Michael A. Gayed, portfolio manager at Toroso Investments and publisher of macro research service The Lead-Lag Report, has put the XRP community on alert after a series of posts teasing a major related initiative.

Gayed Teases Yen-XRP Strategy

Gayed, a CFA charterholder known for his bearish, risk-focused market commentary, first flagged the cryptocurrency on December 4, posting: “Might do something related to XRP.” A day later he tied that tease directly to his broader macro outlook, writing: “You know how I always say we’re fucked? It’s time to find a way to profit from it. Might involve the Yen. And XRP.”

On December 6, he indicated that his interest in the token would not be a one-off remark, stating: “Going to do a long form post on XRP shortly.” In a separate message the same day he warned followers, “Might get annoying as fuck about XRP,” and urged them: “Put your notifications on for my account.”

The tone shifted further on December 7 from exploration to concrete signaling. Responding to speculation that he was chasing social metrics, Gayed insisted: “It’s not engagement farming. I’m working on something big. Big hint will be revealed this Thursday.” Without specifying whether he is referring to research, a trading strategy, or a product, he made clear that the token will be central to whatever he is preparing.

In a final note to close out that sequence, Gayed addressed the community directly: “Goodnight XRP army. I wrote this song. It’s yours now.” The song, shared with his followers, has since been circulated by prominent accounts, cementing his outreach to one of crypto’s most vocal retail bases.

Goodnight XRP army.

I wrote this song.

It’s yours now. pic.twitter.com/7EPjl65Twh

— Michael A. Gayed, CFA (@leadlagreport) December 7, 2025

What makes this notable is not just the content of the posts, but who is posting them. Gayed operates at the intersection of traditional asset management, ETF work and cross-asset macro research. His Lead-Lag framework is built around intermarket signals and risk regimes, and he has repeatedly warned of underpriced systemic risk in global markets.

Against that backdrop, the line “Might involve the Yen. And XRP” suggests he is working on a structured macro thesis that somehow connects currency dislocations, his negative outlook and the token. However, he has not yet disclosed any specific trade structure, allocation decision or product plan.

As of now, the verifiable facts are limited: Gayed has promised a long-form analysis, has stated he is “working on something big,” has explicitly rejected the idea that this is “engagement farming,” and has linked the token and the yen to his long-standing message that markets are in a precarious state. The exact nature, timing and market impact of his planned initiative remain unknown.

Until he publishes the promised long-form piece or a formal announcement, holders and broader market participants only know one thing for sure: a high-profile macro and ETF strategist has decided to make XRP a central theme of his upcoming work—and he wants everyone watching when he does.

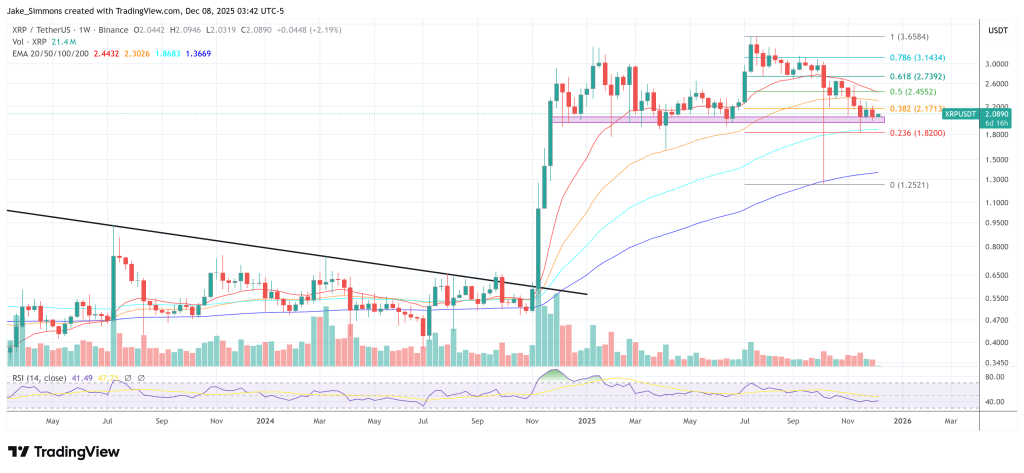

At press time, XRP traded at $2.089.