以太坊价格八个月来首次突破4000美元 受国库快速增持及ETF资金流入推动

以太币价格自12月16日以来首次触及4000美元关口。此次上涨正值以太坊国库企业加速积累代币,且近几周ETF资金持续流入。

周五,以太坊原生资产以太币价格八个月来首次突破4000美元大关,在Coinbase交易所盘中最高触及4013.67美元后小幅回落。根据The Block的ETH价格页面数据,当前市值排名第二的加密货币过去24小时上涨3.8%,周涨幅达11.3%,月涨幅超过50%。其上次突破4000美元是在12月16日,当时最高触及4107美元。

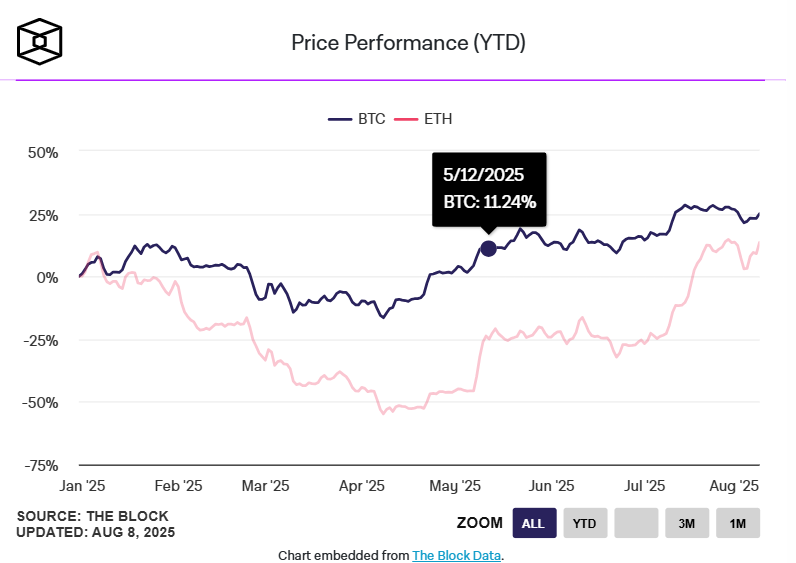

2025年大部分时间里,ETH相对于BTC表现疲软。在4月前总统唐纳德·特朗普宣布"解放日"关税政策后,ETH/BTC交易对一度跌至0.018的底部,较年初贬值50%。但自4月21日起,以太坊开启强势反弹周期,对比特币汇率累计上涨约90%。

不过,以太坊年内涨幅仍小幅落后于比特币(19.2% vs 25%),较2021年11月创下的4867美元历史高点仍有约18%的下跌空间。

以太坊国库公司快速增持与ETF资金流入激增

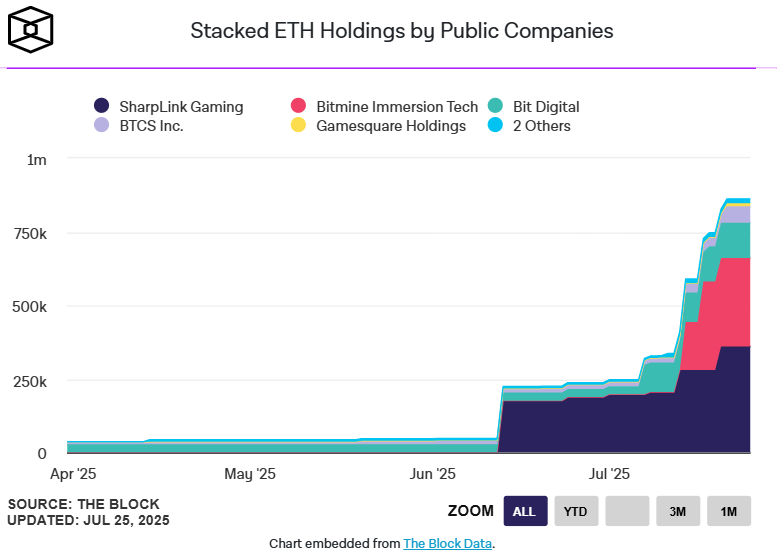

以太币价格的上涨,源于近期大量新兴以太坊国库公司筹集并购买了价值数十亿美元的ETH,模仿了比特币国库公司先驱迈克尔·塞勒(Michael Saylor)的策略,但这次是针对权益证明(PoS)加密货币。

根据The Block的以太坊国库持仓页面,由Tom Lee领导的BitMine目前以超过83.3万枚ETH(33亿美元)的持仓量位居榜首,其次是Joe Lubin的SharpLink,持有近52.2万枚ETH(21亿美元),而The Ether Machine则持有超过34.5万枚ETH(14亿美元)。

渣打银行的杰弗里·肯德里克(Geoffrey Kendrick)在近期报告中指出,以太坊国库公司“才刚刚起步”——未来可能将其持仓量提升至ETH总供应量的10%,即当前规模的10倍。

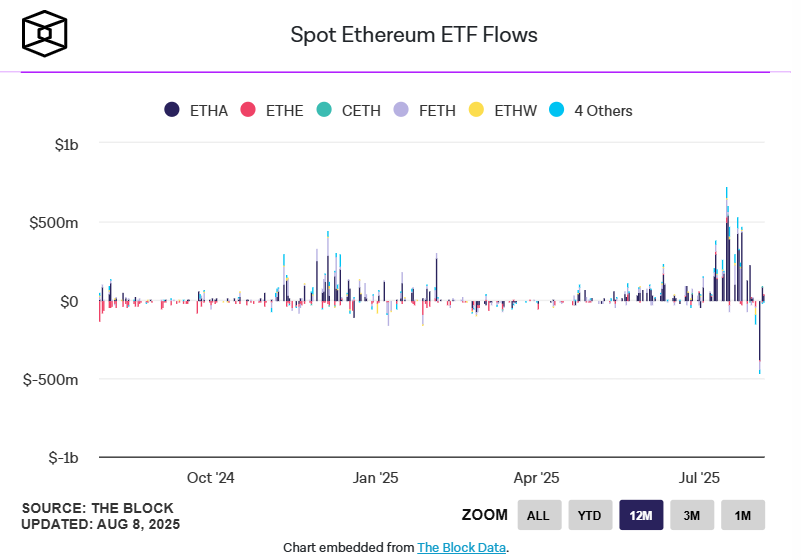

此外,美国现货以太坊ETF的净流入资金近几周也大幅增加,表现甚至优于比特币ETF。仅过去一个月,其净流入就接近50亿美元,而自2024年7月该产品开始交易以来,总净流入已达94亿美元。

另一个推动因素是,以太坊在周三创下了174万笔的日交易量历史新高,超越了2021年5月的前峰值。此前,该网络在7月刚刚经历了有史以来最繁忙的一个月,交易量超过4600万笔。

Kronos Research首席投资官Vincent Liu周四向The Block表示,以太坊激增的链上活动尚未完全反映在ETH价格中,而美国证券交易委员会(SEC)可能批准现货以太坊ETF增加质押功能,将成为下一个潜在催化剂。