Despite recent fluctuations in the price of Ethereum, accumulation seems to be holding strong, which is observed in the Spot Ethereum Exchange-Traded Funds (ETFs). With more ETH leaving exchanges and ETFs stacking ETH, the leading altcoin could be poised for a crucial shift in market dynamics, which may be good for its price trajectory.

Smart Money Moves Quietly Via Ethereum Spot ETFs

The broader cryptocurrency market is shifting towards a bullish state once again, and the Ethereum institutional story is subtly transitioning into a new chapter. While price action remains relatively subdued, on-chain and fund flow data show a strong undercurrent as Spot Ethereum ETFs are steadily stacking.

According to Everstake.eth, the head of the Ethereum segment at Everstake, the ETH spot ETFs have been quietly increasing, reaching unprecedented levels. This silent accumulation raises the possibility that major companies are positioning themselves well ahead of the competition, creating long-term exposure while retail attention is still dispersed.

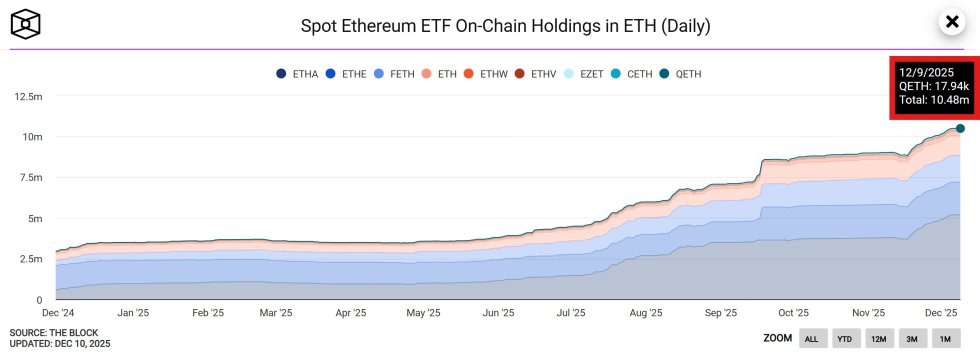

Data shared by the expert reveals that spot Ethereum ETF on-chain holdings have now reached approximately 10.48 million ETH. Everstake added that this is one of the strongest, most consistent accumulation trends ever recorded since the launch of the funds about a year ago.

Given the substantial growth of the funds, the expert has declared that “the future is bullish, and the future is Ethereum.” As ETF holdings rise to previously unheard-of levels, the question now is not whether smart money is going in, but rather what they anticipate.

The steady growth is not observed among other metrics, like the Funding Rates. Currently, the derivatives market for ETH is starting to cool, and funding rates are clearly reflecting this change. However, this is not entirely a bad thing for the altcoin and its price trajectory.

As reported by Sina Estavi, the Chief Executive Officer (CEO) of Bridge Capital, a declining ETH funding rate is not merely a sign of a cool market. Rather, it is the structure that typically appears on the chart prior to a sustained move.

When funding resets in the absence of aggressive shorting, it usually implies that leverage is not overcrowded, the rally is not overheated, and spot-driven demand can carry the price further. Should ETH register even a modest growth in demand, the market may have room to extend this bullish leg.

Institutional Demand For ETH Is Returning

Ethereum’s recent sideways price movements do not seem to have swayed institutions from acquiring the altcoin. Big firms such as Bitmine Immersion, a leading treasury company run by industry leader Tom Lee, are still scooping up ETH at a substantial rate and scale.

The report from Arkham shows that as of Tuesday, Bitmine has purchased over 138,452 ETH valued at approximately $431.97 million since last week. Following the purchase, the company’s crypto holdings now boost about $12.05 billion in ETH. Despite this massive holding of ETH, the firm still has $1 billion left to accumulate more of the altcoin.