Another stablecoin wearing the crown of "Tether's Favorite Son" has officially launched, but the market doesn't seem to be buying it.

On the evening of December 8th, the highly anticipated stablecoin-dedicated public chain Stable officially launched its mainnet and STABLE token. As a Layer 1 deeply incubated by the core teams of Bitfinex and Tether, the "Tether's Favorite Son" narrative attracted widespread market attention for Stable from the moment it was announced.

However, against a backdrop of tightening market liquidity, Stable did not have a strong opening like its competitor Plasma, suffering from both low prices and a trust crisis involving insider trading. Is Stable's script aiming for a low start before a high finish, or is it set for a continuous decline?

STABLE Plunges 60% from Highs After Launch, Mired in Insider Trading Trust Crisis

Before Stable's launch, market sentiment was quite optimistic. The project's two-phase pre-deposit program totaled over $1.3 billion, with approximately 25,000 participating addresses and an average deposit size of about $52,000 per address, showing strong user interest. This was particularly valuable during a period of low market sentiment and indicated strong recognition of the "Tether-affiliated" endorsement, with expectations that STABLE's debut would replay Plasma's wealth-creating story.

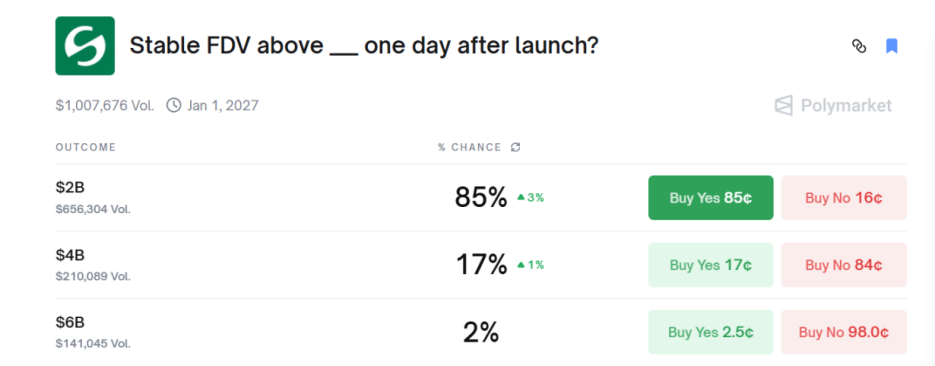

Data from the prediction market Polymarket showed that the market once estimated an 85% probability that STABLE token's FDV (Fully Diluted Valuation) would exceed $2 billion.

However, the law of "Great heat foreshadows death" (a Chinese idiom meaning extreme popularity can lead to a downfall) struck again.

STABLE token's performance on its TGE (Token Generation Event) debut day was disappointing. The STABLE token opened at around $0.036, reached a high near $0.046 after listing, and then continued to fall over 60%, hitting a low of $0.015. As of 21:00 on December 9th, STABLE token's FDV had shrunk to $1.7 billion. In a state of thin liquidity, no one in the market was willing to buy.

Notably, spot markets on top CEXs (Centralized Exchanges) like Binance, Coinbase, and Upbit have still not listed the STABLE token. Their absence limits the STABLE token's reach to a larger retail investor base, further contributing to its limited liquidity.

STABLE token's暴跌 (plunge) performance has also sparked heated discussion within the community.

DeFi researcher @cmdefi stated: Expectations for Stable were relatively low; various amateurish operations occurred during the early project launch, raising concerns about their seriousness.

Crypto KOL @cryptocishanjia pointed out: The crowd is more willing to pay for new narratives. When the market already has a clear leader (Plasma), the consensus for the second player (Stable) will be significantly weaker, leading to reduced profit margins.

Former VC professional @Michael_Liu93 said bluntly: Stable's pre-listing valuation of 3 billion plus an inflated FDV makes it a good target for long-term shorting. Tight control of holdings (no airdrop, no pre-sale, no KOL round) does not equal price pumping, but precisely because it's not listed on top CEXs, it might see a reversal.

Additionally, many users mentioned the pre-deposit controversy before the Stable mainnet launch. During the first round of pre-deposit activities, a whale wallet deposited hundreds of millions of USDT *before* the official start time, sparking strong community质疑 (doubts) about the project's fairness and potential insider trading. The project team did not directly respond and simply opened the second round of pre-deposits.

This event creates a paradox for Stable's narrative, whose value proposition is to provide transparent, reliable, and compliant infrastructure. The project疑似 (suspected) insider trading right from the start creates a trust deficit that will hinder active community participation and negatively impact its long-term narrative.

USDT as Gas Fee Optimizes Payment Experience, Token Economic Model Hides Concerns

Stable's architecture is designed to achieve maximum transaction efficiency and user-friendliness.

Stable is the first L1 to use USDT as the native Gas fee, providing a near Gas-less user experience. The importance of this design lies in minimizing user friction. Users can pay transaction fees using the medium of exchange itself (USDT), without needing to manage and hold a highly volatile governance token. This feature enables sub-second settlement and minimal fees, making it particularly suitable for daily transactions and institutional payment scenarios that require strict price stability and predictability.

Stable uses the StableBFT consensus mechanism, a DPoS (Delegated Proof-of-Stake) model customized based on CometBFT (formerly Tendermint) and fully compatible with the EVM (Ethereum Virtual Machine). StableBFT ensures transaction finality through a Byzantine Fault Tolerant mechanism, meaning transactions are irreversible once confirmed, which is crucial for payment and settlement scenarios. Additionally, StableBFT supports parallel processing of proposals by nodes, ensuring the network can achieve both high throughput and low latency performance to meet the stringent requirements of payment networks.

Stable received strong capital backing from the start. The project raised $28 million in a seed round led by Bitfinex and Hack VC. Tether/Bitfinex CEO Paolo Ardoino serves as an advisor, leading the market to speculate on a close strategic synergy between Stable and the leading stablecoin issuer Tether.

Stable CEO Brian Mehler previously served as VP of Venture Capital at Block.one (EOS development company), managing a $1 billion crypto fund and investing in industry giants like Galaxy Digital and Securitize.

The CTO is Sam Kazemian, founder of the hybrid algorithmic stablecoin project Frax, who has deep experience in the DeFi field and has provided advice on US stablecoin legislation.

However, Stable's initial CEO was former Block.one investment lead Joshua Harding. The project changed leadership just before launch without any announcement or explanation, casting another shadow over Stable's transparency.

Stable's token economic model employs a strategy of separating network utility and governance value. The sole purpose of the STABLE token is governance and staking. It is not used to pay for any network fees; all transactions are settled in USDT.

Token holders can stake STABLE to become validators and help secure the network. They can also participate in key decisions like network upgrades, fee adjustments, or introducing new stablecoins through community voting. Since it does not share in the network's revenue, this weakens the token's potential value (imagination). Before the ecosystem matures, its token lacks utility (empowerment).

Notably, 50% of the total token supply (100 billion tokens) will be allocated to the team, investors, and advisors. Although these tokens are subject to a one-year lock-up period (cliff), followed by linear vesting, the明显侧重 (clearly skewed) allocation ratio will create long-term potential selling pressure on the token price.

Fierce Competition in the Stablecoin Public Chain Arena, Execution Will Be Key to Victory

Stable faces extremely fierce market competition. In the current multi-chain landscape, Polygon and Tron have a large retail user base for low-cost remittances in Southeast Asia, South America, the Middle East, and Africa. Solana also holds a place in the payments field凭借 (relying on) its high-throughput performance advantages.

More importantly, Stable also faces competition from emerging vertical L1s同样致力于 (also dedicated to) stablecoin payments. For example, Circle's Arc focuses on becoming infrastructure for institutional-grade on-chain treasuries, global settlement, and tokenized assets. Additionally, Tempo, backed by Stripe and Paradigm, is also positioned as a payment-oriented public chain, a strong competitor瞄准 (aiming at) the same vertical field.

In the field of payments and settlement, network effects will be the core winning factor. Whether Stable succeeds will depend on its ability to quickly leverage the USDT ecosystem, attract developers and institutional users, and establish a first-mover advantage in large-scale settlement. If execution strength and market penetration are insufficient, it could be overtaken by同类 (similar) L1s with stronger integration capabilities or deeper compliance backgrounds.

According to its roadmap, the most important timeline is enterprise integration and developer ecosystem building in 2025 Q4 - 2026 Q2. Achieving these goals will be key to validating Stable's value proposition and the feasibility of a vertical L1. But from mainnet launch to pilot implementation, with only about six months, Stable must quickly overcome multiple challenges including technical optimization, institutional integration, and ecosystem cultivation. Any misstep in execution could further erode market confidence in its long-term potential.

The launch of Stable's mainnet marks the entry of the stablecoin赛道 (race track) competition into a new infrastructure-focused stage. Whether it can achieve its goal of reshaping payment networks will ultimately depend on execution, not narrative.