Author: Silvio (@SilvioBusonero)

Original Title: The monetary premium on L1s is fading

Compiled and Edited by: BitpushNews

The valuation of L1 blockchains is a comprehensive reflection of multiple factors: including cultural narrative (Memetics), network fees, security, and the development of upper-layer applications. Among these, the most underestimated is the so-called "Monetary Premium".

The monetary premium stems from the demand of market participants to use assets as a Store of Value (SoV) or a Medium of Exchange (MoE).

-

Store of Value is directly related to the robustness (lindiness) and degree of decentralization of an asset, so it is not an easy market entry strategy.

-

In contrast, acting as a Medium of Exchange may be easier to achieve. Tokens can serve as the primary method for value exchange and measurement within the blockchain economy.

This is similar to the role of tokens in the Web2 economy:

-

Roblox's in-game token Robux, has strong exchange value.

-

When Meme coins started to grow, people bought SOL to enter and exit Meme trades. As SOL was the default currency on Pump platforms, most traders did not convert assets back to dollars but kept some SOL ready to "ape". A similar situation occurred with ETH during the 2021 NFT boom. A large number of users began using the native asset for transactions, effectively creating the utility of a Medium of Exchange (MoE).

Does the Premium Still Exist?

The answer is: No, this premium is rapidly disappearing. Users are increasingly inclined to use stablecoins for transactions.

Ethereum — Stablecoins Have Become the Medium of Exchange

-

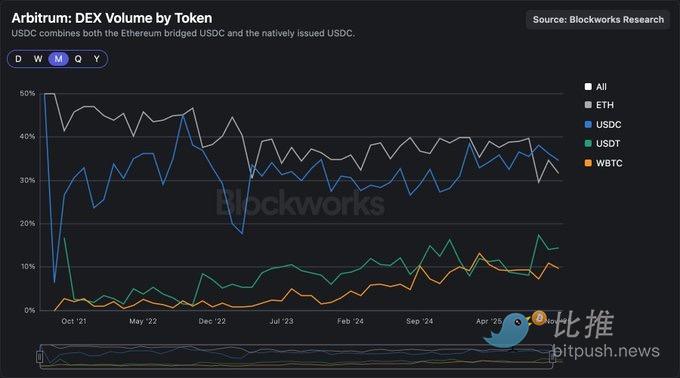

Judging from the on-chain transaction volume of mainstream tokens, Ethereum's native token ETH is no longer the primary medium of exchange it once was.

-

ETH's dominance as an MoE is declining, while USDC and USDT are rising in popularity on transaction volume charts and in top Uniswap liquidity pools.

The situation is similar for L2s like Arbitrum.

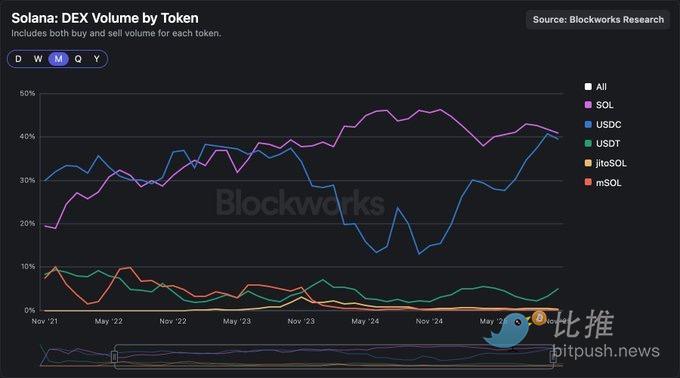

Solana — SOL Maintains the Lead, but USDC is Catching Up

-

SOL remains the primary medium of exchange and the highest volume asset on Solana (but USDC is catching up). This is mainly because platforms like Pumpfun and Raydium tend to use SOL as the quote currency, while other platforms (like Meteora) have a mixed situation.

-

However, new launch platforms like MetaDAO are setting USDC as the default paired trading asset.

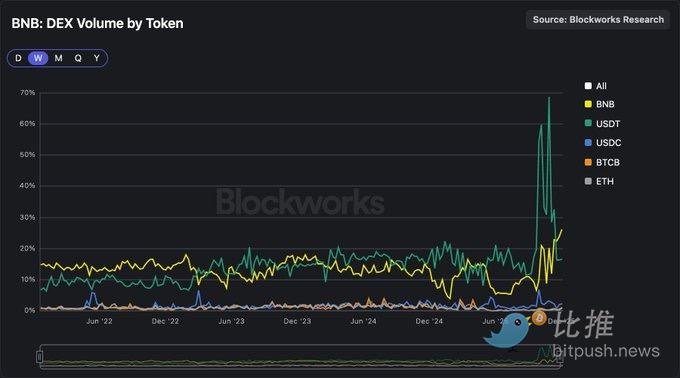

BNB and USDT Go Hand in Hand

-

From 2021 to 2022, BNB absolutely dominated the role of medium of exchange, but then USDT gained market share and surpassed BNB.

The Market Has Chosen the Medium of Exchange — And It's Stablecoins

There is no such thing as "Onchain Legal Tender" in the on-chain market.

Some projects use a "quote asset" strategy, making their native token the medium of exchange, such as Zora and Virtuals. But in reality, this increases transaction costs for both users and projects, while having minimal impact on the token price itself. Ecosystem tokens can attempt a similar strategy through asset issuance platforms, i.e., requiring quotes in a specific token, but this may not be worth it.

The user experience (UX) and liquidity of the on-chain market are improving: the past monetary premium was also partly due to a lack of alternatives and lower liquidity.

The next batch of billions of users will use the same medium of exchange as in real life (USDC, Euros, etc.).

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush