Bitcoin (BTC) climbed 14.50% from its recent lows at $80,600, inching back toward $93,000 as traders are at odds between a “comeback” by the bulls or the start of a bear market.

Key takeaways:

Analysts say Bitcoin’s rebound is a bull trap, with risks extending to as low as $40,000.

Google Trends suggests a rally toward $97,000 before the correction continues.

Among those leaning bearish is CryptoBirb, who remained unconvinced, arguing that the current and upcoming Bitcoin price “rallies are for selling,” not signals of a renewed push toward widely cited year-end targets of $150,000 and beyond.

Bear flag hints at a 16% BTC price dip next

The top arguments in favor of a Bitcoin bull trap mentioned a classic technical pattern dubbed the “bear flag,” a structure that, during downtrends, typically resolves with another leg lower.

Mister Crypto, Celeb Franzen, and several other analysts highlighted the bearish continuation pattern during Bitcoin’s recovery, with some noting that the BTC price can easily plunge toward $80,000.

A further examination of the bear flag revealed its technical downside target for December to be around $77,100, calculated by adding the previous downtrend’s height to a potential breakdown point near the $88,000 support.

That is down about 16% from the current price levels.

Bitcoin can crash to $40,000 if 2021 fractal repeats

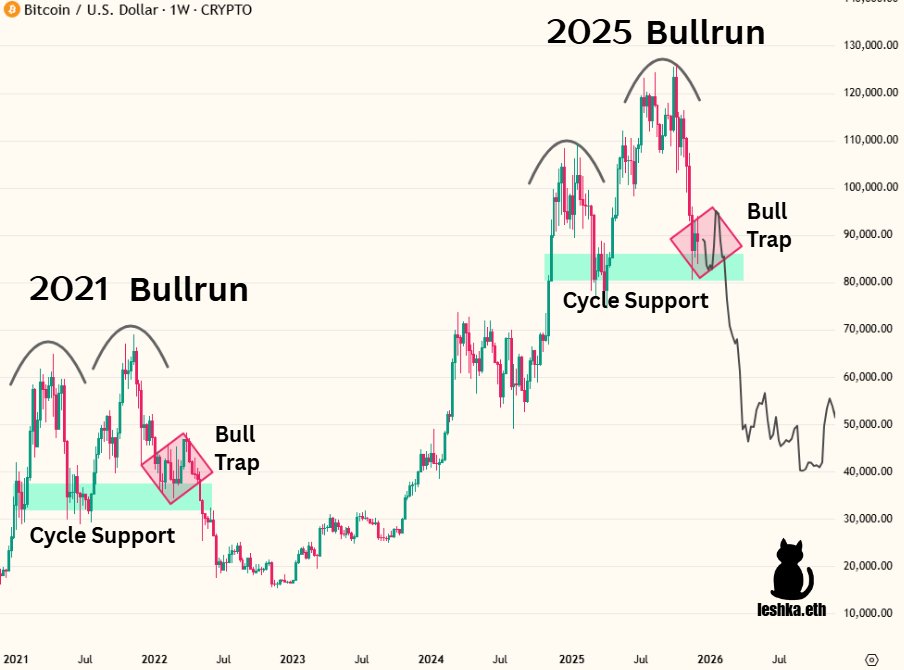

Bitcoin’s current structure mirrors the 2021 cycle almost “exactly,” according to analyst Leshka.

He shared a BTC fractal that consisted of a repeating double-top formation, a sharp breakdown into cycle support, and a deceptive rebound that ultimately formed a bull trap before a more resounding crash.

In the 2021 analogue, that trap preceded a prolonged decline that cut BTC’s value in half. The 2025 fractal showed a nearly identical setup, with the price hovering within the same support band before an expected breakdown.

Related: 5 market patterns that repeat every December

Leshka warned Bitcoin could revisit the $40,000 region in early 2026, a drop of more than 50% from current levels, if the pattern repeats.

Analyst Alex Wacy highlighted the same downside target, citing Bitcoin’s retreat from its multiyear ascending trendline resistance, which typically results in 70% drawdowns.

Bitcoin “crowd is terrified again,” per Google Trends

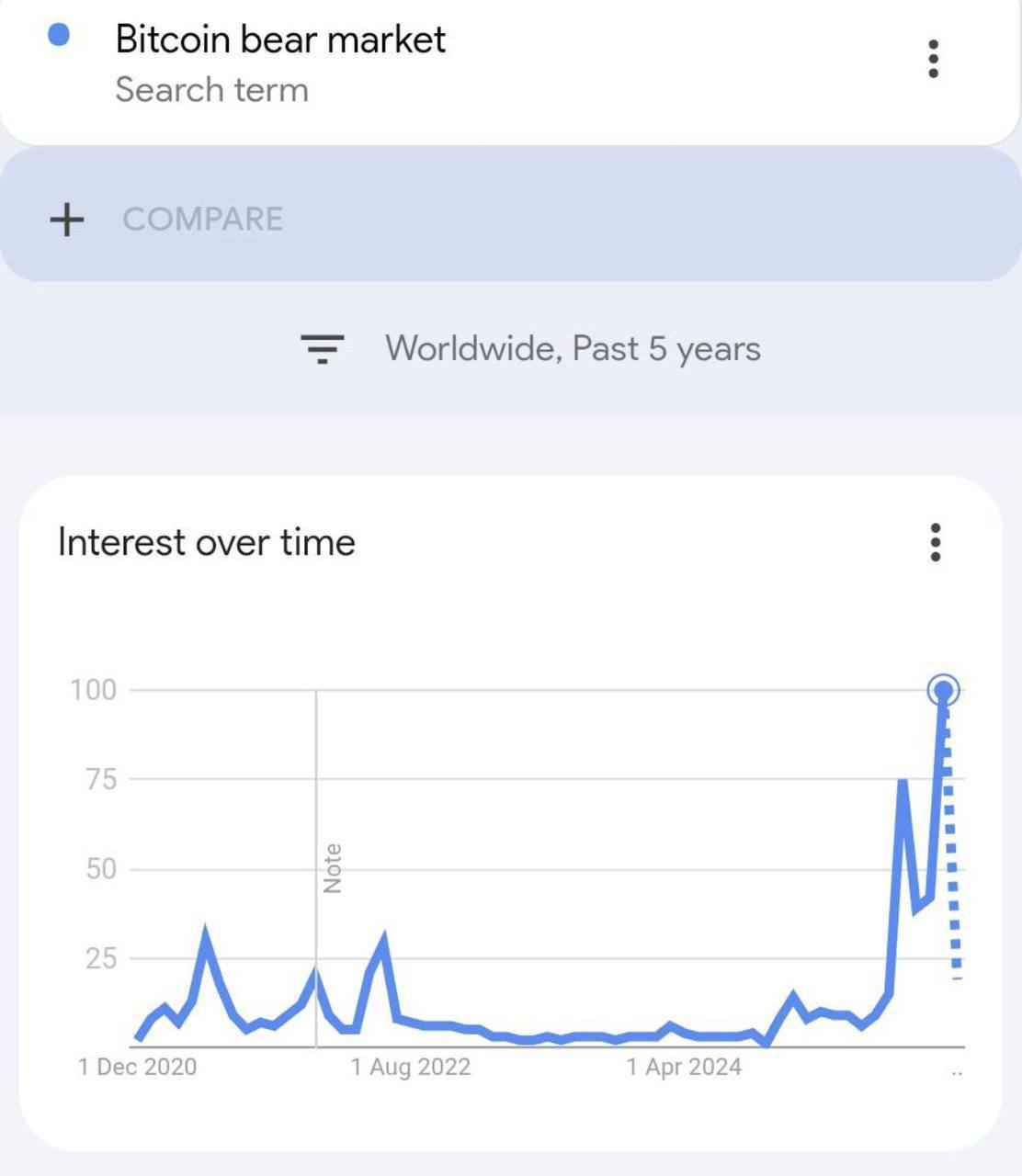

Last week, Google searches for “Bitcoin bear market” on a five-year time frame hit their highest level on record, as highlighted by analyst AndrewBTC in his Monday post on X, who said the BTC “crowd is terrified again.”

Historically, these fears appeared just ahead of BTC market selloffs.

For instance, in May 2021, when BTC hovered near $60,000 before a 50%-plus correction, and again in June 2022, around $26,000, as Bitcoin slid toward the then-cycle bottom of around $15,450.

A spike in the “Bitcoin bear market” Google search trend in August also followed a downturn in the BTC price.

Bitcoin could easily rally toward the $97,000 zone next, but only to trap bulls, AndrewBTC warned, adding:

“Everyone will think the bull run is back, but it isn’t and bear market starts.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.