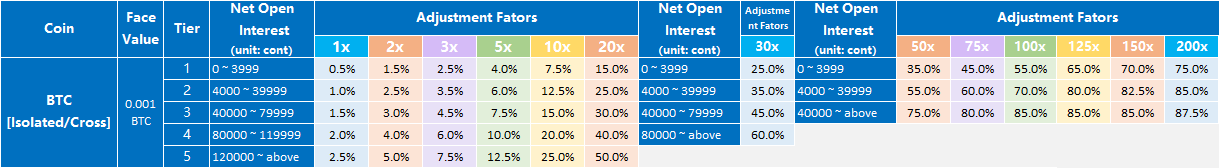

Tiered Adjustment Factor of USDⓈ-Margined Contracts

- USDT-M Futures Guides

The adjustment factor is designed to prevent users from extended margin call loss. HTX USDT-margined Contracts use a tiered adjustment factor mechanism, which supports up to five tiers based on the position amount. For contracts with different expirations under the different account modes, they are separately calculated. The larger the use’s net positions, the higher the tier, and the greater the risk.

- Take BTC/USDT as an example:

[Searching the adjustment factors of more types of contract and trading pairs]

[The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.]

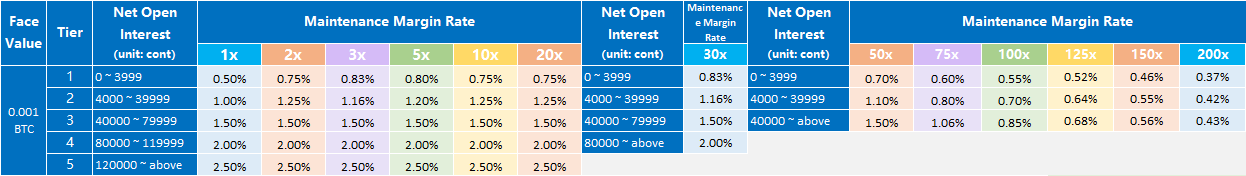

Maintenance Margin Ratio = Adjustment Factor / Leverage (This data is for reference only and is not used as a basis for liquidation)

- Take BTC/USDT as an example:

[Searching maintenance margin ratio of more types of contract and trading pairs]

[The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.]

For example,

1、When using 10x leverage, Tom holds a long position of 12,000 conts BTC/USDT swaps and a short position of 30,000 conts BTC/USDT swaps, then the net positions shall be 18,000 conts, and the corresponding adjustment factor is 12.5%.

2、 When Tom uses 20x leverage, then his positions shall be as below:

Weekly USDT-margined Futures (Long): 1,000 conts; Weekly USDT-margined Futures (Short): 4,000 conts.

Bi-weekly USDT-margined Futures (Long): 8,000 conts; Bi-weekly USDT-margined Futures (Short): 5,000 conts.

Quarterly USDT-margined Futures (Long): 5,000 conts; Quarterly USDT-margined Futures (Short): 0 cont.

Hence, Tom’s net positions are as below:

Weekly USDT-margined Futures: ∣ 1,000 – 4,000 ∣ = 3,000 conts;

Bi-weekly USDT-margined Futures: ∣ 8,000 – 5,000 ∣ = 3,000 conts;

Quarterly USDT-margined Futures: ∣ 5,000 - 0 ∣ = 5,000 conts;

In conclusion, Tom’s adjustment factor is 15% for the weekly futures, 15% for the bi-weekly futures, and 25% for the quarterly futures.