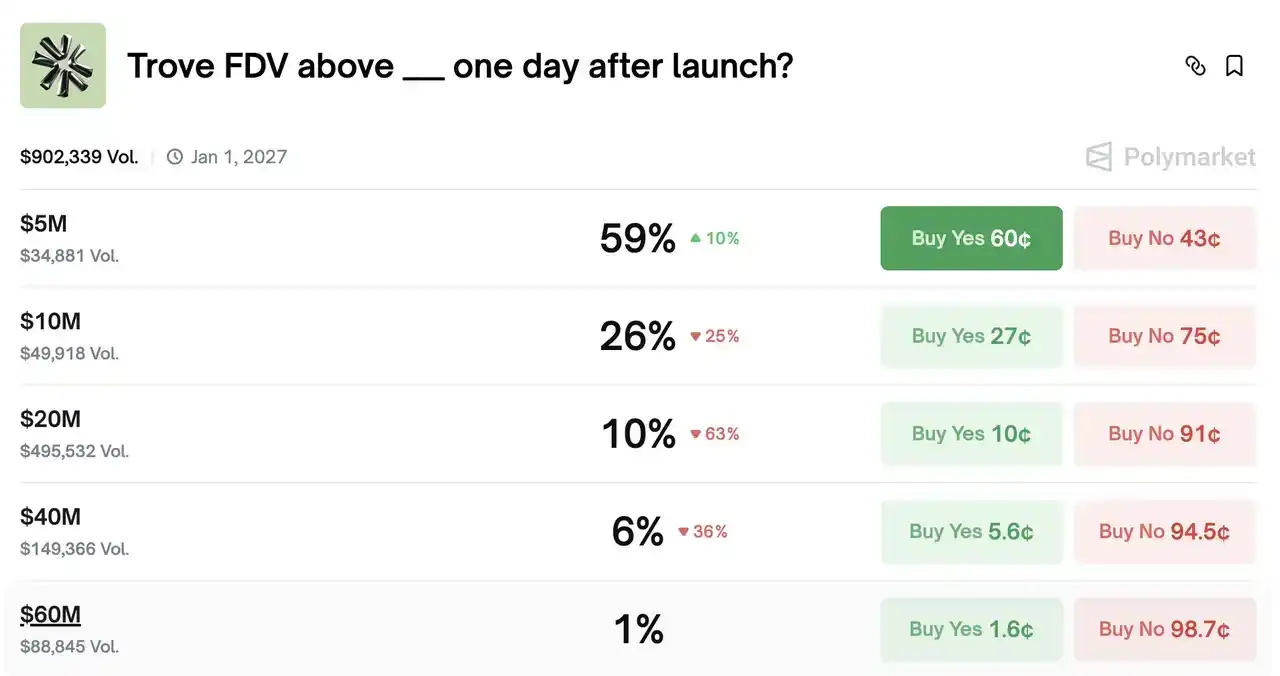

Trove's TGE is scheduled for January 20th at 1:00 AM Beijing Time. The prediction market on Polymarket shows, based on the pre-sale valuation, a 90% probability that the TROVE token will fall below its issuance price.

The good news is that this farce might not end with a simple "Soft Rug." Trove had previously claimed on its official website to comply with EU MiCA regulations. Now, facing accusations of false advertising and potential fraud, angry investors have every reason to initiate civil lawsuits based on MiCA provisions.

The bad news is, as revealed in chat screenshots by a KOL, team members appear to be from Iran.

The Hyperliquid ecosystem is known for its strong community cohesion, but this atmosphere of abundant trust also provides fertile ground for scammers to thrive.