Original Author: Wall Street Insights

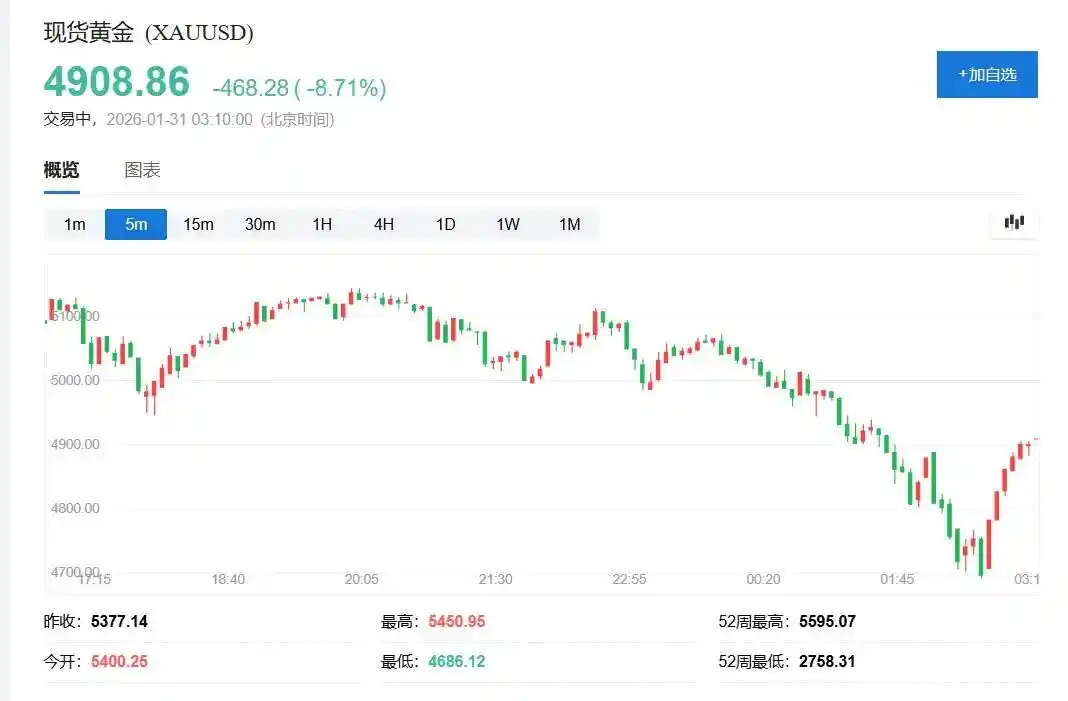

Gold and silver, which had both hit record intraday highs on Thursday, experienced a sharp decline. Gold turned lower early in the Asian session on Friday following news that Trump would nominate Warsh as Fed Chair, and had fallen below the $5,000/oz level during European trading. Losses accelerated during the US afternoon session, with spot gold at one point down nearly 13% intraday, its largest drop in over forty years since the early 1980s, exceeding the declines seen during the 2008 financial crisis.

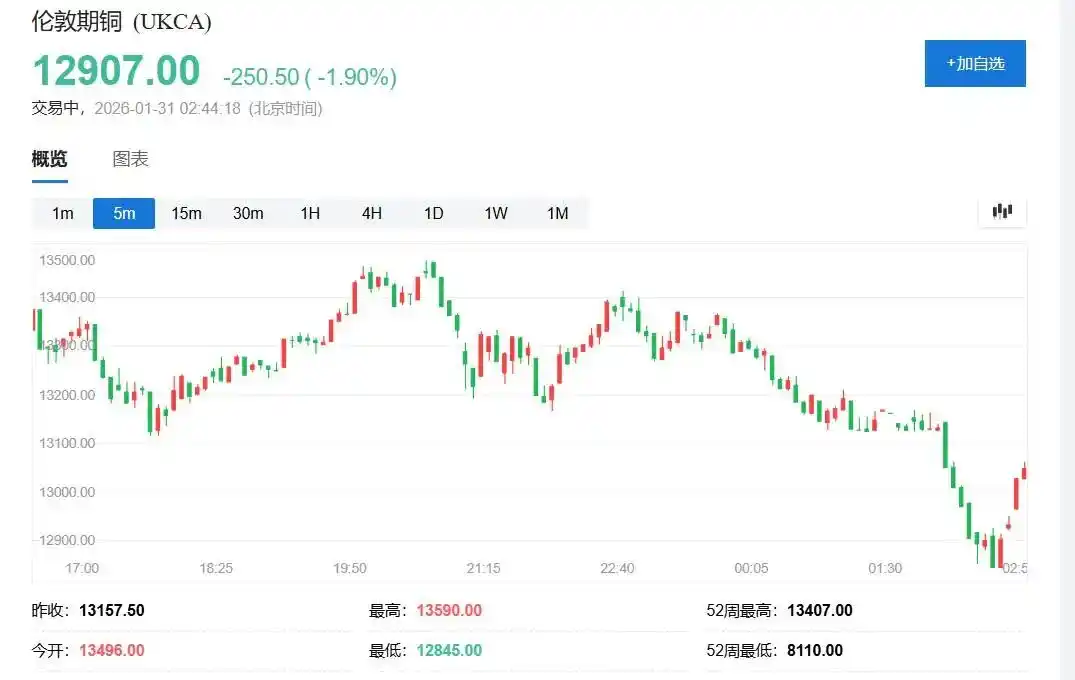

Silver, which broke above $120 for the first time ever on Thursday, fell below $100 during European trading on Friday and dropped below $80 during US session. Spot silver plummeted over 35% at one point, its largest recorded decline. This 'bloodbath' spread across the entire metals complex, with LME copper, which also hit a record high on Thursday, retreating nearly 6% at one point.

The market attributed the crash to a sharp shift in investor expectations regarding Fed policy.

Warsh has long been known for his hawkish stance, and although he recently publicly supported rate cuts to align with Trump, the market still believes he is unlikely to cut rates aggressively.

Commerzbank analyst Thu Lan Nguyen stated: "The market perceives Warsh as more hawkish than other candidates like Hassett." This expectation fueled a rebound in the US dollar, making dollar-denominated commodities less attractive to global buyers.

Warsh's nomination also alleviated market concerns about a loss of Fed independence.

Previously, investors flocked to precious metals for safety, partly due to fears of currency devaluation and concerns about Fed independence.

ING FX strategist Francesco Pesole said the choice of Warsh is "good news for the dollar, removing some concerns about a more dovish candidate."

The crash also exposed the extreme fragility of the precious metals market.

After the continuous surge in gold and silver prices recently, crowded long positions, record call option buying, and extreme leverage levels left the market in a state ripe for triggering a "gamma squeeze."

Pepperstone Senior Research Strategist Michael Brown stated: "The market was already very bubbly; it only took a small trigger to spark a move like this."

Historic Plunge for Gold and Silver

During the US afternoon session on Friday, the precious metals market staged a heart-stopping dive. The front-month NYMEX silver contract, after hitting a historic high of $121.785 on Thursday, fell below $80, touching $74 at one point, for an intraday drop of just over 35%. Spot silver fell below $74.60, down 35.5% on the day, its largest intraday decline on record.

Gold was also hit hard. NYMEX gold futures, which reached a historic high of $5,586.2 intraday on Thursday, fell to $4,714.5 during the US afternoon session on Friday, down nearly 12% on the day. Spot gold approached $4,670 during the US afternoon session, down over 12.7%.

By the close of COMEX floor trading, February gold futures settled down 11.37% at $4,713.9/oz, the largest single-day drop since January 22, 1980. February silver futures settled down 31.35% at $78.29/oz, the largest settlement decline since March 27, 1980.

Industrial metals were not spared. LME copper, which surged over 11% to a record high above $14,520 on Thursday, fell below $12,850 during Friday's session, down nearly 5.7% intraday, and settled about 3.4% lower at $13,158/ton. At the close, tin was down about 5.7%, while aluminum and nickel fell over 2%.

Fed Chair Pick Seen as Hawkish

The trigger for the market sell-off was the news of Warsh's nomination.

Reports emerged early in the Asian session on Friday that Trump would nominate Warsh as Fed Chair, and gold, which had set intraday record highs for nine consecutive sessions, immediately turned lower.

Before the US market open on Friday, Trump officially announced the nomination in a post on his social media platform, stating he has known Warsh for a long time, has no doubt he will rank among the great Fed Chairs, and might even be the best one.

Warsh was long known for his hawkish views but changed his tune last year, echoing Trump's calls for significant rate cuts, seen as key to his nomination.

Wall Street investors and strategists said Trump's choice of Warsh to lead the Fed is a relatively hawkish selection; he would likely resist balance sheet expansion, which would support the dollar and steepen the US Treasury yield curve.

Panmure Liberum analyst Tom Price said:

"The market sees Kevin Warsh as rational; he won't aggressively push for rate cuts. Those retail investors with various goals—like capital preservation—are taking profits."

Warsh's nomination fueled a major dollar rebound, with the currency posting its best single-day performance in six months since last July on Friday. The ICE US Dollar Index, which tracks the dollar against a basket of currencies, rose above 97.10 during the US afternoon session, up nearly 0.9% on the day. A stronger dollar makes dollar-denominated commodities less attractive to many global buyers and undermines theories that precious metals could replace the dollar as the global reserve currency.

Crowded Market Triggers "Stampede"

Although the Warsh nomination was the trigger for the sell-off, analysts widely believe technical factors amplified the decline.

Media reports suggest soaring prices and volatility had already put pressure on traders' risk models and balance sheets. A Goldman Sachs research note pointed out that the record wave of call option buying "mechanically reinforced the upward price momentum" because option sellers hedge their exposure by buying more futures.

Gold's decline may have been accelerated by a so-called "gamma squeeze." This refers to option dealers needing to buy more futures to keep their portfolios balanced when prices rise, and sell when prices fall.

For the SPDR Gold ETF, a large number of positions expiring on Friday were concentrated at $465 and $455, while a significant number of option positions on Comex for March and April were concentrated at $5300, $5200, and $5100.

Miller Tabak equity strategist Matt Maley said: "This is insane. Much of this is likely 'forced selling.' Silver has recently been the hottest asset for day traders and other short-term traders, so silver accumulated some leverage. With today's big drop, margin calls went out."

Pepperstone's Michael Brown noted, "Conditions in the metals market have been very bubbly for some time, and signs earlier this week suggested things were becoming completely disorderly." He stated that positioning in the gold and silver markets was "clearly extremely crowded on the long side, and volatility had increased to frankly absurd levels." In a market with such high volume and such stretched "leveraged longs," "it doesn't take much to trigger" a move like Friday's.

Brown said: "Simply put, everyone was rushing for the exit at the same time, forcing prices lower, which in turn triggered further forced selling," a reminder that "momentum works both ways."

Overseas-Chinese Banking Corp. strategist Christopher Wong said gold's move "validates the warning of 'fast up, fast down'." While the Warsh report was the trigger, he said a pullback was long overdue, "It's like one of those excuses the market was waiting for to unwind those parabolic moves."

Technical Indicators Had Warned Earlier

Before the crash, several technical indicators had flashed warning signals. The Relative Strength Index (RSI) had shown in recent weeks that gold and silver might be overbought and due for a pullback. Gold's RSI recently touched 90, its highest level for the precious metal in decades.

Heraeus Precious Metals trading head Dominik Sperzel said volatility was extremely extreme, and the psychological resistance levels of $5,000 and $100 were breached multiple times on Friday, "but we need to be prepared for the rollercoaster to continue."

Despite Friday's plunge, gold and silver still posted substantial gains for January. Based on the front-month contract settlement prices, NYMEX gold rose about 9% in January, and silver rose over 10%.

COMEX February gold futures gained 8.98% for January, the largest monthly gain in four months, marking six consecutive months of gains, the longest winning streak since October 2024. COMEX February silver futures gained 11.63% in January, rising for nine consecutive months, a record monthly winning streak. Over these nine months, they accumulated a gain of 140.66%, the largest nine-month gain since April 2011.

Commerzbank analysts wrote in a note on Friday that the extent of the pullback "suggests market participants were just waiting for an opportunity to take profits after the rapid price increases." The bank's head of commodity research, Thu Lan Nguyen, noted,

Although "the market perceives Warsh as more hawkish than other candidates like Hassett," "we still believe it is very likely that the Fed will yield to pressure to some extent and cut rates more than the market currently expects"

Mining Stocks Also Plunge

The precious metals crash dragged down shares of major mining companies. During Friday's session, US-listed gold mining giants Newmont (NEM), Barrick Gold (GOLD), and Agnico Eagle Mines (AEM) all fell over 10%, while Coeur Mining (CDE) dropped nearly 19% at one point.

Silver ETFs were hit even harder. During the session, ProShares Ultra Silver (AGQ) fell over 60% at one point, and iShares Silver Trust ETF (SLV) fell over 30% at one point, both funds recording their worst single-day performances on record. Gold ETFs also came under pressure.

Although mining stocks were battered on Friday, some analysts believe the pullback is healthy for the market. Amplify ETFs VP of Product Development Nate Miller said silver benefits from safe-haven and store-of-value demand, industrial demand, and global supply shortages, and some consolidation after such a sharp rally "is healthy and consistent with typical behavior in commodity markets following rapid price appreciation."

Zaner Metals VP and senior metals strategist Peter Grant said that while the rally did go too far too fast, it's not too late to buy metals. He called the drop below $100 an "opportunity," especially near the 20-day moving average around $93. However, "you have to be able to handle the volatility, which is likely to remain elevated."

Bloomberg Macro Strategist Simon White noted:

"The silver/gold (price) ratio had climbed almost as much as in the late 1970s, and today's dramatic move suggests this may mark a point of rejection. However, looking at gold and silver individually, they haven't yet fully matched the 1979 rally. It is too early to conclude whether silver relative to gold marks the end of the historic precious metals rally. Price is now becoming the main driver, with fundamentals temporarily taking a back seat."