International credit rating agency Fitch Ratings has warned that it may reassess US banks with “significant” cryptocurrency exposure negatively.

In a report posted on Sunday, Fitch Ratings argued that while crypto integrations can boost fees, yields and efficiency, they also pose “reputational, liquidity, operational and compliance” risks for banks.

“Stablecoin issuance, deposit tokenization and blockchain technology use give banks opportunities to improve customer service. They also let banks leverage blockchain speed and efficiency in areas such as payments and smart contracts,” Fitch said, adding:

“However, we may negatively re-assess the business models or risk profiles of U.S. banks with concentrated digital asset exposures.”

Fitch stated that while regulatory advancements in the US are paving the way for a safer cryptocurrency industry, banks still face several challenges when dealing with cryptocurrencies.

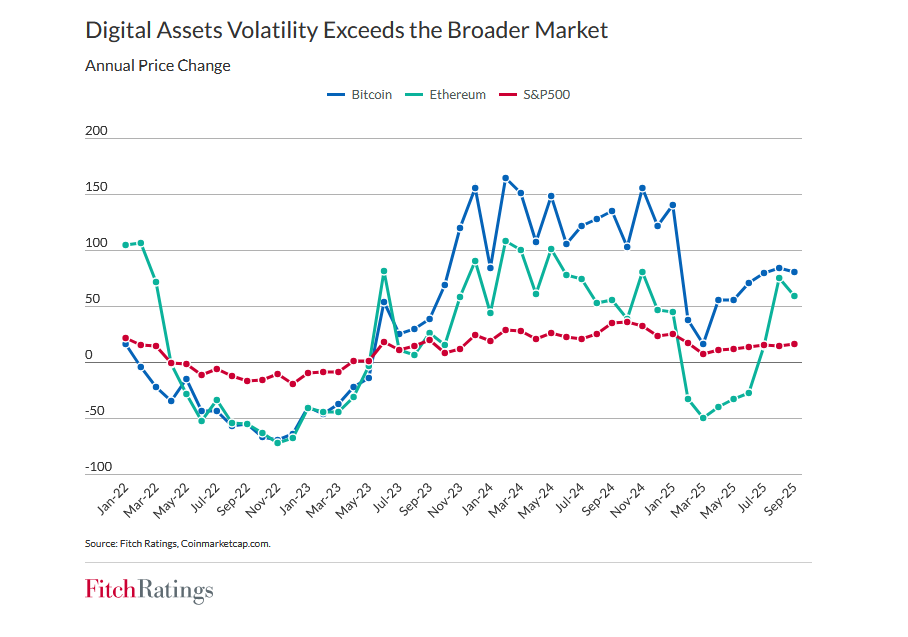

“However, banks would need to adequately address challenges around the volatility of cryptocurrency values, the pseudonymity of digital asset owners, and the protection of digital assets from loss or theft to adequately realize the earnings and franchise benefits,” said Fitch.

Fitch Ratings is one of the “Big Three” credit rating agencies in the US alongside Moody’s and S&P Global Ratings.

The ratings from these firms — which can be controversial — carry significant weight in the financial world and impact how businesses are perceived or invested in from an economic viability perspective.

As such, Fitch’s downgrading the ratings of a bank with significant crypto exposure could result in lower investor confidence, higher borrowing costs and challenges to growth.

The report highlighted that several major banks, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are involved in the crypto sector.

Fitch highlights systemic stablecoin risks

Fitch argued that another risk could come from the explosive growth of the stablecoin market, especially if it becomes large enough to influence other areas and institutions.

“Financial system risks could also increase if adoption of stablecoins expands, particularly if it reaches a level sufficient to influence the Treasury market.”

Related: Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?

Moody’s also recently highlighted potential systemic risks of stablecoins in a report from late September, arguing that widespread adoption of stablecoins in the US could ultimately threaten the legitimacy of US dollar.

“High penetration of USD-linked stablecoins in particular can weaken monetary transmission, especially where pricing and settlement increasingly occur outside the domestic currency,” Moody’s said.

“This creates cryptoization pressures analogous to unofficial dollarization, but with greater opacity and less regulatory visibility,” it added.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice