2025 In-Depth Crypto Market Report: Review of Institutions, Stablecoins & Regulation in 2025 and 2026 Outlook

I. Institutions as Marginal Buyers: Lower Volatility But Higher Rate Sensitivity

In the early development period of the crypto market, price action and market rhythm were almost entirely driven by retail traders, short-term speculative capital and community sentiment. The market exhibited extreme sensitivity to social media hype, narrative shifts, and on-chain activity. Such a pricing mechanism driven by sentiment and narratives often summarized as “community beta”. Under this regime, upward moves of assets were rarely rooted in fundamental improvements or long-term capital allocation, but rather driven by rapid FOMO accumulation. Conversely, when expectations reversed, panic selling was exacerbated immediately by the absence of sustained capital support. This structure resulted in highly nonlinear price volatility for core assets like Bitcoin and Ethereum: Sharp rallies are followed by steep drawdowns, with cycles governed by sentiment rather than capital constraints. Retail participants were both the primary actors and key amplifiers of volatility, and traded based on short-term price moves rather than risk-adjusted returns, leaving the crypto market in a state of high volatility, high correlation and low stability.

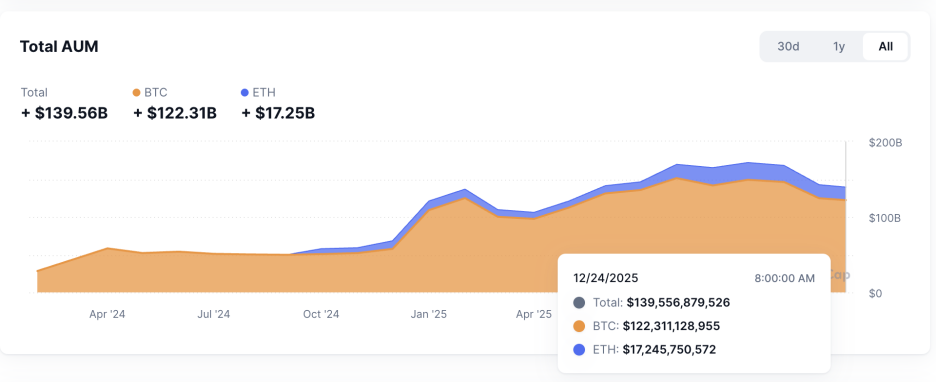

However, from 2024 into 2025, this long-standing market structure underwent a fundamental shift, as demonstrated by detailed ETF AUM figures presented in the chart. With the sequential approval and successful operation of U.S. spot Bitcoin ETFs, crypto assets gained their first regulated conduits for large-scale institutional capital allocation. Unlike previous “sub-optimal” paths via trusts, futures, or on-chain custody, ETFs, by leveraging their standardized, transparent, and regulated nature, significantly lowered operational and compliance costs for institutions to enter the crypto market. By 2025, institutional capital was no longer merely “testing the waters” but consistently accumulating positions via ETFs, regulated custodial solutions and asset management products, evolving into marginal buyers in the market. This change was not about sheer capital size, but about the nature of the capital: The new market demand shifted from being driven by retail sentiment to be led by institutional investors that prioritize governed asset allocation and risk budgeting. A shift in the marginal buyer leads to a corresponding transformation in the market’s pricing mechanism. Institutional capital is primarily characterized by lower turnover and longer holding periods. Unlike retail actors driven by short-term price fluctuations and narrative signals, pensions, sovereign wealth funds, family offices and large hedge funds base decisions on medium-to-long-term portfolio performance, requiring investment committee deliberation, risk oversight and compliance review to make allocation decisions. This decision-making mechanism inherently curbs impulsive trading and leads to position adjustments that are more characteristic of gradual rebalancing rather than sentiment‑driven momentum chasing and panic selling. As institutional participation increased, the share of high-frequency, short-term trading diminished, and price action increasingly reflected capital allocation directions rather than instantaneous sentiment shifts. This transition was directly manifested in volatility structures: Although prices still responded to macro and systemic events, extreme short-term swings driven by sentiment were markedly reduced, especially in deep liquidity assets like Bitcoin and Ethereum, reflecting a “static orderliness” more akin to traditional assets in the overall market where price movements no longer hinge entirely on narrative‑driven leaps but are progressively reverting to dynamics constrained by capital.

Simultaneously, institutional capital’s second defining feature, heightened sensitivity to macro variables, emerged distinctly. Institutional investment is centered on optimizing risk-adjusted returns rather than maximizing absolute gains, meaning asset allocation decisions are deeply influenced by the broader macro environment. In traditional finance, interest rates, liquidity conditions, risk preferences and cross-asset arbitrage conditions are core inputs for institutions adjusting positions. When this framework entered the crypto market, crypto prices began to exhibit stronger linkages with macro signals. The 2025 market landscape clearly demonstrated that changes in interest rate expectations more significantly affected Bitcoin and overall crypto assets. When major central banks, particularly the Federal Reserve, adjusted their policy rate paths, institutions reevaluated crypto allocations based on opportunity cost and portfolio risk, rather than shifts in narrative confidence.

Overall, the transition of institutions to marginal buyers in 2025 marked crypto’s evolution from a “narrative-driven, sentiment-priced” regime to one of “liquidity-driven, macro-priced” dynamics. Lower volatility did not imply risk elimination but a migration of risk sources from internal sentiment shocks to heightened sensitivity to macro rates, liquidity and risk appetite. For 2026 research, this shift carries methodological significance. Analytical frameworks must expand beyond on-chain indicators and narratives to systemic study of capital structure, institutional constraints and macro transmission pathways. The crypto market is increasingly integrated into global asset allocation frameworks, with prices no longer simply answering “what story the market is telling” but reflecting more “how capital is allocating risk”. This shift stands as one of the most profound structural changes of 2025.

II. Maturation of the On-Chain Dollar System: Stablecoins Transitioning into Infrastructure and RWAs Bringing Yield Curves On-Chain

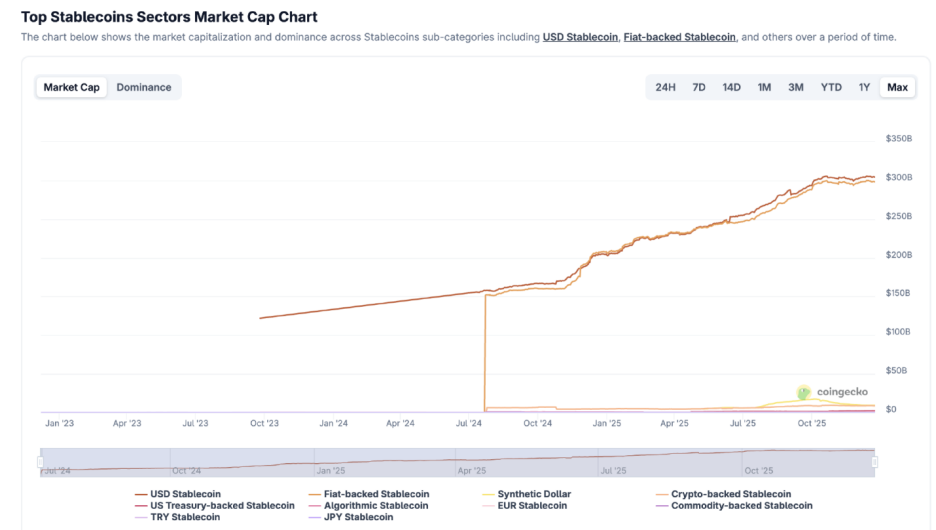

If institutional capital’s large-scale entry answered “who is buying crypto assets”, the maturation of stablecoins and tokenization of real-world assets (RWAs) further answered the more fundamental questions — “what to buy, how to settle, and where returns come from”. At this level, the crypto market in 2025 completed a critical leap from “crypto-native financial experimentation” to an “on-chain dollar financial system”. Stablecoins evolved beyond trading media or hedging instruments to become the settlement and valuation foundation of the entire on-chain economic system. Concurrently, on-chain U.S. Treasuries, represented by RWAs, began to scale materially, endowing the chain with sustainable, auditable low-risk return anchors, and fundamentally altering DeFi’s yield structure and risk pricing logic.

Functionally, stablecoins in 2025 indisputably became the core infrastructure of on-chain finance. Their role has long moved beyond that of “price-stable trading tokens” to fully assume multiple functions: cross-border settlement, trading pair denomination, DeFi liquidity hubs, and institutional capital on- and off-ramps. Across centralized exchanges, decentralized protocols, RWAs, derivatives and payments, stablecoins formed the underlying axis of capital flows. On-chain transaction volume data clearly shows that stablecoins have become a significant extension of the global dollar system, with annualized on-chain transaction volumes reaching tens of trillions of dollars, significantly exceeding those of most individual national payment systems. This indicates that in 2025, blockchains truly served as “functional dollar networks”, rather than mere adjuncts to high-risk asset trading. Moreover, widespread adoption of stablecoins transformed risk structures of on-chain finance. With stablecoins becoming the default unit of account, market participants could trade, borrow, lend and allocate assets without direct exposure to crypto price volatility, significantly lowering participation thresholds. This feature was especially crucial for institutional capital. That's because institutions seeks predictable cash flows and risk-controlled returns rather than high-volatility crypto gains. The maturity of stablecoins enabled institutions to maintain “dollar-denominated” exposure on-chain without traditional crypto price risk, laying the groundwork for expanded RWAs and yield products.

Within this context, RWAs, particularly the scaled deployment of on-chain U.S. Treasuries, became one of the most structurally significant developments of 2025. Unlike earlier initiatives focused on “synthetic assets” or “yield mapping”, RWA projects in 2025 began bringing traditional financial assets on-chain in forms that closely resembled conventional issuance. On-chain Treasuries were no longer conceptual narratives, but existed as auditable, traceable and composable instruments with transparent cash flows and well-defined maturities that directly linked to traditional risk-free yield curves.

However, alongside the rapid expansion of stablecoins and RWAs in 2025, the on-chain dollar system also exposed its latent systemic vulnerabilities. Particularly, multiple de-pegging events and collapses in the yield-bearing and algorithmic stablecoin sectors sounded alarms. These failures were not isolated incidents but reflected a common structural problem: recursive re-staking implicit leverage, opaque collateral structures, and concentrated risks in a small set of protocols and strategies. When stablecoin reserves extended beyond short-term Treasuries or cash equivalents into complex DeFi strategies seeking higher yields, stability stemmed not from underlying assets but from the implicit assumption of continued market prosperity. When this assumption collapsed, de-pegging transitioned from technical fluctuation to systemic shock. The events of 2025 indicated that stablecoin risk lies not in “whether they are stable”, but in "whether its sources of stability are transparent and auditable". Yield-bearing stablecoins can temporarily offer significantly higher returns than risk-free rates, but these often rely on stacked leverage and liquidity mismatches, with risks insufficiently priced. When market participants regard these products as “cash equivalents”, risk becomes systemically amplified. This forced the market to reexamine stablecoin roles: Are they primarily payment and settlement tools or financial products embedded with high-risk strategies? This question was posed in real economic terms for the first time in 2025.

Therefore, looking toward 2026, research focus is no longer on “whether stablecoins and RWAs will continue to grow”. Trendwise, the expansion of the on-chain dollar system is nearly irreversible. The key issue will be “quality stratification”. Differences among stablecoins in collateral transparency, maturity structure, risk isolation, and regulatory compliance will be directly reflected in their capital costs and use cases. Similarly, differences in legal structures, clearing mechanisms and yield stability among various RWAs products will determine their eligibility for institutional asset allocations. It is foreseeable that the on-chain dollar system will evolve from a homogeneous market into one with clear tiering: High-transparency, low-risk, strongly compliant products will enjoy lower capital costs and broader adoption, while products relying on complex strategies and implicit leverage may become marginalized and even phased out. From a macro perspective, the maturation of stablecoins and RWAs embedded the crypto market into the global dollar financial system for the first time. The on-chain ecosystem became an extension of dollar liquidity, yield curves and asset allocation logic rather than a mere experiment for value transfer. This transition, reinforced by institutional capital entry and normalized regulation, jointly propelled the crypto industry from cyclical speculation to infrastructure-level development.

III. Regulatory Normalization: Compliance as a Moat Reshaping Valuation & Industry Structure

In 2025, global crypto regulation entered a stage of normalization, not through a single law or event, but via a fundamental shift in the industry’s “survival assumptions”. For years, the crypto market operated under highly uncertain regulatory conditions, with the core question not about growth or efficiency but “whether this industry is allowed to exist". Regulatory uncertainty was seen as a systemic risk; capital entering the market priced in an extra risk premium for potential compliance shocks, enforcement and policy reversals. In 2025, this long-outstanding issue was partially resolved for the first time. As major jurisdictions in Europe, the U.S. and the Asia-Pacific progressively formed clearer and enforceable regulatory frameworks, market focus shifted from “whether crypto can exist” to “how to expand scale under compliance”, profoundly impacting capital behavior, business models and asset pricing logic.

Regulatory clarity significantly lowered institutional entry barriers. For institutional capital, uncertainty itself is a cost, and regulatory ambiguity means unquantifiable tail risk. In 2025, as stablecoins, ETFs, custodial services and trading platforms were progressively brought into defined regulatory scopes, institutions could finally evaluate crypto risks and returns within existing compliance and risk-control frameworks. This did not mean regulation became lax, but predictable. Predictability itself is a prerequisite for capital scaling. Once regulatory boundaries were defined, institutions could absorb constraints through internal processes, legal structures and risk models without treating them as “uncontrollable variables”. As a result, more long-term capital systematically entered the market, deepening participation and enhancing allocation scale; and crypto assets were steadily incorporated into broader asset allocation frameworks. More significantly, the normalization of regulation has altered the competitive dynamics at both the corporate and protocol levels.

The profound influence of regulatory normalization lies in reshaping industry organization. With compliance requirements materializing across issuance, trading, custody and settlement, the crypto industry began to exhibit stronger centralization and platformization trends. More products were issued and distributed on regulated platforms, and trading activity also concentrated on licensed and compliant infrastructures. This trend did not signify the disappearance of decentralization ideals but the reorganization of “entry points” for capital formation and flow. Token issuance gradually evolved from unstructured peer-to-peer sales to standardized processes more akin to traditional capital markets and became a new form of “internet capital marketization”. In this system, issuance, disclosure, lock-ups, distribution and secondary liquidity are more tightly integrated, stabilizing participants’ risk and return expectations. This organizational shift directly influenced asset valuation methods. In prior cycles, crypto asset valuation heavily relied on narrative strength, user growth and TVL, with limited consideration for legal and regulatory factors. Entering 2026, with regulation becoming a quantifiable constraint, valuation models began incorporating new dimensions. Regulatory capital requirements, compliance costs, legal structure stability, reserve transparency and accessibility of compliant distribution channels increasingly influenced asset prices. In other words, markets began imposing “regulatory premiums” or “regulatory discounts” on different projects and platforms. Entities capable of operating efficiently within compliance frameworks and internalizing regulatory demands as operational advantages often secured lower capital costs while models reliant on regulatory arbitrage or ambiguity faced valuation compression and even marginalization.

IV. Conclusion

The turning point in the 2025 crypto market fundamentally involved three simultaneous changes: capital migrating from retail investors to institutions; assets transitioning from narratives to an on-chain dollar system (stablecoins + RWAs); and regulatory frameworks evolving from gray areas to normalized governance. These forces jointly pushed crypto from “high-volatility speculative assets” toward “modelable financial infrastructure”. Looking ahead to 2026, research and investment should center on three core variable sets: transmission strength of macro rates and liquidity to crypto; quality stratification of on-chain dollar liquidity and sustainability of real yields; and institutional moats formed by compliance costs and distribution capacity. In this new paradigm, winners will not be projects with the best narratives, but those capable of sustained expansion under capital, yield and regulatory constraints.