Crypto wallet application Phantom has partnered with regulated prediction market Kalshi to bring event-based trading directly inside its wallet interface, signaling a deeper convergence between onchain finance and real-world outcome betting.

The companies said Friday that the integration would allow Phantom users to discover trending events, track live odds and place bets without leaving their wallets.

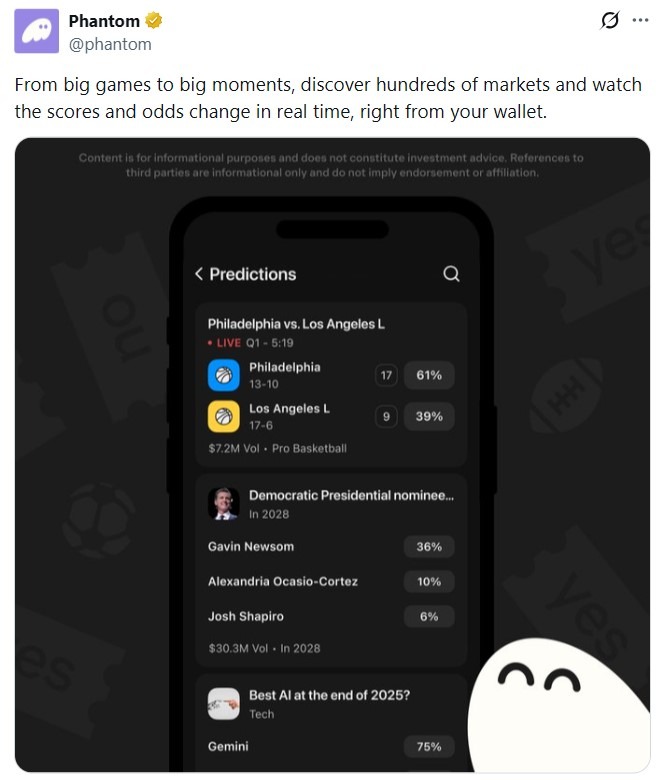

A new feature called Phantom Prediction Markets would allow users to trade tokenized positions that reference Kalshi’s event markets across politics, economics, sports and culture.

“By integrating a layer of tokenized positions referencing Kalshi’s regulated event markets with Phantom, users can trade what they care about in real time,” said Phantom CEO Brandon Millman.

Crypto exchanges eye US prediction markets

Phantom’s move comes as major crypto trading platforms race to enter the US prediction markets business.

On Thursday, Gemini Titan, an affiliate of the crypto exchange Gemini, received a designated contract market license from the US Commodity Futures Trading Commission (CFTC). Gemini said it plans to enter the prediction markets space.

The exchange said that it would allow users to access event contract trading on its web platform. Following its announcement, Gemini shares went up by nearly 14% in after-hours trading.

On Nov. 19, tech researcher Jane Manchun Wong, known for discovering in-development features on Big Tech websites, claimed that crypto exchange Coinbase is working on a prediction market. Wong shared screenshots apparently showing the unreleased platform.

Citing anonymous sources, Bloomberg reported that Coinbase plans to announce the launch of its prediction markets and tokenized equities.

A Coinbase spokesperson previously told Cointelegraph that they company will hold a livestream on Wednesday to showcase new products. However, the spokesperson did not mention prediction markets or tokenized stocks.

Related: Polymarket trading figures are being double-counted: Paradigm

Prediction markets face regulatory pushback

While prediction markets have gained popularity in the US, the state of Connecticut has recently taken a stance against certain platforms.

On Dec. 4, the Connecticut Department of Consumer Protection (DCP) sent cease and desist orders to Robinhood, Kalshi and Crypto.com, alleging that they were conducting unlicensed online gambling. However, Kalshi immediately took action a day later.

The prediction market platform sued the DCP, arguing that its event contracts are lawful under federal law.

Connecticut federal court judge Vernon Oliver stated in an order that the DCP must refrain from taking enforcement action against Kalshi. This temporarily stops the DCP’s cease and desist order against Kalshi.

Magazine: Koreans ‘pump’ alts after Upbit hack, China BTC mining surge: Asia Express