Crypto and Traditional Finance Sentiment Improves: Can Bitcoin (BTC) Traders Sweep Shorts Above $93,000?

The improvement in sentiment among retail crypto and traditional finance investors aligns with Bitcoin's recent upward price movement, but sell orders and short positions in the $93,000 region are suppressing the rebound.

Over the past two weeks, as retail investor sentiment improved, fund managers reiterated their bullish expectations for potential year-end market conditions, and Strategy announced a substantial purchase, Bitcoin's price has revisited the $90,000 range multiple times.

According to Matthew Sigel, Head of Digital Asset Research at VanEck, Bernstein wrote: "Bitcoin's cycle has broken the 4-year pattern (peaking every 4 years) and is now in an extended bull cycle, with more resilient institutional buying offsetting any panic selling by retail investors."

Bernstein commented after Berkshire Hathaway Chairman and CEO Larry Fink mentioned that sovereign wealth funds are "gradually" buying Bitcoin because it has "fallen back from its $126,000 peak."

Fink said,

"I know they bought more in the 80s. They are building a longer-term position. You hold it for years. This is not a trade. You hold it for a purpose, but the market is skewed, the leverage is high, which is why you get more volatility."

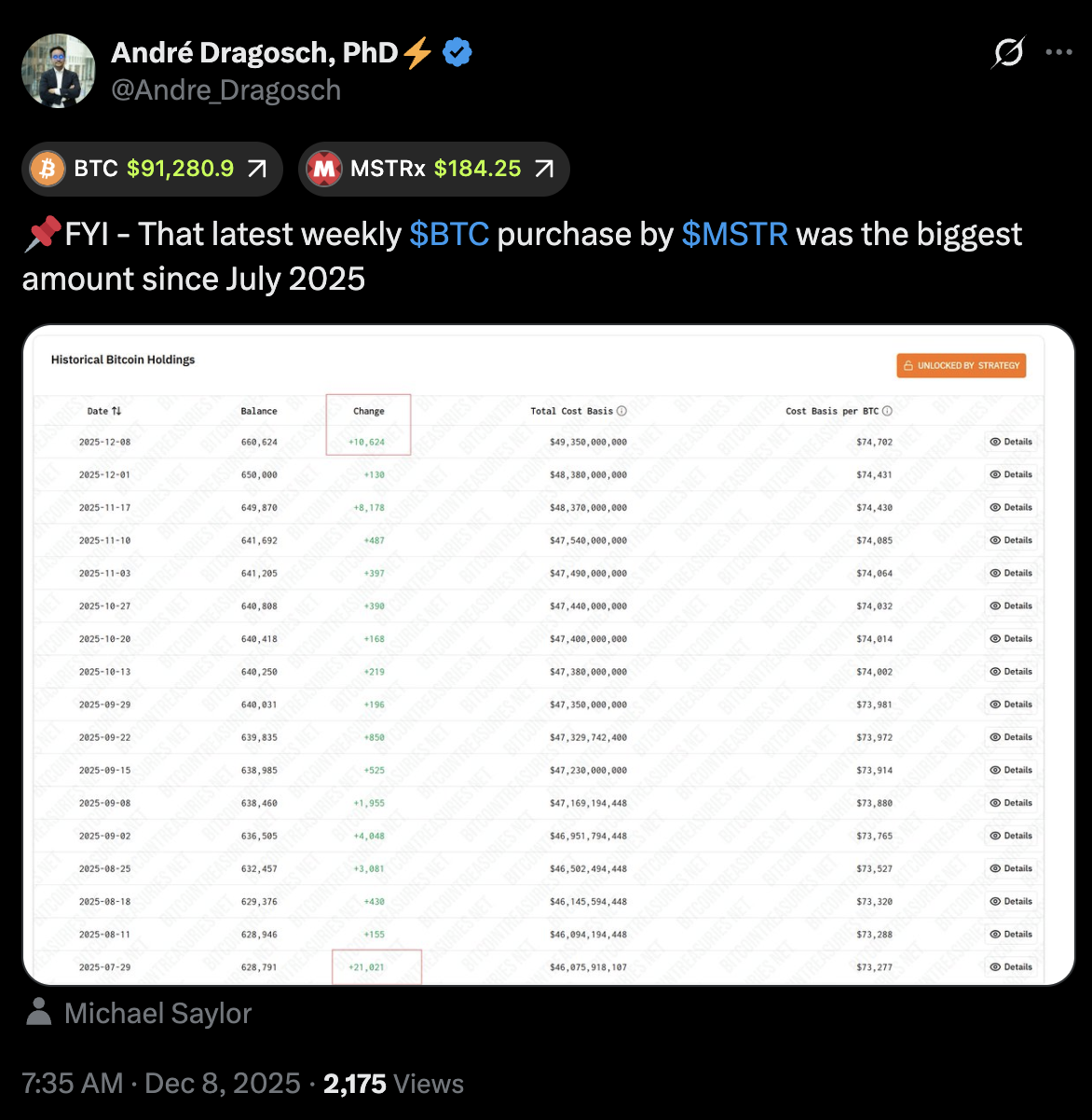

Reflecting Fink and Bernstein's views, on Monday, Strategy announced the purchase of 10,624 Bitcoin ($962.7 million) at an average price of $90,615 per coin. Andre Dragosch, Head of European Research at Bitwise, pointed out that Strategy's purchase "is the largest amount since July 2025."

Although Bitcoin has warmed up from the low of $80,612 on November 21, the price is still confined between $90,000 and $93,000. On Saturday, technical analyst Aksel Kibar stated,

"This is part of the volatile price behavior where BTC/USD may be trying to find a bottom. Technical support is lower, between $73,700 and $76,500. A short-term double bottom formed over several months between March and May."

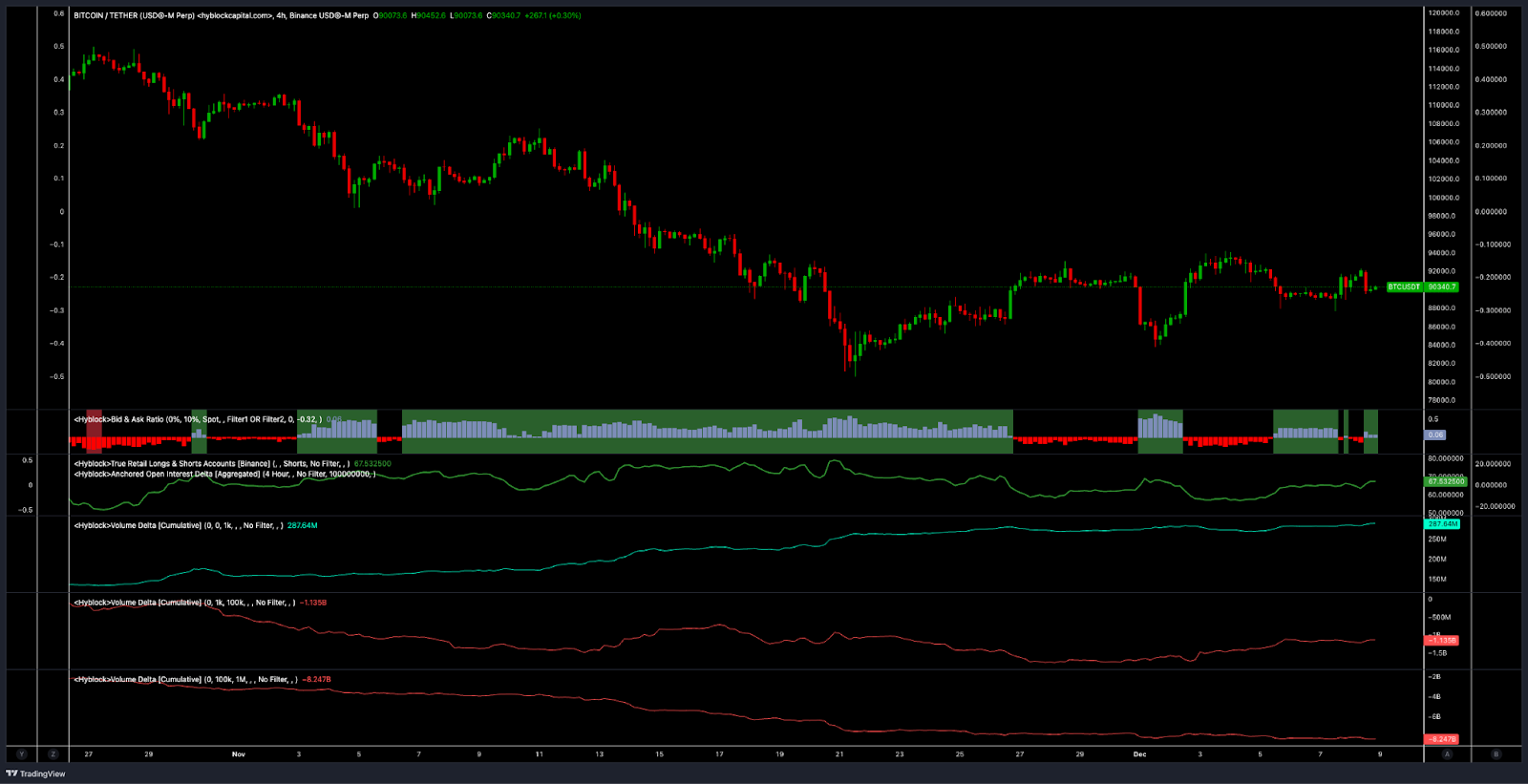

Cumulative volume delta data from Hyblock shows a more detailed perspective, highlighting an increase in participation from investors in the 0 to 100 Bitcoin trading group, which some analysts mark as retail. Groups with larger trading volumes (1,000 to 100,000 and 100,000 to 1 million cumulative volume delta) appear to be selling during the rebound from $90,000 to $93,000.

Similarly, order book data for BTC/USDT (Binance perpetual contract) shows a wall of sell orders starting from $90,000, thickening between $94,000 and $95,000.

On the other hand, liquidation heatmap data shows short liquidity between $94,000 and $95,300, which could provide fuel for bulls if the market provides enough catalyst to trigger a rise in spot or futures buying, potentially attempting to冲击 $100,000.

Related Recommendation: Paradigm: Polymarket Trading Data Double-Counted

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any loss or damage resulting from reliance on this information.