ali****@gmail.com

2025/02/05 15:07

Why is XRP price down today?

Why is XRP price down today?

XRP has dropped by over 20% in the past 24 hours, reaching around $2.30 as of Feb. 3.

Key takeaways:

XRP’s sharp declines appear after US President Donald Trump’s new tariffs on China, Mexico, and Canada.

Other top coins Bitcoin and Ether are also down, exacerbated by record long liquidations.

XRP price still holds above a key support area.

Trump’s tariffs trigger market panic

President Trump’s latest tariff announcement has triggered a sharp sell-off in XRP and other cryptocurrencies as traders react to rising economic uncertainty.

Trump has imposed a 25% tariff on imports from Canada and Mexico and a 10% tariff on Chinese goods.

The announcement has shaken financial markets, fueling global trade war fears.

Investors are fleeing riskier assets, including cryptocurrencies like XRP, in favor of safe havens.

At the same time, demand for safer assets like the US dollar has jumped. Yields on US short-dated Treasuries have also risen, pulling investors away from risk-on assets, including XRP.

A wave of stop-loss triggers and a lack of buying interest from retail investors has fueled the altcoin market rout, says Markus Thielen, founder of 10x Research.

Crypto market liquidations exacerbate XRP drop

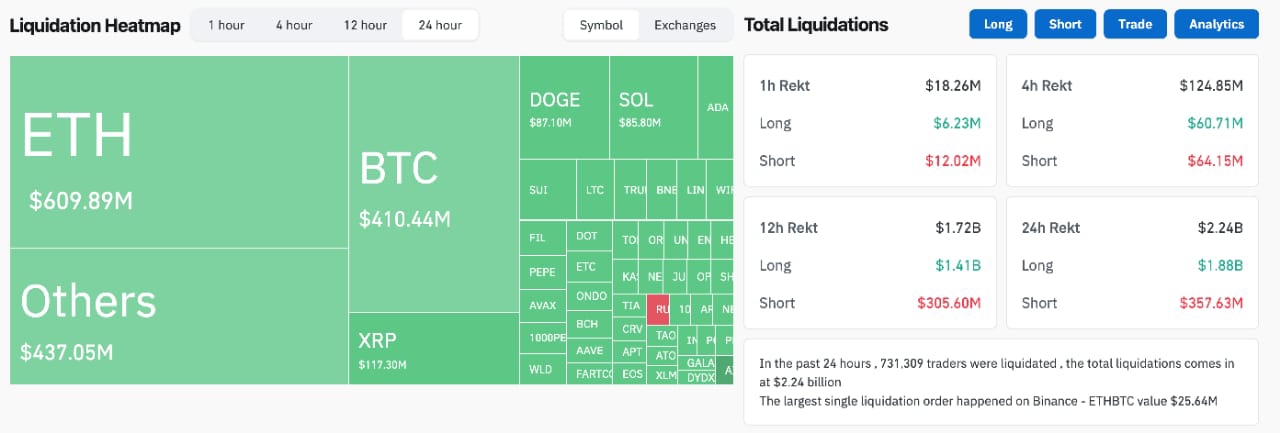

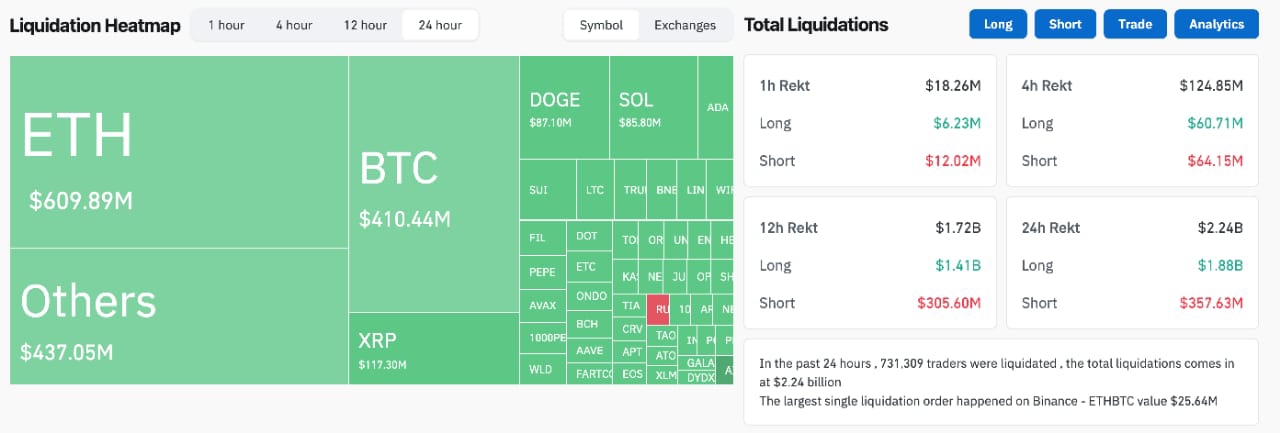

The crypto market has faced massive liquidations following Trump’s tariff announcement, with XRP among the hardest-hit assets.

Approx. $2.5 billion in crypto positions have been liquidated in the last 24 hours. Almost $1.88 billion of those are long positions.

XRP’s 20%-plus drop in the last 24 hours has made it one of the worst-performing assets in the derivatives market.

XRP has witnessed $117.30 million worth of total liquidations, out of which $95.87 million are longs.

Traders betting on price increases were forced to close at a loss, accelerating the XRP and the broader crypto market sell-off.

XRP price slips below key trendline

XRP’s sharp decline today accelerated after breaking below its 50-day exponential moving average (50-day EMA; the red wave) at around $2.61. However, it rebounded strongly from a critical support zone, suggesting a potential bullish rejection.

Key points:

XRP’s relative strength index (RSI) dropped to its lowest since October 2024, nearing the oversold threshold at 30.

After the plunge, XRP bounced sharply from its intraday low of $1.76.

The rebound coincided with a confluence of previous support (highlighted in the $1.77-2.00 red range) and the 200-day EMA (the blue wave) at around $1.60.

The bounce at this key support zone suggests buyers may be stepping in.

XRP’s next upside targets are best visible on the weekly chart, which shows it still inside the $1.95-3.00 range, defined by the 1.0 and 1.618 Fibonacci retracement levels.

Edit the caption here or remove the text

Should the rebound continue, XRP’s next upside target appears to be around $3.

A decline below $1.95 will likely lead the XRP price toward $1.60, coinciding with the 0.786 Fib retracement level.

Analyst Dom further supports a bullish reversal outlook, citing XRP’s “generational bottoms” from March 2020 and December 2020, which coincided with the COVID-19 pandemic market rout and the beginning of the SEC vs. Ripple lawsuit, respectively.

#Grab $100,000 Surprise Gifts#Share Screenshots of Your 2024 Year-In-Review#Win 400 USDT: Share Your Crypto Loans Trades

3Condividi

Tutti i commenti0RecentePopolare

Nessuno storico