文章来源:公众号佩佩梭哈

加密货币市场在过去 24 小时内下跌 1.18%,延续了 4.97% 的周跌幅。避险情绪、杠杆清算以及技术故障是导致市场下跌的原因。

- 清算压力——清算金额达 1.08 亿美元,ETH 面临 10 亿美元以上的清算门槛,接近 4,400 美元

- 避险情绪——比特币和黄金 ETF 同时出现资金流出,预示宏观不确定性

- 技术分析– 市值跌破关键斐波那契支撑位(3.8 万亿美元),RSI 为 42.6,表明势头疲软

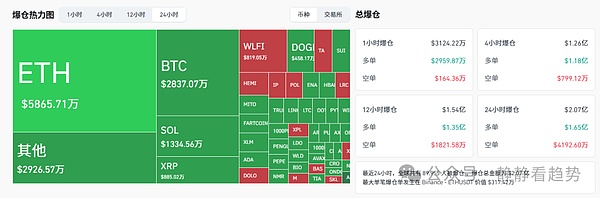

最近24小时,全球共有 89955人被爆仓,爆仓总金额为 $ 2.07 亿,其中空单爆仓 $ 4192.60万,多单爆仓 $1.65 亿。

以下是主要加密资产的最新行情与动态分析:

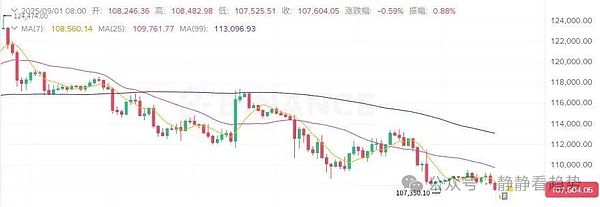

1.比特币(BTC)

比特币当前价格为 $107,504.05,过去24小时内下跌 1.10 %,近7天下跌 4.49 %。24小时成交量达 493.9 亿美元,流通供应量为 1,991 万 BTC,当前市值为 2.15 万亿美元。

2.以太坊(ETH)

以太坊当前价格为 $4,377.54,过去24小时内下跌 1.00 % ,近7日下跌7.18 %。24小时交易量为 267.3 亿美元,流通供应量为 1.207 亿ETH,总市值为 5302.7 亿美元。

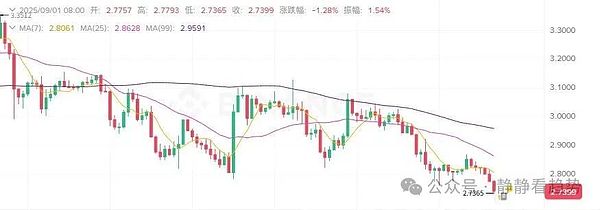

3.瑞波币(XRP)

XRP当前价格为 $2.7399,过去24小时下跌 3.44 %,近7日下跌 8.58 %。24小时交易量达到 38.8 亿美元,流通供应量为 1637.3 亿瑞波币,总市值为 1683.5 亿美元。

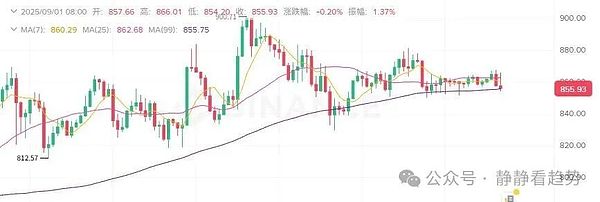

4.币安币(BNB)

BNB当前价格为$855.93,过去24小时下跌 0.12 %,7天内下跌 1.68 %。24小时交易量达到 18.5 亿美元,流通量为 1.3928 亿BNB,总市值为 1197.6 亿美元。

今日加密市场:

加密货币总市值:3.75万亿美元(▼1.41%)

24小时总交易量:1205.7亿美元(▲0.40%)

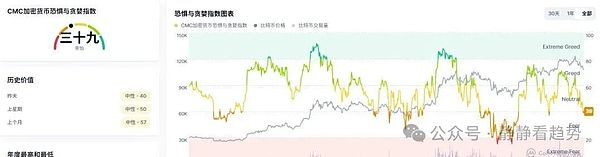

恐惧与贪婪指数

概述:截至 9 月 1 日,CMC 恐惧与贪婪指数从上周的 50(中性)降至 39/100(恐惧区间)。这反映出:- 7 天加密货币总市值下跌(-4.97% 至 3.75 万亿美元)- 衍生品交易活跃度下降(24 小时交易量下降 48.2%),现货与永续合约比率为 0.22

这意味着:这是中性看跌,因为持续的恐惧可能导致投降,但从历史上看,当与积极的催化剂相结合时,低于 40 的读数会先于反弹。

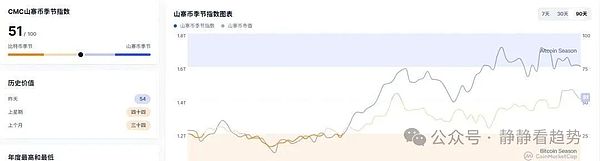

BTC 主导地位及山寨币季度指数

比特币的主导地位在 24 小时内下降了 0.06%,至 57.31%(上月为 61.25%),而山寨币季度指数下跌 5.56%,至 51/100,勉强进入“中性”区域。这反映出市场正在尝试转向山寨币,但缺乏整个山寨币季度常见的广泛动能。

这意味着:山寨币正在崛起,但缺乏成为决定性领导者所需的持续资本周转。

今日涨幅最大的币子

1.POL (prev. MATIC)(POL)

价格:US$0.2837,24小时上涨 10.39 %

2.BUILDon (B)

价格:US$0.7209,24小时上涨 4.60 %

3.KuCoin Token (KCS)

价格:US$14.60,24小时上涨 3.61 %

今日跌幅最大的币子

1.FOur (FORM)

价格:US$2.97,24小时下跌 21.24%

2.OKB (OKB)

价格:US$167.02,24小时下跌 8.67 %

3.Pyth Network (PYTH)

价格:US$0.1759,24小时下跌 8.38 %

其他主流币种表现

1.Solana(SOL)

价格:US$198.98,24 小时收益:-3.29%

2.USD Coin(USDC)

价格:US$0.9998,24 小时收益:0.00%

3.狗狗币(DOGE)

价格:US$0.2108,24 小时收益:-3.59%

4.波场(TRX)

价格:US$0.3383,24 小时收益:-0.68%

5.艾达币(ADA)

价格:US$0.8042,24 小时收益:-3.70%

6.Hyperliquid(HYPE)

价格:US$44.55,24 小时收益:-0.10%

7.恒星币(XLM)

价格:US$0.3475,24 小时收益:-4.63%

8.Sui(SUI)

价格:US$3.31,24 小时收益:-3.26%

9.Chainlink(LINK)

价格:US$23.11,24 小时收益:-2.70%

10.Hedera(HBAR)

价格:US$0.2143,24 小时收益:-5.93%

11.比特现金(BCH)

价格:US$535.81,24 小时收益:-3.02%

12.Avalanche(AVAX)

价格:US$23.21,24 小时收益:-3.26%

13.Shiba Inu(SHIB)

价格:US$0.00001206,24 小时收益:-3.23%

14.莱特币(LTC)

价格:US$107.95,24 小时收益:-3.24%

15.LEO Token(LEO)

价格:US$9.62,24 小时收益:0.38%

16.Toncoin (TON)

价格:US$3.12,24 小时收益:-0.53%