Regulatory Crossroads: The United States, Europe, and the Future of Crypto Assets

The article "Regulatory Crossroads: The US, Europe, and the Future of Crypto Assets" examines the divergent regulatory paths shaping the cryptocurrency landscape. It begins by contrasting Bitcoin’s origins as a decentralized, anti-establishment innovation with its current status as a heavily industrialized, energy-intensive asset. The piece draws parallels between the unregulated pre-1933 US stock market and today's crypto space, arguing that a shift from a libertarian "wild west" to a compliant asset class is inevitable.

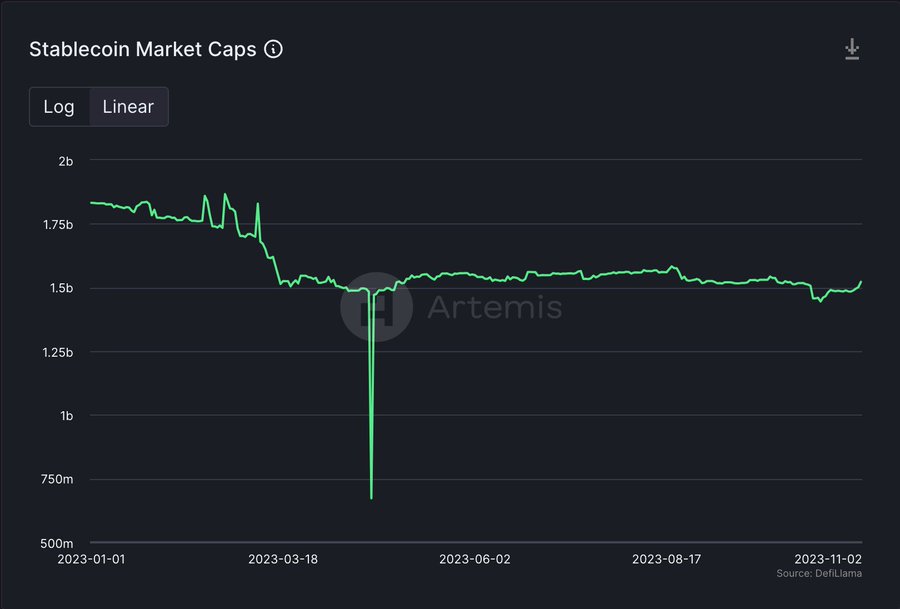

The US approach is portrayed as increasingly pragmatic and institutionally friendly. Key developments include the GENIUS Act, which mandates 1:1 Treasury backing for stablecoins, the repeal of restrictive accounting rules, and a perceived regulatory "regime change" at the SEC under Paul Atkins. This framework aims to integrate crypto into traditional finance, with major banks like JPMorgan now offering crypto-backed loans and the Treasury viewing stablecoins as tools for extending dollar hegemony.

In stark contrast, the EU’s Markets in Crypto-Assets (MiCA) regulation is criticized as a risk-averse, innovation-stifling "bureaucratic masterpiece." Its high compliance burdens, treatment of crypto founders like sovereign banks, and effective ban on non-euro stablecoins like USDT are seen as creating a "regulatory moat" that drives talent and startups to more favorable jurisdictions like Switzerland and the UAE.

The article concludes that the US is poised to become the dominant global crypto financial center by normalizing DeFi, while Europe risks becoming a "financial museum" due to its oppressive regulatory framework. It calls for urgent, decisive action to build a functional crypto industry that protects investors and allows for safe institutional capital entry before the window of opportunity closes.

深潮Há 7m