Author: Ma He, Foresight News

Original Title: 5 Major Data Indicators Revealed: Is There a BTC Buying Signal Below $75,000?

Wintermute stated last week that $85,000 is a key level for BTC and that a direction would be chosen soon. Unfortunately, the direction was not upward but sharply downward.

On February 2, BTC fell to $75,700, and ETH dropped to $2,220. Numerous altcoins continued to decline. Regarding liquidation data, Coinglass data shows that $435 million was liquidated in the past 12 hours, with long positions accounting for $324 million.

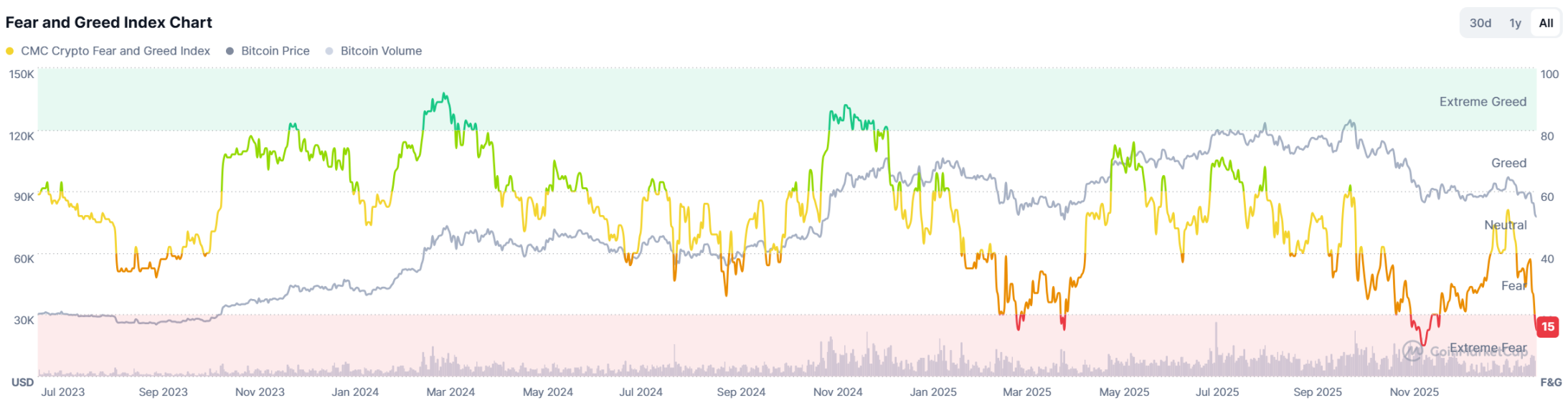

The market fear index is 15, indicating that market sentiment has once again fallen into extreme panic.

After the market turned bearish, where is BTC's bottom range? Five major data indicators reveal the answer.

Data Survey: 30% of Users Believe BTC's Bottom Range Is Between $60,000 and $75,000

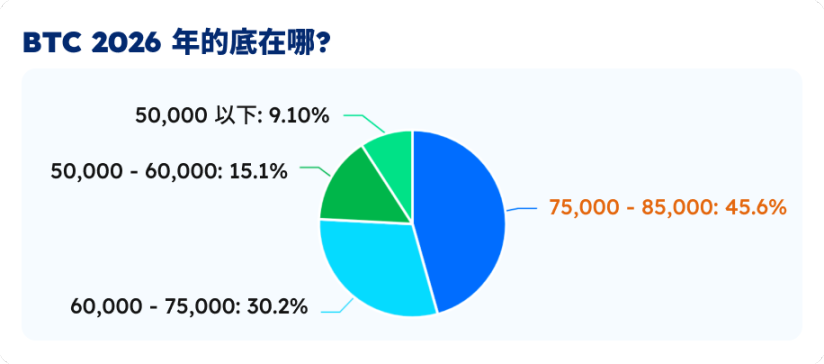

On January 30, Foresight News conducted an investor market confidence survey. At the time of the survey, BTC was priced at $84,000. It has since fallen significantly over the following days, so the survey results are for reference only.

The poll (with 1,189 participants) showed that most respondents (45.6%) believe BTC's bottom price in 2026 will be between $75,000 and $85,000. Another 30.2% of respondents believe the bottom price will be between $60,000 and $75,000.

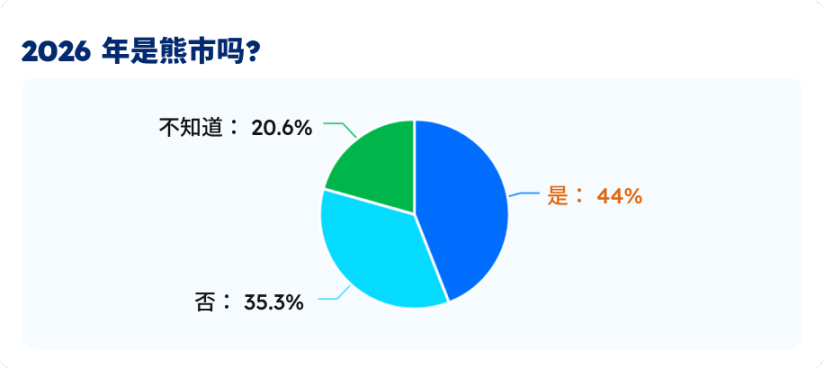

44% of respondents believe 2026 will be a bear market, while 35.3% disagree and do not think it will be a bear market. Another 20.6% of respondents are uncertain.

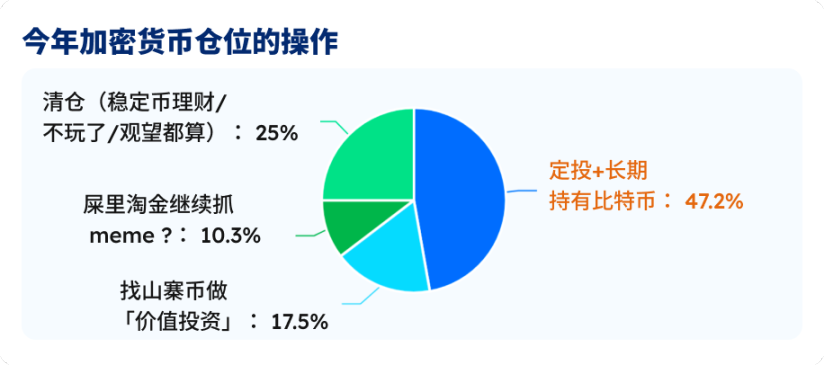

Nearly half of the respondents (47.2%) choose to dollar-cost average and hold Bitcoin long-term. Another 25% of respondents choose to liquidate their positions and switch to stablecoin investments or wait and see. 17.5% of respondents are looking for altcoins for value investing.

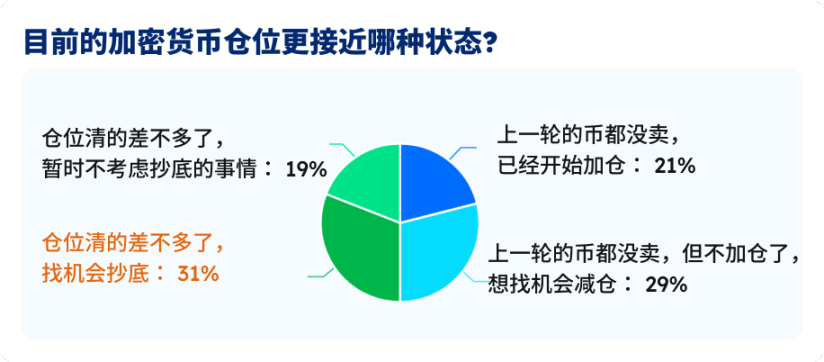

Currently, among the voting respondents, 31% say they have mostly cleared their positions but are still looking for opportunities to buy the dip. 29% say they haven't sold their holdings from the last cycle but are not adding positions for now and are looking for opportunities to reduce them. 21% say they haven't sold their holdings from the last cycle and have already started adding positions.

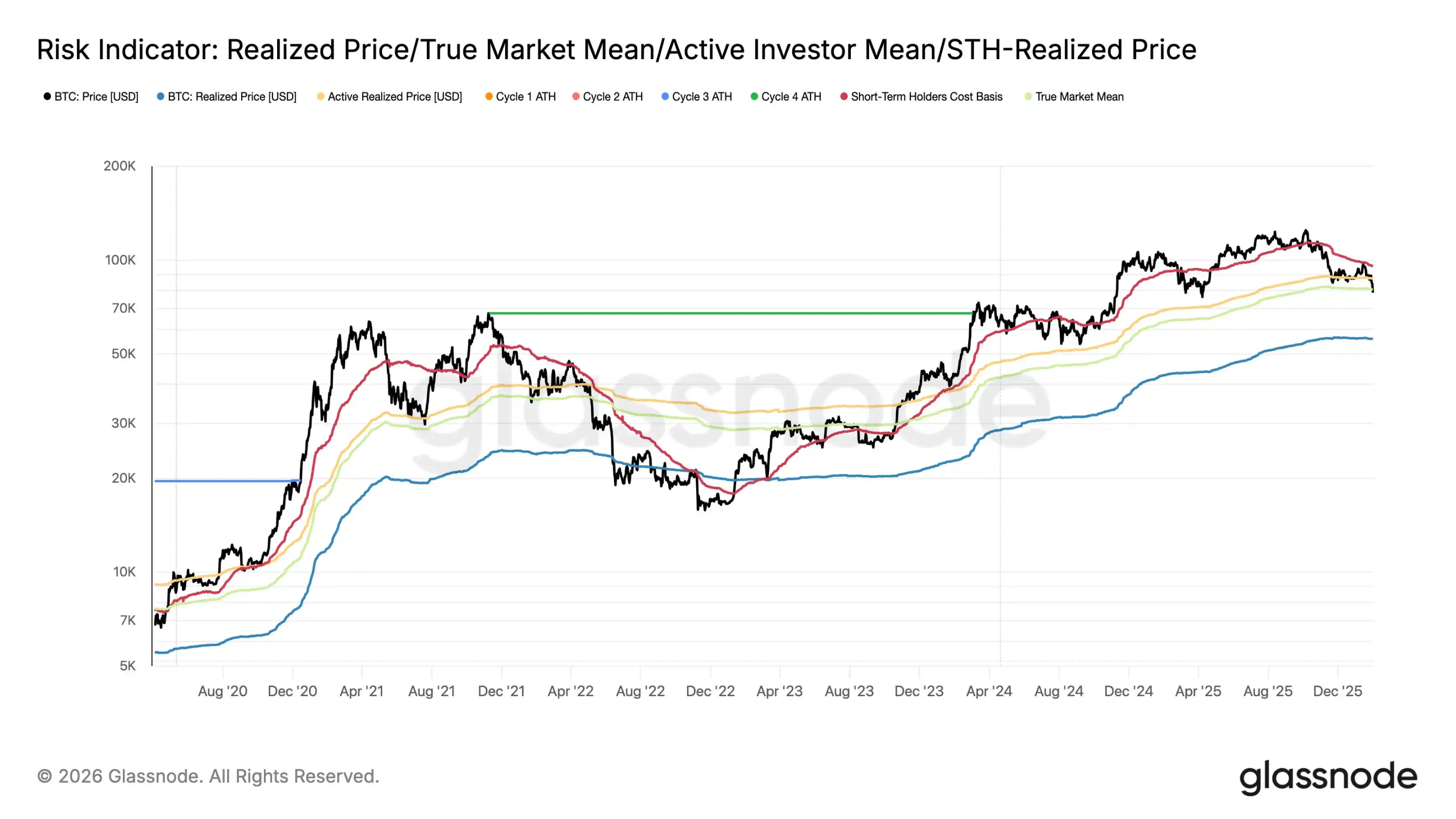

Glassnode Shows BTC's On-Chain Cost Basis Is $55,900

As Bitcoin falls below $78,000, Glassnode has updated the key on-chain price distribution as follows: The STH (Short-Term Holder) cost basis, reflecting the average holding price of new buyers/traders who entered the market in recent months, is $95,400.

The average investment of active investors, representing the average holding cost of traders currently "on the field," is $87,300; the Realized Price, focusing on the cost basis of actual traders in the secondary market, is $80,500. The Coin Price, representing the average cost basis of all coins across the entire network, is $55,900.

This means that when the BTC price is below $80,500, your purchase price is lower than the cost price of other recent traders. If BTC falls below $55,900, it means your purchase price is already below the average cost of the entire network.

In the 2022 cycle, the BTC price once fell below the entire network's average cost basis. In this cycle, influenced by macro liquidity, spot ETFs, and other factors, whether BTC will fall below $55,900 remains unknown.

Ahr999 Indicator Shows Accumulation Signal

The ahr999 indicator was invented years ago by Weibo user ahr999 to evaluate BTC's short-term returns and price deviations. The calculation formula is (Current Price / 200-day Dollar-Cost Average) × (Current Price / Exponential Growth Valuation), where the exponential growth valuation is based on a fitting curve of historical prices and block height, representing the long-term "fair value." Historical experience shows: ahr999 < 0.45 is the low-price buying zone; 0.45-1.2 is suitable for dollar-cost averaging; >1.2 is the high-price zone.

On February 1, 2026, ahr999 fell below 0.45 for the first time, the first occurrence in 839 days since October 16, 2023, marking a potential market bottom. The current break below the threshold suggests the BTC price is significantly below long-term growth expectations, similar to the end of the 2023 bear market. This signal strongly suggests buying the dip, but it needs to be confirmed with trading volume to avoid false breakouts. Buying strategy: If ahr999 stabilizes below 0.45, consider buying in batches below $76,000, and reduce positions when it rebounds above 1.2.

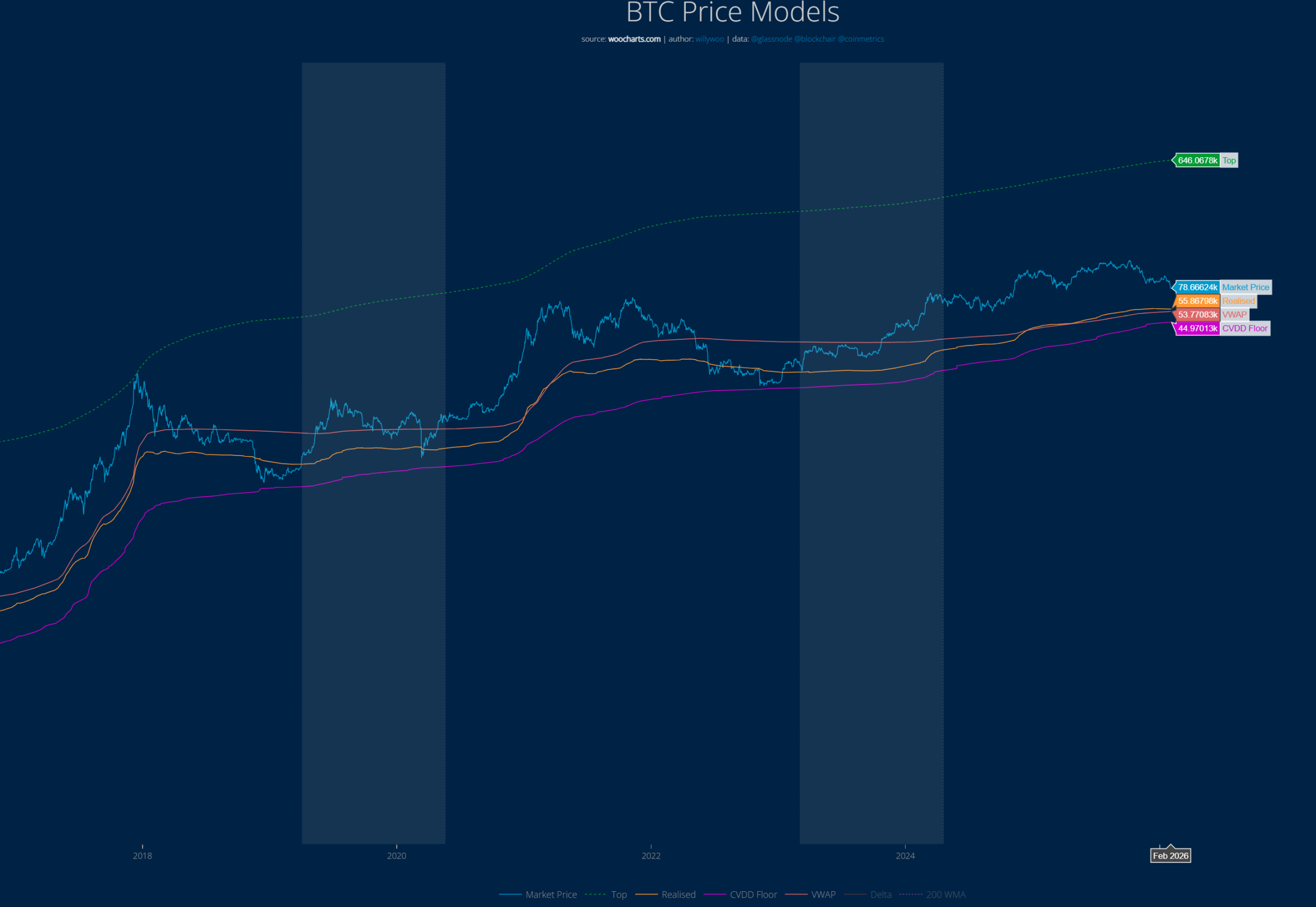

Willy Woo Indicator Shows BTC's Hard Bottom Is $45,000

The indicator developed by renowned analyst Willy Woo is the CVDD model. "When Bitcoin transfers from an old investor who bought at $1 to a new investor who buys at $100,000, the new investor will value these Bitcoins with a higher floor price, which helps raise the perceived floor price of the entire Bitcoin supply globally. Active custodian rotation (i.e., frequent transfers of Bitcoin between different investors or custodians) may also indicate that investors value these Bitcoins highly."

When many whales transfer BTC to new Bitcoin wallet addresses, the market's bottom price is rising.

The BTC price has never fallen to the red line (CVDD model). Currently, the CVDD indicator shows a hard bottom of approximately $45,000. In past cycles, BTC once fell below the yellow line in the chart, which currently ranges from $53,000 to $56,000.

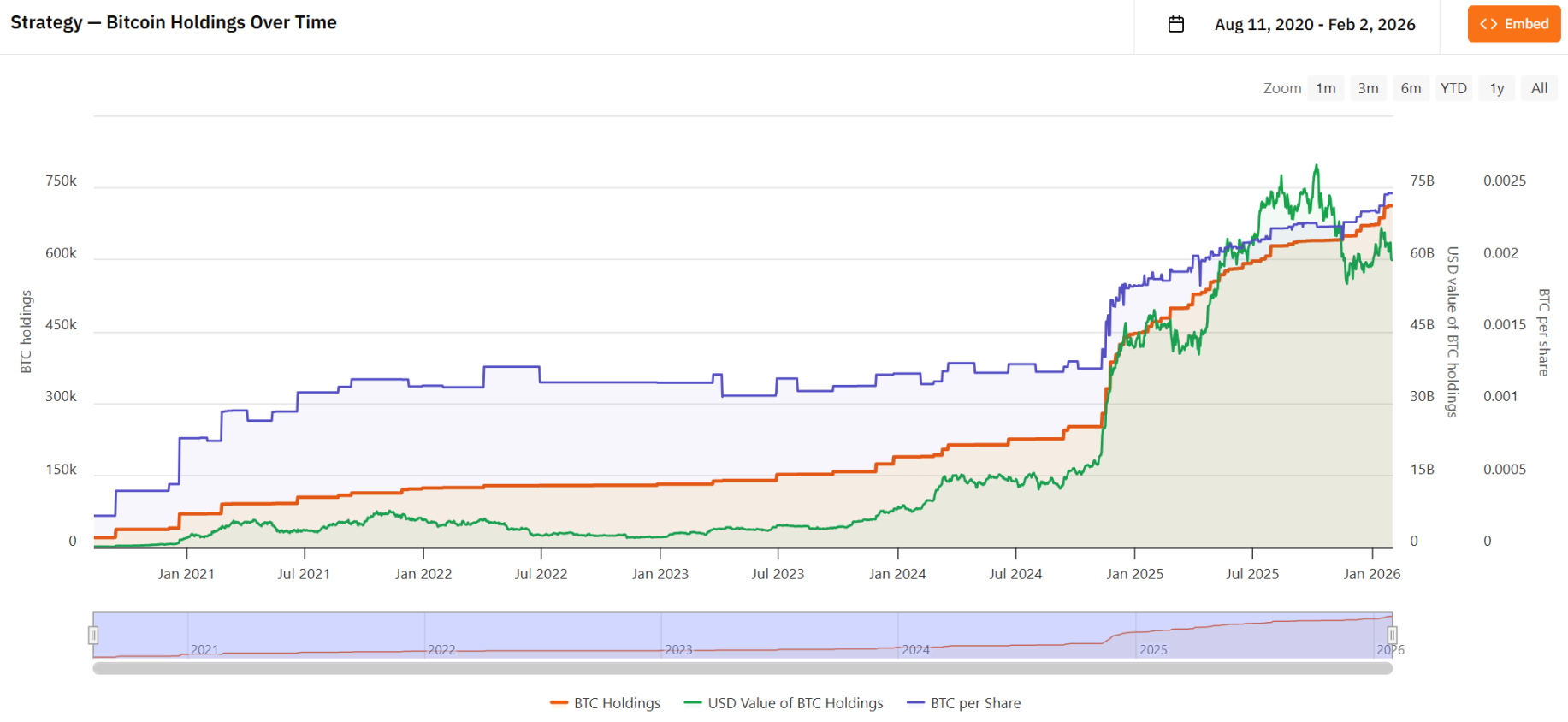

Strategy's Bitcoin Cost Price Is $76,040

As of February 2, the well-known Bitcoin accumulation大户 (large holder) Strategy holds a total value of approximately $54.2 billion, with 712,647 BTC. Their average holding cost is about $76,040.

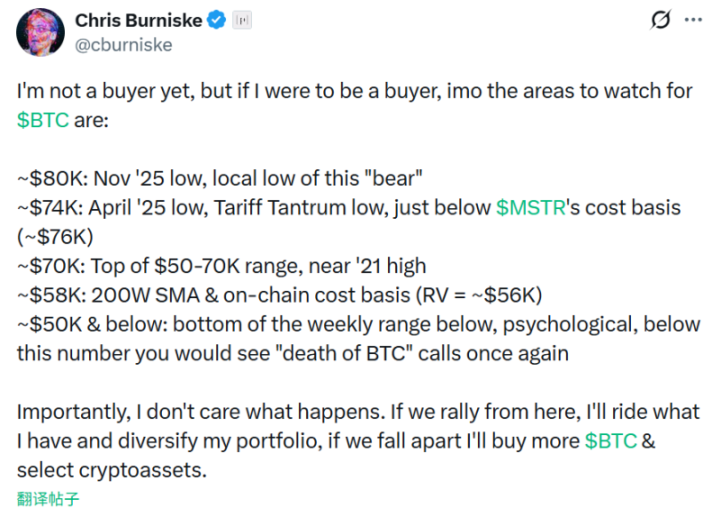

Historically, the area below this average cost has been the bottom range. Placeholder partner Chris previously stated that the $74,000 to $76,000 range is a price line worth paying close attention to.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush